IHOP 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

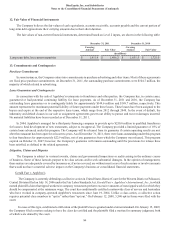

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

74

do not change the underlying principle that the carrying value of goodwill should not exceed its implied fair value, the adoption

of ASU 2011-08 is not anticipated to have a material impact on the Company's consolidated balance sheets, statements of income

or statements of cash flows.

The Company reviewed all other significant newly issued accounting pronouncements and concluded that they either are

not applicable to the Company's operations or that no material effect is expected on the Company's financial statements as a result

of future adoption.

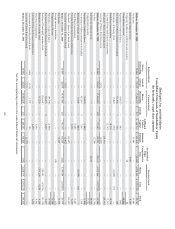

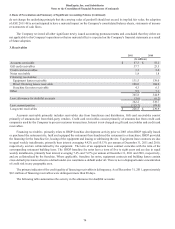

3. Receivables

Accounts receivable

Gift card receivables

Credit card receivables

Notes receivable

Financing receivables:

Equipment leases receivable

Direct financing leases receivable

Franchise fee notes receivable

Other

Less: allowance for doubtful accounts

Less: current portion

Long-term receivables

2011

(In millions)

$ 57.3

37.7

3.3

1.8

131.5

100.0

4.3

9.9

345.8

(3.6)

342.2

(115.7)

$ 226.5

2010

$ 55.2

25.5

5.4

1.8

139.0

104.6

6.3

7.1

344.9

(6.2)

338.7

(98.8)

$ 239.9

Accounts receivable primarily includes receivables due from franchisees and distributors. Gift card receivables consist

primarily of amounts due from third-party vendors. Credit card receivables consist primarily of amounts due from credit card

companies used by the Company to process customer transactions. Interest is not charged on gift card receivables and credit card

receivables.

Financing receivables primarily relate to IHOP franchise development activity prior to 2003 when IHOP typically leased

or purchased the restaurant site, built and equipped the restaurant then franchised the restaurant to a franchisee. IHOP provided

the financing for the franchise fee, leasing of the equipment and leasing or subleasing the site. Equipment lease contracts are due

in equal weekly installments, primarily bear interest averaging 9.92% and 10.13% per annum at December 31, 2011 and 2010,

respectively, and are collateralized by the equipment. The term of an equipment lease contract coincides with the term of the

corresponding restaurant building lease. The IHOP franchise fee notes have a term of five to eight years and are due in equal

weekly installments, primarily bear interest averaging 7.4% and 7.67% per annum at December 31, 2011 and 2010, respectively,

and are collateralized by the franchise. Where applicable, franchise fee notes, equipment contracts and building leases contain

cross-default provisions wherein a default under one constitutes a default under all. There is not a disproportionate concentration

of credit risk in any geographic area.

The primary indicator of the credit quality of financing receivables is delinquency. As of December 31, 2011, approximately

$0.3 million of financing receivables were delinquent more than 90 days.

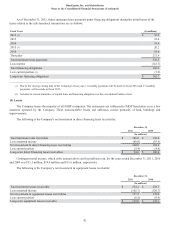

The following table summarizes the activity in the allowance for doubtful accounts: