IHOP 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

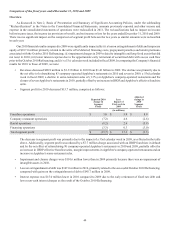

Comparison of the fiscal years ended December 31, 2011 and 2010

Overview

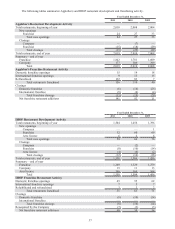

Our 2011 financial results compared to 2010 were significantly impacted by (i) the successful refranchising of 215 Applebee's

company-operated restaurants since October 2010; (ii) a loss on extinguishment of debt and temporary equity of $107.0 million

primarily related to the write off of deferred financing costs, prepayment penalties and tender premiums associated with our 2010

debt refinancing that did not recur; (iii) lower interest expense due to our refinancing of long-term debt in October 2010, the

ongoing early retirement of debt with excess cash flow and the repricing of our bank debt in February 2011; and (iv) impairment

and closure charges related to termination of the sublease of Applebee's Restaurant Support Center in Lenexa, Kansas. Highlights

of comparison between the two periods included:

• Revenues decreased $258.4 million to $1.1 billion in 2011 from $1.3 billion in 2010. The decline was primarily due to

the net effect of refranchising 132 company-operated Applebee's restaurants in 2011 and 83 in the fourth quarter of 2010,

and a decrease in IHOP domestic system-wide same-restaurant sales of (2.0)% , partially offset by a 3.6% increase in

IHOP effective franchise units and a 2.0% increase in Applebee's domestic system-wide same-restaurant sales.

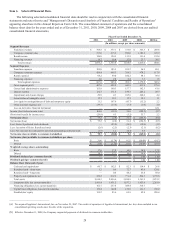

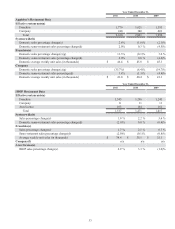

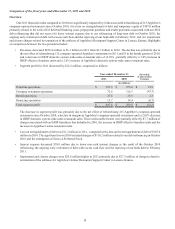

• Segment profit for 2011 decreased by $22.2 million, comprised as follows:

Franchise operations

Company restaurant operations

Rental operations

Financing operations

Total segment profit

Year ended December 31

2011

(in millions)

$ 293.5

72.6

27.8

13.7

$ 407.6

2010

$ 273.6

116.3

25.5

14.4

$ 429.8

Favorable

(Unfavorable)

Variance

$ 19.9

(43.7)

2.3

(0.7)

$(22.2)

The decrease in segment profit was primarily due to the net effect of refranchising 215 Applebee's company-operated

restaurants since October 2010, a decline in margins at Applebee's company-operated restaurants and a (2.0)% decrease

in IHOP domestic system-wide same-restaurant sales. These unfavorable factors were partially offset by $7.7 million of

charges associated with an IHOP franchisee that defaulted in 2010, the increase in IHOP effective franchise units and the

increase in Applebee's same-restaurant sales.

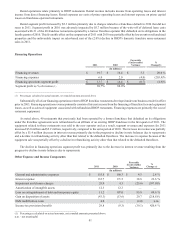

• Loss on extinguishment of debt was $11.2 million in 2011, compared with a loss on the extinguishment of debt of $107.0

million in 2010. The significant loss in 2010 included charges of $110.2 million related to our debt refinancing in October

2010 and the redemption of Series A Preferred Stock.

• Interest expense decreased $38.8 million due to lower non-cash interest charges as the result of the October 2010

refinancing, the ongoing early retirement of debt with excess cash flow and the repricing of our bank debt in February

2011.

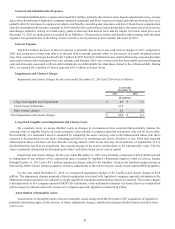

• Impairment and closure charges were $25.6 million higher in 2011 primarily due to $27.5 million of charges related to

termination of the sublease for Applebee's former Restaurant Support Center in Lenexa, Kansas.