IHOP 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

3. Receivables (Continued)

75

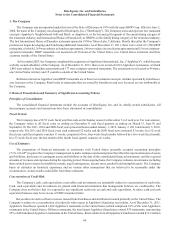

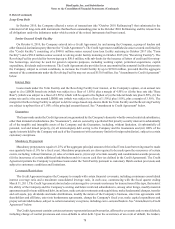

Allowance for Doubtful Accounts

Balance at December 31, 2008

Provision

Charge-offs

Recoveries

Balance at December 31, 2009

Provision

Charge-offs

Recoveries

Balance at December 31, 2010

Provision

Charge-offs

Recoveries

Balance at December 31, 2011

(In millions)

$ 2.9

1.7

(1.3)

0.1

3.4

3.4

(0.8)

0.2

6.2

0.4

(3.1)

0.1

$ 3.6

As of December 31, 2011, approximately $0.2 million of the allowance for doubtful accounts related to financing receivables.

4. Assets Held For Sale

The Company classifies assets as held for sale and ceases the depreciation of the assets when there is a plan for disposal of

the assets and those assets meet the held for sale criteria as defined in U.S. GAAP. Reacquired franchises, property and equipment

and other assets held for sale are accounted for on the specific identification basis.

Reacquired franchises

For reacquired franchises, the Company records the value of the reacquired franchise and equipment at the lower of (1) the

sum of the franchise receivables and costs of reacquisition, or (2) the estimated net realizable value at the reacquisition date.

Pending the sale of such franchise, the carrying value is amortized ratably over the remaining life of the asset or lease, and the

estimated net realizable value is evaluated in conjunction with our impairment evaluation of long-lived assets. There were no

reacquired franchises and equipment included in assets held for sale at December 31, 2011; there was $332,000 of reacquired

franchises and equipment included in assets held for sale at December 31, 2010.

Property and equipment

At December 31, 2010, assets held for sale primarily consisted of assets of 36 Applebee's company-operated restaurants in

the St. Louis market area of Missouri, 30 Applebee's company-operated restaurants in the Washington, D.C. area, three parcels of

land on which refranchised Applebee's formerly company-operated restaurants are situated, three parcels of land previously

intended for future restaurant development and one IHOP restaurant held for refranchising.

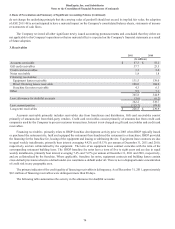

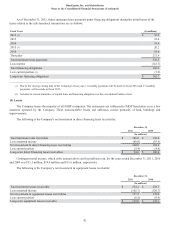

The following table summarizes the changes in the balance of assets held for sale during fiscal 2011:

Balance December 31, 2010

Assets transferred to held for sale

Assets sold

Assets refranchised

Other

Balance December 31, 2011

(In millions)

$ 37.9

43.3

(71.2)

(0.7)

0.1

$ 9.4

During the twelve months ended December 31, 2011, the Company entered into two agreements for the refranchising of

Applebee's company-operated restaurants and sale of related restaurant assets. The first agreement related to 66 restaurants located

in Massachusetts, New Hampshire, Maine, Rhode Island, Vermont and parts of New York and the second agreement related to 17

restaurants located in a six-state market area geographically centered around Memphis, Tennessee. The Company also entered

into an agreement for the sale of the land and building of a single Applebee's company-operated restaurant. Accordingly, $43.3

million, representing the net book value of the assets related to these restaurants, was transferred to assets held for sale. One IHOP