IHOP 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142

|

|

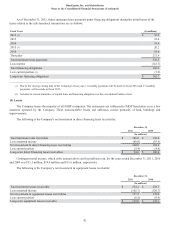

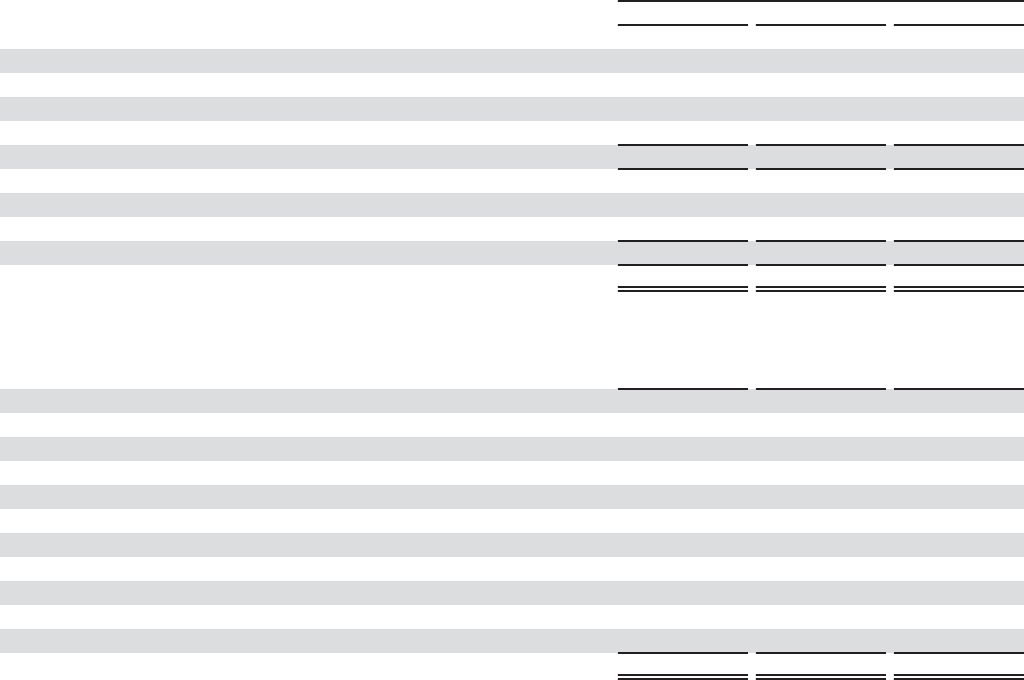

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

92

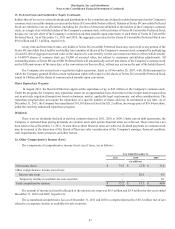

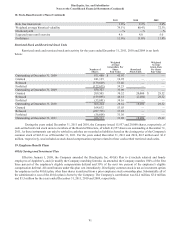

20. Income Taxes

The provision (benefit) for income taxes for the years ended December 31, 2011, 2010 and 2009 was as follows:

Provision (benefit) for income taxes:

Current

Federal

State and foreign

Deferred

Federal

State

Provision (benefit) for income taxes

Year Ended December 31,

2011

(In millions)

$ 13.2

2.8

16.0

11.4

2.4

13.8

$ 29.8

2010

$ 6.2

(0.6)

5.6

(12.8)

(2.1)

(14.9)

$ (9.3)

2009

$ 28.8

4.2

33.0

(21.4)

(6.4)

(27.8)

$ 5.2

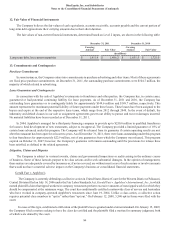

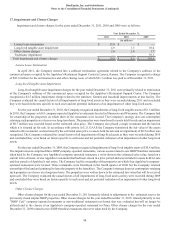

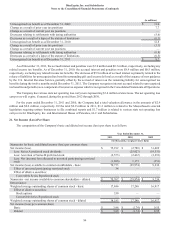

The provision (benefit) for income taxes differs from the expected federal income tax rates as follows:

Statutory federal income tax rate

State and other taxes, net of federal tax benefit

Change in unrecognized tax benefits

Change in valuation allowance

State adjustments including audits and settlements

Compensation related tax credits, net of deduction offsets

Changes in tax rates and state tax laws

Kansas High Performance Incentive Program credits

Goodwill intangibles adjustment

Non-deductible preferred stock issuance costs

Other

Effective tax rate

2011

35.0%

3.7

(4.0)

1.7

0.2

(4.9)

(3.9)

0.5

—

—

0.1

28.4%

2010

(35.0)%

(0.4)

(28.1)

(1.5)

(0.6)

(46.0)

—

—

27.0

8.5

(0.8)

(76.9)%

2009

35.0%

5.8

(9.7)

7.5

4.5

(14.9)

(6.5)

(7.3)

—

—

(0.3)

14.1%