IHOP 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

106

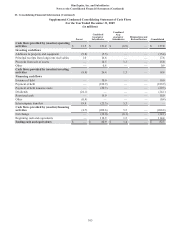

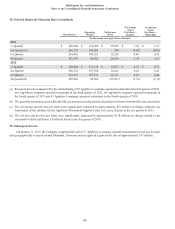

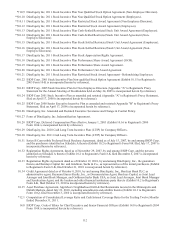

24. Selected Quarterly Financial Data (Unaudited)

2011

1st Quarter

2nd Quarter (c)

3rd Quarter

4th Quarter

2010

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter(d)

Revenues(a)

(In thousands, except per share amounts)

$ 300,200

268,338

264,481

242,179

$ 358,064

340,136

335,515

299,926

Operating

Margin

$ 110,769

100,285

100,553

96,022

$ 115,136

107,398

107,573

99,694

Net Income

(Loss)

$ 29,699

348

16,525

28,620

$ 19,671

14,041

14,331

(50,831)

Net Income

(Loss)

Per Share—

Basic(b)

$ 1.59

(0.02)

0.86

1.55

$ 0.75

0.43

0.45

(3.33)

Net Income

(Loss)

Per Share—

Diluted(b)

$ 1.53

(0.02)

0.85

1.51

$ 0.75

0.42

0.44

(3.33)

________________________________

(a) Revenues have been impacted by the refranchising of 65 Applebee's company-operated restaurants in the first quarter of 2011,

one Applebee's company-operated restaurants in the third quarter of 2011, 66 Applebee's company-operated restaurants in

the fourth quarter of 2011 and 83 Applebee's company-operated restaurants in the fourth quarter of 2010.

(b) The quarterly amounts may not add to the full year amount as each quarterly calculation is discrete from the full-year calculation.

(c) The net income and net loss per share were significantly impacted by approximately $21 million of charges related to the

termination of the sublease for the Applebee's Restaurant Support Center in Lenexa, Kansas in the 2nd quarter of 2011.

(d) The net loss and net loss per share were significantly impacted by approximately $110 million of charges related to the

retirement of debt and Series A Preferred Stock in the 4th quarter of 2010.

25. Subsequent Events

On January 11, 2012, the Company completed the sale of 17 Applebee's company-operated restaurants located in a six-state

area geographically centered around Memphis, Tennessee and recognized a gain on the sale of approximately $17 million.