IHOP 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

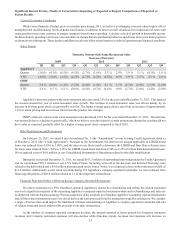

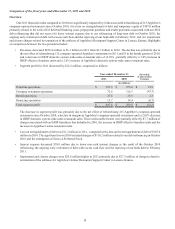

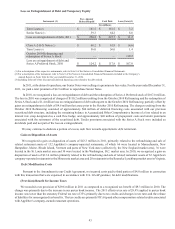

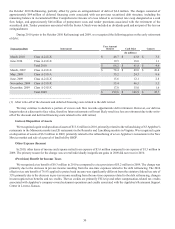

Loss on Extinguishment of Debt and Temporary Equity

Instrument (1)

Term Loans (1)

Senior Notes (1)

Loss on extinguishment of debt, 2011

Class A-2-II-X Notes (2)

Term Loans (1)

October 2010 Refinancing and

redemption of Series A Stock

Loss on extinguishment of debt and

Series A Preferred Stock, 2010

Face Amount

Retired/Repaid

(In millions)

$ 161.5

59.3

$ 220.8

$ 68.2

56.0

—

$ 124.2

Cash Paid

$ 161.5

64.2

$ 225.7

$ 61.8

56.0

—

$ 117.8

Loss (Gain)(3)

$ 3.2

8.0

$ 11.2

$(4.6)

1.4

110.2

$ 107.0

(1) For a description of the respective instruments, refer to Note 8 of the Notes to Consolidated Financial Statements.

(2) For a description of the instrument, refer to Note 8 of the Notes to Consolidated Financial Statements included in the Company’ s

Annual Report on Form 10-K for the year ended December 31, 2010.

(3) Including write-off of the discount and deferred financing costs related to the debt retired.

In 2011, at the dates of repurchase, our Senior Notes were selling at a premium to face value. For the year ended December 31,

2011, we paid a total premium of $4.9 million to repurchase Senior Notes.

In 2010, we recognized a loss on extinguishment of debt and the redemption of Series A Preferred stock of $107.0 million.

The loss in 2010 was comprised of charges of $110.2 million resulting from the October 2010 Refinancing and the redemption of

Series A Stock and a $1.4 million loss on extinguishment of debt subsequent to the October 2010 Refinancing, partially offset by

gains on extinguishment of debt of $4.6 million that arose prior to the October 2010 Refinancing. The charges resulting from the

October 2010 Refinancing consisted of approximately $64 million of deferred financing costs associated with our previous

securitized debt structure, including the remaining balance in Accumulated Other Comprehensive Income of a loss related to an

interest rate swap designated as a cash flow hedge, and approximately $46 million of prepayment costs and tender premiums

associated with the retirement of the securitized debt. Tender premiums associated with the Series A Stock were included as

dividends paid and not part of the loss on extinguishment.

We may continue to dedicate a portion of excess cash flow towards opportunistic debt retirement.

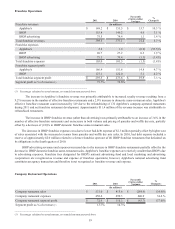

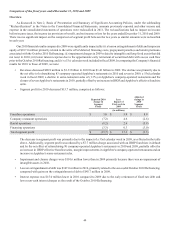

Gain on Disposition of Assets

We recognized a gain on disposition of assets of $43.3 million in 2011, primarily related to the refranchising and sale of

related restaurant assets of 132 Applebee's company-operated restaurants, of which 66 were located in Massachusetts, New

Hampshire, Maine, Rhode Island, Vermont and parts of New York state (collectively, the New England market area), 36 were

located in the St. Louis market area and 30 were located in the Washington, D.C. market area. In 2010, we recognized a gain on

disposition of assets of $13.6 million primarily related to the refranchising and sale of related restaurant assets of 63 Applebee's

company-operated restaurants in the Minnesota market area and 20 restaurants in the Roanoke/Lynchburg market area in Virginia.

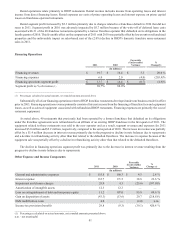

Debt Modification Costs

Pursuant to the Amendment to our Credit Agreement, we incurred costs paid to third parties of $4.0 million in connection

with this transaction that were expensed in accordance with U.S. GAAP guidance for debt modifications.

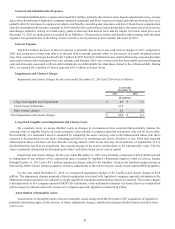

(Provision) Benefit for Income Taxes

We recorded a tax provision of $29.8 million in 2011 as compared to a recognized tax benefit of $9.3 million in 2010. The

change was primarily due to the increase in our pretax book income. The 2011 effective tax rate of 28.4% applied to pretax book

income was lower than the statutory Federal tax rate of 35% primarily due to tax credits and changes in tax rates and the release

of liabilities for unrecognized tax benefits. The tax credits are primarily FICA tip and other compensation-related credits associated

with Applebee's company-owned restaurant operations.