IHOP 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

8. Debt (Continued)

81

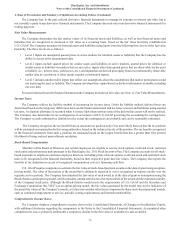

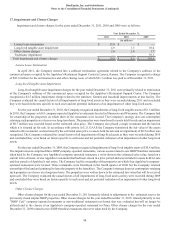

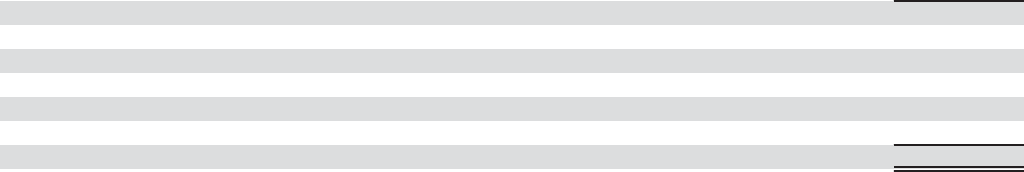

Maturities of Long-term Debt

At December 31, 2011, the aggregate amounts of existing long-term debt maturing in each of the next five years and

thereafter are as follows:

2012

2013

2014

2015

2016

Thereafter

(In millions)

$ 7.4

7.4

7.4

7.4

7.4

1,381.8

$ 1,418.8

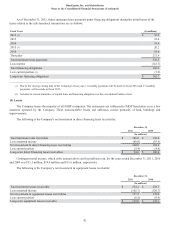

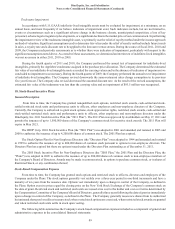

9. Financing Obligations

On May 19, 2008, the Company entered into a Purchase and Sale Agreement relating to the sale and leaseback of 181 parcels

of real property (the "Sale-Leaseback Transaction"), each of which is improved with a restaurant operating as an Applebee's

Neighborhood Grill and Bar (the "Properties"). On June 13, 2008, the closing date of the Sale-Leaseback Transaction, the Company

entered into a Master Land and Building Lease ("Master Lease") for the Properties. The proceeds received from the transaction

were $337.2 million. The Master Lease calls for an initial term of twenty years and four, five-year options to extend the term.

The Company has an ongoing obligation related to the Properties until such time as the lease related to each of the Properties

is assigned to a qualified franchisee in a transaction meeting certain parameters set forth in the Master Lease. Due to this continuing

involvement, the transaction was recorded under the financing method in accordance with U.S. GAAP. Accordingly, the value of

the land, buildings and improvements will remain on the Company's books and the buildings and improvements will continue to

be depreciated over their remaining useful lives. The net proceeds received have been recorded as a financing obligation. A portion

of the lease payments is recorded as a decrease to the financing obligation and a portion is recognized as interest expense. In the

event the lease obligation of any individual property or group of properties is assumed by a qualified franchisee the Company's

continuing involvement will cease. At that time, that portion of the transaction related to that property or group of properties is

expected to be recorded as a sale in accordance with U.S. GAAP and the net book value of those properties will be removed from

the Company's books, along with a ratable portion of the remaining financing obligation.

As of December 31, 2011, the Company's continuing involvement with 80 of the 181 Properties ended by assignment of the

lease obligation to a qualified franchisee or a release from the lessor. In accordance with the accounting described above, the

transactions related to these properties have been recorded as a sale with property and equipment and financing obligations each

reduced by $149.8 million.

In July 2008, the Company entered into a sale-leaseback transaction with respect to its support center in Lenexa, Kansas.

In connection with this transaction, the Company received approximately $39 million in proceeds. The initial term of the leaseback

agreement is 15 years. As the Company had continuing involvement in the form of future subleasing of a substantial portion of

the support center, the transaction was recorded under the financing method as described above. The Company entered into an

agreement to terminate its sublease of the support center effective October 31, 2011, with no remaining continuing involvement.

Accordingly, property and equipment and financing obligations were each reduced by $34.0 million.