IHOP 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

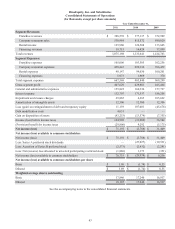

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

73

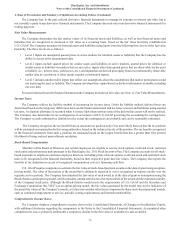

Reclassifications

Certain reclassifications have been made to prior year information to conform to the current year presentation. These

reclassifications had no effect on the net income or financial position previously reported. The following items previously reported

as “other expense, net” for the years ended December 31, 2010 and 2009 have been reclassified as follows:

Total other expense, as reported

Reclassified to:

Rental expenses

Impairment and closure charges

General and administrative expenses

Interest expense

Franchise revenues

Franchise expenses

Financing revenues

Other line items

Total reclassified

2010

(In thousands)

$ 3,590

$ 2,875

802

688

41

(393)

(330)

(163)

70

$ 3,590

2009

$ 1,266

$ 2,898

528

(742)

(215)

(107)

—

(694)

(402)

$ 1,266

Additionally, amounts reported as of December 31, 2010 for current restricted cash of $854,000 and non-current restricted

cash of $778,000 have been reclassified to "other current assets" and "other assets, net" in the Consolidated Balance Sheets.

New Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

No. 2011-04, Fair Value Measurement - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements

in U.S. GAAP and IFRSs (“ASU 2011-04”). The amendments in ASU 2011-04 result in common fair value measurement and

disclosure requirements in U.S. GAAP and international financial reporting standards (“IFRS”). To improve consistency in

application across jurisdictions some changes in wording are necessary to ensure that U.S. GAAP and IFRS fair value measurement

and disclosure requirements are described in the same way. ASU 2011-04 also provides for certain changes in current GAAP

disclosure requirements. The amendments in ASU 2011-04 are to be applied prospectively, and will be effective for the Company's

fiscal years, and interim periods within those years, beginning after December 15, 2011. The adoption of ASU 2011-04 is not

anticipated to have a material impact on the Company's consolidated balance sheets, statements of income or statements of cash

flows.

In May 2011, the FASB issued ASU No. 2011-05, Comprehensive Income - Presentation of Comprehensive Income (“ASU

2011-05”). ASU 2011-05 will require the presentation of the total of comprehensive income, the components of net income, and

the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate

but consecutive statements. The amendments in this update do not change the items that must be reported in other comprehensive

income or when an item of other comprehensive income must be reclassified to net income, nor does it affect how earnings per

share is calculated or presented. Current U.S. GAAP allows reporting entities three alternatives for presenting other comprehensive

income and its components in financial statements. One of those presentation options is to present the components of other

comprehensive income as part of the statement of changes in stockholders' equity, which is the presentation format the Company

currently uses. This update eliminates that option. ASU 2011-05 is required to be applied retrospectively, and will be effective for

the Company's fiscal years, and interim periods within those years, beginning after December 15, 2011. The adoption of ASU

2011-05 is not anticipated to have a material impact on the Company's consolidated balance sheets, statements of income or

statements of cash flows.

In September 2011, the FASB issued ASU No. 2011-08, Intangibles-Goodwill and Other - Testing Goodwill for Impairment

("ASU 2011-08"). The amendments in ASU No. 2011-08 are intended to simplify goodwill impairment testing by adding a

qualitative review step to assess whether the required quantitative impairment analysis that exists today is necessary. Under these

amendments, an entity would not be required to calculate the fair value of a reporting unit unless the entity determines, based on

the qualitative assessment, that it is more likely than not that its fair value is less than its carrying amount. ASU No. 2011-08 will

be effective for the Company's fiscal years beginning after December 15, 2011; earlier adoption is permitted. As the amendments