IHOP 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

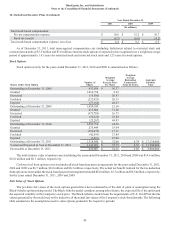

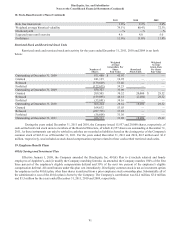

15. Preferred Stock and Stockholders' Equity (Continued)

86

Stock, described below, with respect to the payment of dividends and distributions, in a liquidation, dissolution or winding up,

and upon any other distribution of the Company's assets.

The holders of the Series A Perpetual Preferred Stock were entitled to receive dividends, at the rates and on the dates set

forth in the Certificate of Designations for the Series A Perpetual Preferred Stock (the "Series A Certificate of Designations"), if,

as, and when such dividends were declared by the Company's Board of Directors, but out of funds legally available for the payment

of dividends, which dividends are payable in cash, subject to the Company's right to elect to accumulate any dividends payable

after the first anniversary of the issue date. If, on any scheduled dividend payment date, the holder of record of a share of Series A

Perpetual Preferred Stock did not receive in cash the full amount of any dividend required to be paid on such share on such date

pursuant to the Series A Certificate of Designations (such unpaid dividends that have accrued and were required to be paid, but

remained unpaid, on a scheduled dividend payment date, together with any accrued and unpaid accumulated dividends, the "Passed

Dividends"), then such Passed Dividends accumulated on such outstanding share of Series A Perpetual Preferred Stock, whether

or not there are funds legally available for the payment thereof or such Passed Dividends were declared by the Company's Board

of Directors, and until such Passed Dividends were paid, the applicable dividend rate under the Series A Certificate of Designations

was computed on the sum of the stated value of the share plus such unpaid Passed Dividend. In the event that Passed Dividends

had accrued but remained unpaid for two consecutive quarterly dividend periods (each such quarterly dividend period, a "Passed

Quarter"), the applicable dividend rate under the Series A Certificate of Designations was, as of the end of such two-Passed Quarters

period, prospectively increased by two percent (2.0%) per annum, and the applicable dividend rate under the Series A Certificate

of Designations further increased prospectively by two percent (2.0%) per annum as of the end of each subsequent two-Passed

Quarters period with respect to which Passed Dividends had accrued but remained unpaid. The Series A Certificate of Designations

further provided that (i) under no circumstances shall the dividend rate applicable at any time prior to the tenth (10th) anniversary

of the issue date of the Series A Perpetual Preferred Stock exceed sixteen percent (16%) per annum, and (ii) upon payment by the

Company of all accrued and unpaid Passed Dividends, the dividend rate is thereupon automatically reduced prospectively to the

applicable per annum dividend rate under the Series A Certificate of Designations. As of the time of redemption, all required

dividends had been paid in cash on the scheduled dividend payment dates.

The Certificate of Designations for Series A Perpetual Preferred Stock required that, upon the occurrence of a Change of

Control, unless prohibited by applicable law, the Company would redeem all then outstanding shares of the Series A Perpetual

Preferred Stock for cash at a redemption price per share corresponding to the timing of such Change of Control, as specified in

the Certificate of Designations. U.S. GAAP requires preferred securities that are redeemable for cash or other assets to be classified

outside of permanent equity if they are redeemable upon the occurrence of an event that is not solely within the control of the

issuer. Accordingly, the Series A Perpetual Preferred Stock was not included as a component of Stockholders' Equity in the

accompanying Consolidated Balance Sheets.

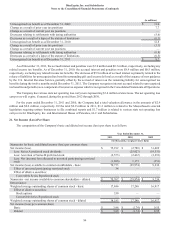

In the fourth quarter of 2010, the Company redeemed all 190,000 shares of the Series A Perpetual Preferred Stock for $199.0

million, including a redemption premium of $7.6 million and $1.4 million of dividends accrued through the date of redemption.

In accordance with U.S. GAAP, the redemption premium has been included as part of dividends paid on Series A Perpetual Preferred

Stock for the year ended December 31, 2010.

Series B Convertible Preferred Stock

On November 29, 2007, the Company issued and sold 35,000 shares of Series B Convertible Preferred Stock for an aggregate

purchase price of $35.0 million in cash. Total issuance costs were approximately $0.8 million. All of the shares were sold to

affiliates of Chilton Investment Company, LLC (collectively, "Chilton") pursuant to a purchase agreement dated as of July 15,

2007. The shares of Series B Convertible Preferred Stock rank (i) senior to the common stock, and any series of preferred stock

specifically designated as junior to the Series B Convertible Preferred Stock, with respect to the payment of dividends and

distributions, in a liquidation, dissolution or winding up, and upon any other distribution of the Company's assets; and (ii) on a

parity with all other series of preferred stock, including the Series A Perpetual Preferred Stock, with respect to the payment of

dividends and distributions, in a liquidation, dissolution or winding up, and upon any other distribution of the Company's assets.

Each share of Series B Convertible Preferred Stock has an initial stated value of $1,000, that increases at the rate of 6.0%

per annum, compounded quarterly, commencing on the issue date of such share of Series B Convertible Preferred Stock to and

including the earlier of (i) the date of liquidation, dissolution or winding up or the redemption of such share, or (ii) the date such

share is converted into the Company's common stock. The stated value of a share as so accreted as of any date is referred to as

the accreted value of the share as of that date. Shares of Series B Convertible Preferred Stock may be redeemed by the Company,

in whole or in part at the Company's option, on or after the fourth anniversary of the issue date, at a redemption price equal to the

accreted value as of the applicable redemption date, subject to the terms set forth in the Certificate of Designations for the Series B

Convertible Preferred Stock ("the "Series B Certificate of Designations"). The Series B Convertible Preferred Stock entitles the