IHOP 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

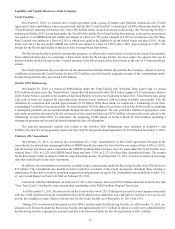

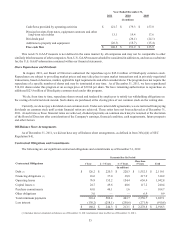

Liquidity and Capital Resources of the Company

Credit Facilities

On October 8, 2010, we entered into a credit agreement with a group of lenders and financial institutions (the "Credit

Agreement") that established a senior secured credit facility (the "Credit Facility") consisting of a $900 million term facility (the

"Term Facility") maturing in October 2017 and a $50 million senior secured revolving credit facility (the "Revolving Facility")

maturing in October 2015. Loans made under the Term Facility and the Revolving Facility bore interest, at our option, at an annual

rate equal to (i) a LIBOR based rate (which was subject to a floor of 1.50%) plus a margin of 4.50% or (ii) the base rate (the "Base

Rate") (which was subject to a floor of 2.50%), which was equal to the highest of (a) the federal funds rate plus 0.50%, (b) the

prime rate and (c) the one month LIBOR rate (which was subject to a floor of 1.50%) plus 1.00%, plus a margin of 3.50%. The

margin for the Revolving Facility is subject to debt leverage-based step-downs.

The Revolving Facility is utilized, among other purposes, to collateralize certain letters of credit we are required to maintain.

Such collateralization does not constitute a draw-down under the Revolving Facility but does reduce the amount that can be

borrowed under the Revolving Facility. Unused amounts of the Revolving Facility bear interest at the rate of 75 basis points per

annum.

The Credit Agreement also provides for an uncommitted incremental facility that permits the Company, subject to certain

conditions, to increase the Credit Facility by up to $250 million; provided that the aggregate amount of the commitments under

the Revolving Facility may not exceed $150 million.

October 2010 Refinancing

On October 20, 2010, we borrowed $900 million under the Term Facility (the "Original Term Loan") and we issued

$825 million of senior notes (the "Senior Notes") at par that will mature in October 2018 with a coupon of 9.5% per annum. Interest

on the Senior Notes is payable in the months of April and October of each year, beginning in April 2011. These borrowings, along

with cash on hand not required for operating needs and previously restricted cash becoming available concurrently with the

retirement of securitized debt totaled approximately $1.85 billion. With these funds we completed a refinancing of our then-

outstanding $1.6 billion of securitized debt. We also redeemed 143,000 shares of our Series A Stock for $149.6 million, including

a redemption premium and accrued dividends through the date of redemption. We also paid $46.1 million of prepayment costs

and tender premiums associated with the retirement of the securitized debt and $57.6 million of transaction costs related to the

refinancing. In November 2010, we redeemed the remaining 47,000 shares of Series A Stock for $49.4 million including a

redemption premium and accrued dividends through the date of redemption.

The material agreements entered into related to the October 2010 Refinancing were included as Exhibit 4.1 and

Exhibits 10.1and 10.2 of our quarterly report on Form 10-Q for the period ended September 30, 2010 filed on November 3, 2010.

February 2011 Amendment

On February 25, 2011, we entered into Amendment No. 1 (the "Amendment") to the Credit Agreement. Pursuant to the

Amendment, the interest rate margin applicable to LIBOR-based loans under the Term Facility was reduced from 4.50% to 3.00%,

and the interest rate floors used to determine the LIBOR and Base Rate reference rates for loans under the Term Facility were

reduced from 1.50% to 1.25% for LIBOR-based loans and from 2.50% to 2.25% for Base Rate denominated loans. The margin

for the Revolving Facility is subject to debt leverage-based step-downs. As of December 31, 2011, we have not achieved a leverage

ratio that would result in any such step-downs.

In addition, the Amendment increased the available lender commitments under the Revolving Facility from $50 million to

$75 million. The Amendment also modified certain restrictive covenants of the Credit Agreement, including those relating to

repurchases of other debt securities, permitted acquisitions and payments on equity. The Amendment was included as Exhibit 10.1

of our Current Report on Form 8-K filed on February 28, 2011.

Concurrent with the Amendment, on February 25, 2011, the Company borrowed $742.0 million under the Term Facility (the

"New Term Loan"), retiring the same amount then outstanding of the $900.0 million Original Term Loan.

As of December 31, 2011, the interest rate on the Term Facility was 4.25%. Taking into account fees and expenses associated

with the Credit Agreement and the Amendment that will be amortized as additional non-cash interest expense over a seven-year

period, the weighted average effective interest rate for the Credit Facility as of December 31, 2011 was 5.6%.

During 2011 we borrowed and repaid a total of $40.0 million under the Revolving Facility. As of December 31, 2011, no

amounts were borrowed under the Revolving Facility and approximately $15.7 million in letters of credit were collateralized by

the Revolving Facility, reducing the amount available to be borrowed under the Revolving Facility to $59.3 million.