Kodak 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

trends, and other information that is not historical information. When used in this report on Form 10-K, the words “estimates,” “expects,”

“anticipates,” “projects,” “plans,” “intends,” “believes,” “predicts”, “forecasts,” or future or conditional verbs, such as “will,” “should,” “could,”

or “may,” and variations of such words or similar expressions are intended to identify forward–looking statements. All forward–looking

statements, including, without limitation, management’s examination of historical operating trends and data are based upon Kodak’s

expectations and various assumptions. Future events or results may differ from those anticipated or expressed in these forward-looking

statements. Important factors that could cause actual events or results to differ materially from these forward-looking statements include, among

others, the risks and uncertainties described in more detail in this report on Form 10–K under the headings “Business”, “Risk Factors”,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations–Liquidity and Capital Resources” and those

described in filings made by the Company with the U.S. Bankruptcy Court for the Southern District of New York and in other filings the

Company makes with the SEC from time to time, as well as the following: the Company’s ability to successfully emerge from Chapter 11 as a

profitable sustainable company; the ability of the Company to develop, secure approval of and consummate one or more plans of reorganization

with respect to the Chapter 11 cases; Kodak’s ability to improve its operating structure, financial results and profitability; the ability of Kodak to

achieve cash forecasts, financial projections, and projected growth; our ability to raise sufficient proceeds from the sale of businesses and non-

core assets; the businesses Kodak expects to emerge from Chapter 11; the ability Kodak to discontinue certain businesses or operations; the

ability of Kodak to continue as a going concern; Kodak’s ability to comply with the Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) covenants in its Debtor-in-

Possession Credit Agreement; our ability to obtain additional financing; the potential adverse

effects of the Chapter 11 proceedings on Kodak’s liquidity, results of operations, brand or business prospects; the outcome of our intellectual

property patent litigation matters; Kodak’s ability to generate or raise cash and maintain a cash balance sufficient to comply with the minimum

liquidity covenants in its Debtor-in-Possession Credit Agreement and to fund continued investments, capital needs, restructuring payments and

to service its debt; our ability to fairly resolve legacy liabilities; the resolution of claims against the Company; our ability to retain key

executives, managers and employees; our ability to maintain product reliability and quality and growth in relevant markets; the seasonality of our

business; our ability to effectively anticipate technology trends and develop and market new products, solutions and technologies; and the impact

of the global economic environment on Kodak. There may be other factors that may cause Kodak’s actual results to differ materially from the

forward–looking statements. All forward–looking statements attributable to Kodak or persons acting on its behalf apply only as of the date of

this report on Form 10-K, and are expressly qualified in their entirety by the cautionary statements included in this report. Kodak undertakes no

obligation to update or revise forward–looking statements to reflect events or circumstances that arise after the date made or to reflect the

occurrence of unanticipated events.

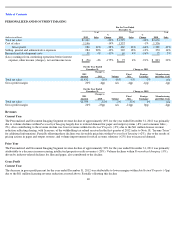

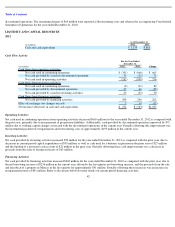

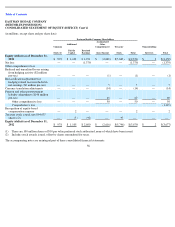

SUMMARY OF OPERATING DATA

A summary of operating data for 2012 and for the four years prior is shown on page 120.

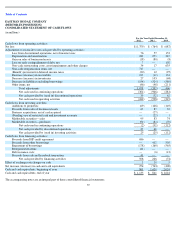

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Kodak, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates, commodity prices,

and interest rates, which may adversely affect its results of operations and financial position. In seeking to minimize the risks associated with

such activities, Kodak may enter into derivative contracts. Kodak does not utilize financial instruments for trading or other speculative purposes.

Foreign currency forward contracts are used to hedge existing foreign currency denominated assets and liabilities, especially those of Kodak’s

International Treasury Center, as well as forecasted foreign currency denominated intercompany sales. Silver forward contracts are used to

mitigate Kodak’s risk to fluctuating silver prices. Kodak’

s exposure to changes in interest rates results from its investing and borrowing activities

used to meet its liquidity needs. Long-term debt is generally used to finance long-term investments, while short-term debt is used to meet

working capital requirements.

Using a sensitivity analysis based on estimated fair value of open foreign currency forward contracts using available forward rates, if the U.S.

dollar had been 10% weaker at December 31, 2012 and 2011, the fair value of open forward contracts would have decreased $21 million and

increased $34 million, respectively. Such changes in fair value would be substantially offset by the revaluation or settlement of the underlying

positions hedged.

There were no open silver forward contracts as of December 31, 2012. Using a sensitivity analysis based on estimated fair value of open silver

forward contracts using available forward prices, if available forward silver prices had been 10% lower at December 31, 2011, the fair value of

open forward contracts would have decreased $2 million. Such changes in fair value, if realized, would have been offset by lower costs of

manufacturing silver-containing products.

Kodak is exposed to interest rate risk primarily through its borrowing activities and, to a lesser extent, through investments in marketable

securities. Kodak may utilize borrowings to fund its working capital and investment needs. The majority of short-

48