IHOP 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

84

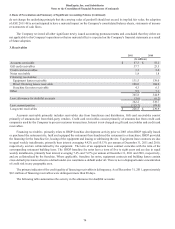

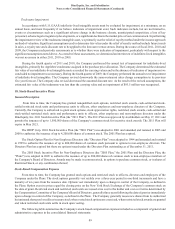

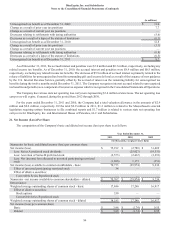

12. Fair Value of Financial Instruments

The Company believes the fair values of cash equivalents, accounts receivable, accounts payable and the current portion of

long-term debt approximate their carrying amounts due to their short duration.

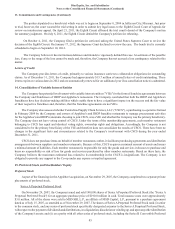

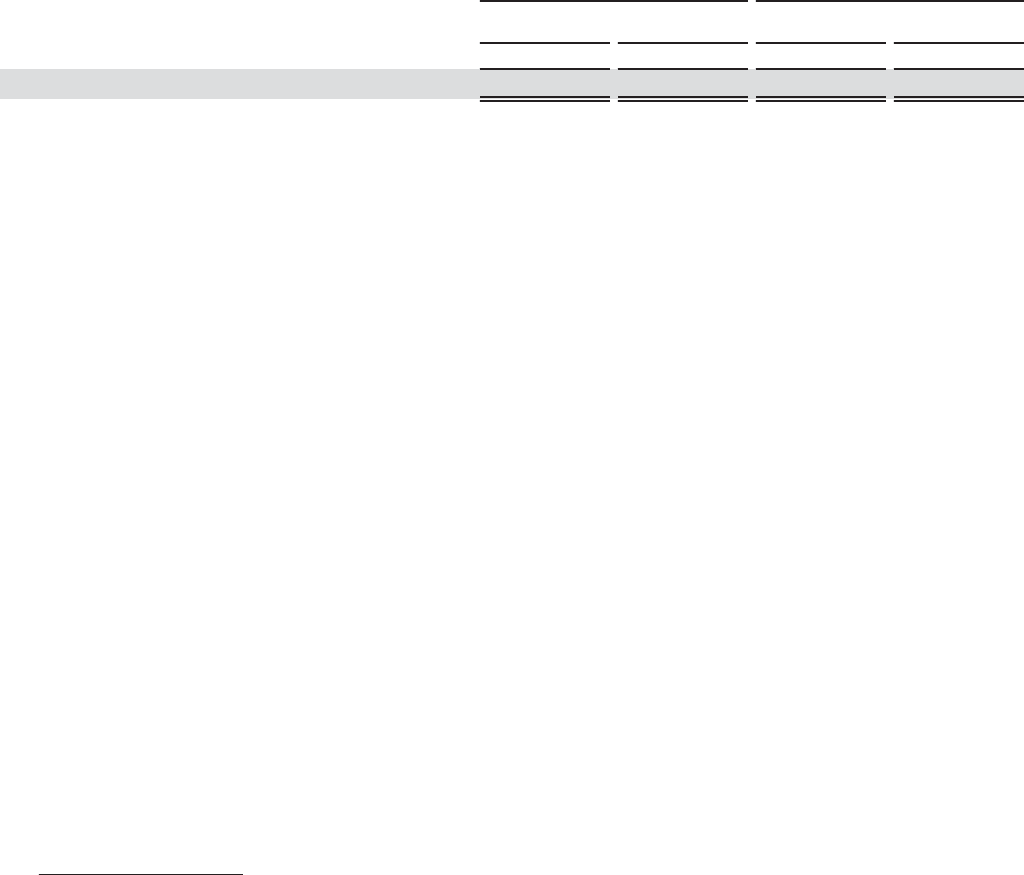

The fair values of non-current financial instruments, determined based on Level 2 inputs, are shown in the following table:

Long-term debt, less current maturities

December 31, 2011

Carrying

Amount

(in millions)

$ 1,411.4

Fair Value

$ 1,486.2

December 31, 2010

Carrying

Amount

$ 1,631.5

Fair Value

$ 1,721.0

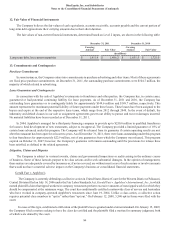

13. Commitments and Contingencies

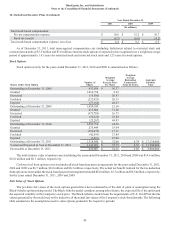

Purchase Commitments

In some instances, the Company enters into commitments to purchase advertising and other items. Most of these agreements

are fixed price purchase commitments. At December 31, 2011, the outstanding purchase commitments were $104.7 million, the

majority of which related to advertising.

Lease Guarantees and Contingencies

In connection with the sale of Applebee's restaurants to franchisees and other parties, the Company has, in certain cases,

guaranteed or had potential continuing liability for lease payments. As of December 31, 2011 and 2010, the Company has

outstanding lease guarantees or is contingently liable for approximately $349.6 million and $149.7 million, respectively. This

amount represents the maximum potential liability of future payments under these leases. These leases have been assigned to the

buyers and expire at the end of the respective lease terms, which range from 2012 through 2048. In the event of default, the

indemnity and default clauses in our sale or assignment agreements govern our ability to pursue and recover damages incurred.

No material liabilities have been recorded as of December 31, 2011.

In 2004, Applebee's arranged for a third-party financing company to provide up to $250.0 million to qualified franchisees

for loans to fund development of new restaurants, subject to its approval. The Company provided a limited guarantee of 10% of

certain loans advanced under this program. The Company will be released from its guarantee if certain operating results are met

after the restaurant has been open for at least two years. As of December 31, 2011, there were loans outstanding under this program

to four franchisees for approximately $22.9 million, net of any guarantees from which the Company was released. This program

expired on October 31, 2007; however, the Company's guarantee will remain outstanding until the provisions for release have

been satisfied, as defined in the related agreement.

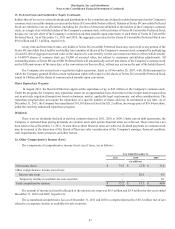

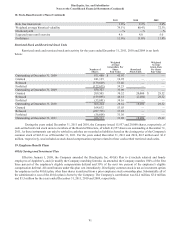

Litigation, Claims and Disputes

The Company is subject to various lawsuits, claims and governmental inspections or audits arising in the ordinary course

of business. Some of these lawsuits purport to be class actions and/or seek substantial damages. In the opinion of management,

these matters are adequately covered by insurance or, if not so covered, are without merit or are of such a nature or involve amounts

that would not have a material adverse impact on the Company's business or consolidated financial statements.

Gerald Fast v. Applebee's

The Company is currently defending a collective action in United States District Court for the Western District of Missouri,

Central Division filed on July 14, 2006 under the Fair Labor Standards Act, Gerald Fast v. Applebee's International, Inc., in which

named plaintiffs claim that tipped workers in company restaurants perform excessive amounts of non-tipped work for which they

should be compensated at the minimum wage. The court has conditionally certified a nationwide class of servers and bartenders

who have worked in company-operated Applebee's restaurants since June 19, 2004. Unlike a class action, a collective action

requires potential class members to “opt in” rather than “opt out.” On February 12, 2008, 5,540 opt-in forms were filed with the

court.

In cases of this type, conditional certification of the plaintiff class is granted under a lenient standard. On January 15, 2009,

the Company filed a motion seeking to have the class de-certified and the plaintiffs filed a motion for summary judgment, both

of which were denied by the court.