IHOP 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

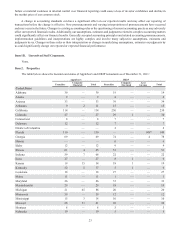

Issuer Purchases of Equity Securities

In August, 2011, our Board of Directors authorized the repurchase up to $45.0 million of DineEquity common stock.

Repurchases are subject to prevailing market prices and may take place in open market transactions and in privately negotiated

transactions, based on business, market, applicable legal requirements and other considerations. The program does not require

the repurchase of a specific number of shares and may be terminated at any time. As of December 31, 2011, we have

repurchased 534,101 shares under this program at an average price of $39.64 per share. We have remaining authorization to

repurchase an additional $23.8 million of DineEquity common stock under this program.

During 2011, a total of 91,798 shares of restricted stock were surrendered to the Company at an average price of $55.34

per share to satisfy tax withholding obligations in connection with the vesting of restricted stock awards issued to employees

under our stock compensation plans. Of that total, 6,346 shares were surrendered during the fourth quarter at an average price of

$43.89 per share.

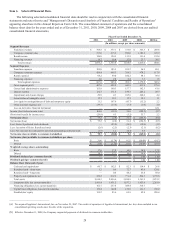

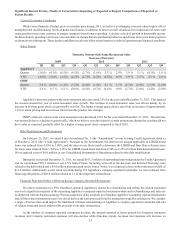

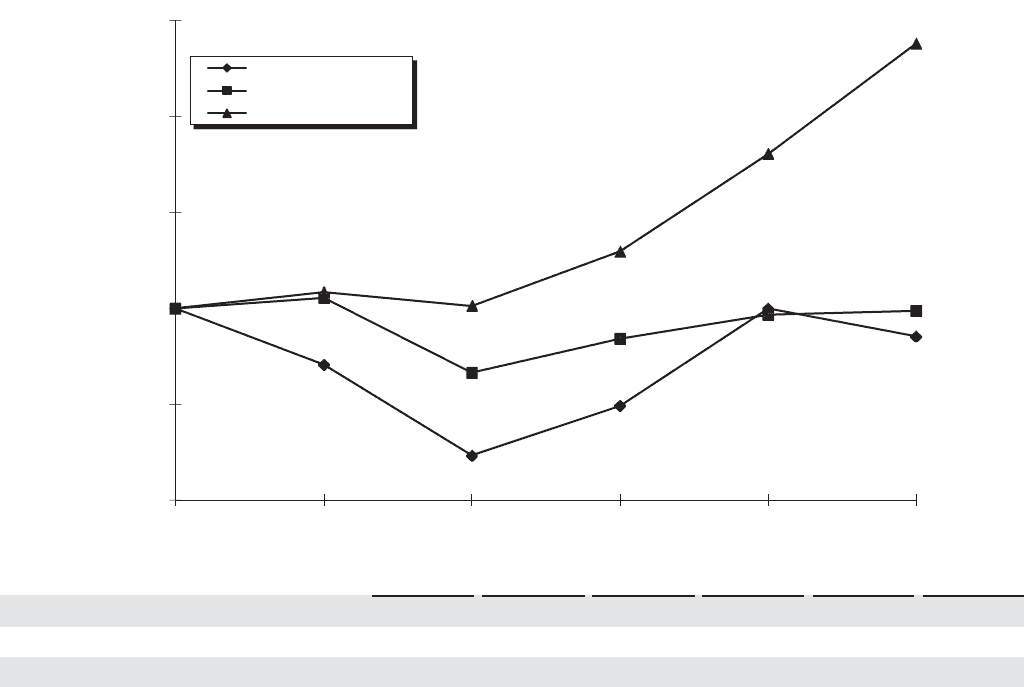

Stock Performance Graph

The graph below shows a comparison of the cumulative total shareholder return on our common stock with the

cumulative total return on the Standard & Poor's 500 Composite Index and the Value-Line Restaurants Index ("Restaurant

Index") over the five-year period ended December 31, 2011. The graph and table assume $100 invested at the close of trading

on the last day of trading in 2006 in our common stock and in each of the market indices, with reinvestment of all dividends.

Stockholder returns over the indicated periods should not be considered indicative of future stock prices or stockholder returns.

Comparison of Five-Year Cumulative Total Shareholder Return

DineEquity, Inc., Standard & Poor's 500 And Value Line Restaurant Index

(Performance Results Through December 31, 2011)

2006 2007 2008 2009 2010 2011

DineEquity, Inc. $100.00 $70.58 $23.41 $49.18 $99.98 $85.46

Standard & Poor's 500 100.00 105.49 66.46 84.04 96.70 98.74

Restaurant Index 100.00 108.49 101.20 129.63 180.40 237.93

$70.58

$23.41

$49.18

$99.98

$85.46

$105.49

$66.46

$84.04

$96.70 $98.74

$108.49

$101.20

$129.63

$180.40

$237.93

$0.00

$50.00

$100.00

$150.00

$200.00

$250.00

2006 2007 2008 2009 2010 2011

DineEquity, Inc.

Standard & Poors 500

Restaurants