IHOP 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

13. Commitments and Contingencies (Continued)

85

The parties stipulated to a bench trial which was set to begin on September 8, 2009 in Jefferson City, Missouri. Just prior

to trial, however, the court vacated the trial setting in order to submit key legal issues to the Eighth Circuit Court of Appeals for

review on interlocutory appeal. On April 21, 2011, the Eighth Circuit affirmed the trial court's denial of the Company's motion

for summary judgment. On July 6, 2011, the Eighth Circuit denied the Company's petition for rehearing.

On October 4, 2011, the Company filed a petition for certiorari asking the United States Supreme Court to review the

decision of the Eighth Circuit. On January 17, 2012, the Supreme Court declined to review the case. The bench trial is currently

scheduled to begin on September 10, 2012.

The Company believes it has meritorious defenses and intends to vigorously defend this case. An estimate of the possible

loss, if any, or the range of the loss cannot be made and, therefore, the Company has not accrued a loss contingency related to this

matter.

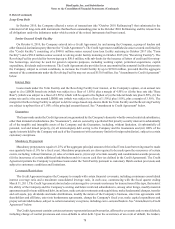

Letters of Credit

The Company provides letters of credit, primarily to various insurance carriers to collateralize obligations for outstanding

claims. As of December 31, 2011, the Company had approximately $15.7 million of unused letters of credit outstanding. These

letters expire on various dates in 2012 and are automatically renewed for an additional year if no cancellation notice is submitted.

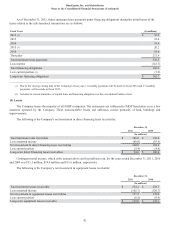

14. Consolidation of Variable Interest Entities

The Company has potential involvement with variable interest entities ("VIEs") in the form of franchise agreements between

the Company and franchisees of IHOP and Applebee's restaurants. The Company concluded that both the IHOP and Applebee's

franchisees have key decision-making abilities which enable them to have a significant impact on the success and the fair value

of their respective franchises and, therefore, that the franchise agreements are not VIEs.

The Company also assessed whether Centralized Supply Chain Services, LLC ("CSCS"), a purchasing co-operative formed

in February 2009 by the Company and owners of Applebee's and IHOP franchise restaurants to manage procurement activities

for the Applebee's and IHOP restaurants choosing to join CSCS, was a VIE and whether the Company was the primary beneficiary.

The Company does not have voting control of CSCS. Under the terms of the membership agreements, each member restaurant

belonging to CSCS has equal and identical voting rights, ownership rights and obligations. Accordingly, the Company is not

considered to be the primary beneficiary of the VIE and therefore does not consolidate the results of CSCS. There have been no

changes in the significant facts and circumstances related to the Company's involvement with CSCS during the year ended

December 31, 2011.

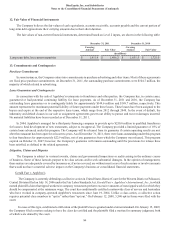

CSCS does not purchase items on behalf of member restaurants; rather, it facilitates purchasing agreements and distribution

arrangements between suppliers and member restaurants. Because of this, CSCS acquires a minimal amount of assets and incurs

a minimal amount of liabilities. Each member restaurant is responsible for only the goods and services it chooses to purchase and

bears no responsibility or risk of loss for goods and services purchased by other member restaurants. Based on these facts, the

Company believes the maximum estimated loss related to its membership in the CSCS is insignificant. The Company is not

obligated to provide any support to the Co-op under any express or implied agreement.

15. Preferred Stock and Stockholders' Equity

Preferred Stock

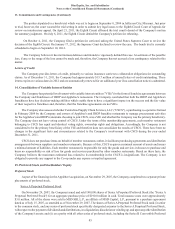

As part of the financing for the Applebee's acquisition, on November 29, 2007, the Company completed two separate private

placements of preferred stock.

Series A Perpetual Preferred Stock

On November 29, 2007, the Company issued and sold 190,000 shares of Series A Perpetual Preferred Stock (the "Series A

Perpetual Preferred Stock") for an aggregate purchase price of $190.0 million in cash. Total issuance costs were approximately

$3.0 million. All of the shares were sold to MSD SBI, L.P., an affiliate of MSD Capital, L.P., pursuant to a purchase agreement

dated as of July 15, 2007, as amended as of November 29, 2007. The shares of Series A Perpetual Preferred Stock rank (i) senior

to the common stock, and any series of preferred stock specifically designated as junior to the Series A Perpetual Preferred Stock,

with respect to the payment of dividends and distributions, in a liquidation, dissolution or winding up, and upon any other distribution

of the Company's assets; and (ii) on a parity with all other series of preferred stock, including the Series B Convertible Preferred