Kodak 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

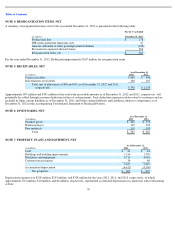

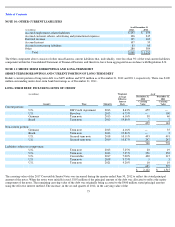

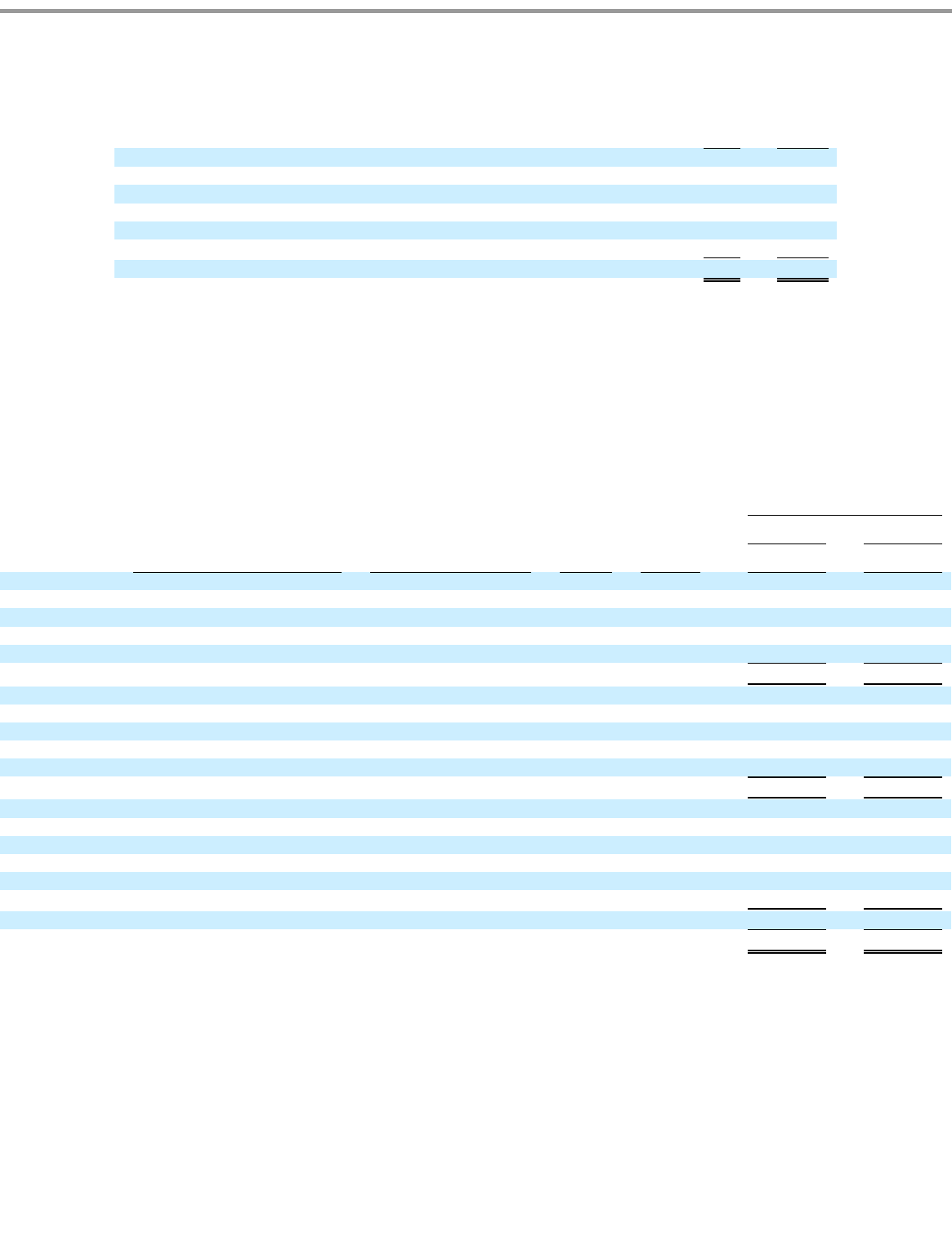

NOTE 10: OTHER CURRENT LIABILITIES

The Other component above consists of other miscellaneous current liabilities that, individually, were less than 5% of the total current liabilities

component within the Consolidated Statement of Financial Position, and therefore, have been aggregated in accordance with Regulation S-X.

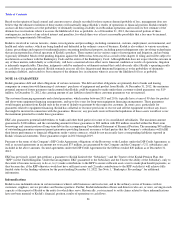

NOTE 11: SHORT-TERM BORROWINGS AND LONG-TERM DEBT

SHORT-TERM BORROWINGS AND CURRENT PORTION OF LONG-TERM DEBT

Kodak’s current portion of long-term debt was $699 million and $152 million as of December 31, 2012 and 2011, respectively. There was $100

million outstanding under short-term bank borrowings as of December 31, 2011.

LONG-TERM DEBT, INCLUDING LINES OF CREDIT

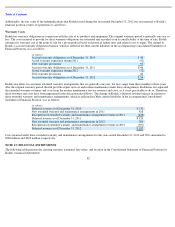

The carrying value of the 2017 Convertible Senior Notes was increased during the quarter ended June 30, 2012 to reflect the stated principal

amount of the notes. When the notes were initially issued, $107 million of the principal amount of the debt was allocated to reflect the equity

component of the notes. The remaining carrying value of the debt was originally being accreted to the $400 million stated principal amount

using the effective interest method. The increase, in the second quarter of 2012, in the carrying value of the

73

As of December 31,

(in millions)

2012

2011

Accrued employment-related liabilities

$

253

$

359

Accrued customer rebates, advertising and promotional expenses

106

245

Deferred revenue

125

169

Accrued interest

107

35

Accrued restructuring liabilities

83

60

Other

286

384

Total

$

960

$

1,252

(in millions)

Weighted

-

As of

Average

Effective

December 31,

2012

December 31,

2011

Country

Type

Maturity

Interest

Rate

Carrying

Value

Carrying

Value

Current portion:

U.S.

DIP Credit Agreement

2013

8.63

%

659

—

U.S.

Revolver

2013

4.75

%

—

100

Germany

Term note

2013

6.16

%

38

40

Brazil

Term note

2013

19.80

%

2

2

699

142

Non

-

current portion:

Germany

Term note

2013

6.16

%

—

35

Brazil

Term note

2013

19.80

%

—

3

U.S.

Secured term note

2018

10.11

%

493

491

U.S

Secured term note

2019

10.87

%

247

247

740

776

Liabilities subject to compromise:

U.S.

Term note

2013

7.25

%

20

19

U.S.

Term note

2013

7.25

%

250

250

U.S.

Convertible

2017

7.00

%

400

315

U.S.

Term note

2018

9.75

%

3

3

U.S.

Term note

2021

9.20

%

10

10

683

597

$

2,122

$

1,515