IHOP 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

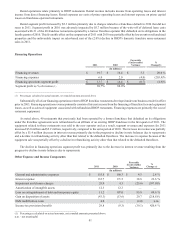

compared to amounts reported in previous periods. Segment profit will also decline as company-operated restaurants are

refranchised because the associated royalties are a smaller percentage of restaurant revenues than the restaurant operating profit

margin percentage of restaurants formerly company-operated. However, refranchising of additional Applebee’s company-operated

restaurants will result in the reduction of interest expense as proceeds from the sale of related restaurant assets (subject to certain

exclusions) must be used to retire debt. Refranchising of additional Applebee’s company-operated restaurants also will result in

a reduction of both general and administrative expenses and required capital investment in restaurant assets.

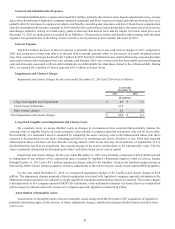

Stock Repurchase Program

On August 15, 2011, the Board of Directors approved the repurchase of up to $45 million of our common stock. Under the

program, we may repurchase shares on an opportunistic basis from time to time in open market transactions and in privately

negotiated transactions, as appropriate. The repurchase program does not require the repurchase of a specific number of shares

and may be terminated at any time. As of December 31, 2011, we have repurchased 534,101 shares of stock for $21.2 million, at

an average price of $39.64 per share.

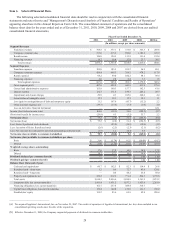

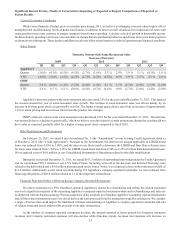

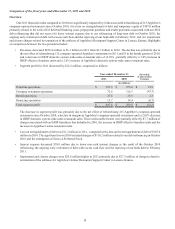

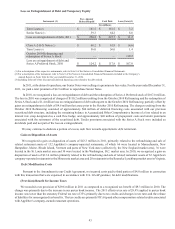

Significant Gains and Charges

There were several significant gains and charges that affect the comparisons of fiscal year 2011 results with the previous

periods presented herein, as shown in the following table:

Impairment and closure charges

Loss (gain) on extinguishment of debt and temporary equity

(Gain) on disposition of assets

Year ended December 31,

2011

(In millions)

$ 29.9

11.2

(43.3)

2010

$ 4.3

107.0

(13.6)

2009

$ 105.6

(45.7)

(7.4)

Each transaction is discussed in further detail under paragraphs captioned with those descriptions elsewhere in Item 7. The

significant impairment and closure charges in 2009 primarily related to a $93.5 million impairment of intangible assets. Our fixed

and intangible assets (including goodwill) must be assessed continually for indicators of impairment. Given the uncertainty as to

future economic and other assumptions used in assessing impairments, it is possible that significant impairment charges may occur

in future periods. We incurred significant charges in connection with the refinancing of debt in October 2010. Additionally, prior

to that refinancing, our debt traded at less than its carrying value such that early retirement by purchases on the open market

resulted in significant gains. The fair value of our current debt instruments is currently greater than its carrying value (see Note 12

of Notes to the Consolidated Financial Statements). Therefore, while we may dedicate a portion of excess cash flow towards early

debt retirement, we do not anticipate recognizing gains on the extinguishment of debt.

Gains on disposition of assets relate primarily to the refranchising and sale of related restaurant assets of Applebee’ s company-

operated restaurants. While we plan to refranchise a significant majority of the remaining Applebee’s company-operated restaurants,

there can be no assurance as to either the timing of additional transactions or the amount of gain or loss that may be recognized

in the future.

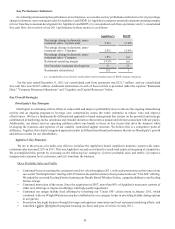

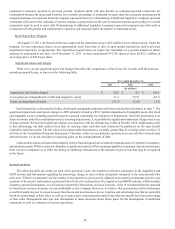

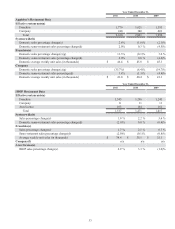

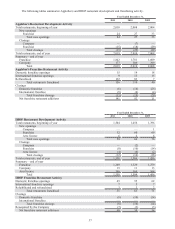

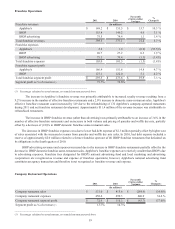

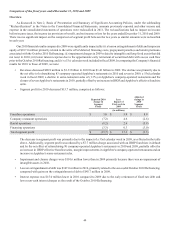

Restaurant Data

The following table sets forth, for each of the past three years, the number of effective restaurants in the Applebee's and

IHOP systems and information regarding the percentage change in sales at those restaurants compared to the same period in the

prior year. "Effective restaurants" are the number of restaurants in a given period, adjusted to account for restaurants open for only

a portion of the period. Information is presented for all effective restaurants in the Applebee's and IHOP systems, which includes

company-operated restaurants, as well as those operated by franchisees and area licensees. Sales of restaurants that are operated

by franchisees and area licensees are not attributable to the Company. However, we believe that presentation of this information

is useful in analyzing our revenues because franchisees and area licensees pay us royalties and advertising fees that are generally

based on a percentage of their sales, as well as, in some cases, rental payments under leases that are usually based on a percentage

of their sales. Management also uses this information to make decisions about future plans for the development of additional

restaurants as well as evaluation of current operations.