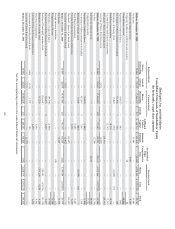

IHOP 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

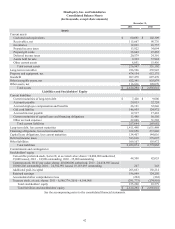

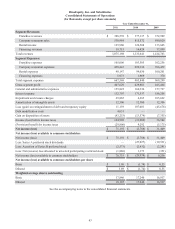

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

67

at December 31, 2011.

The Company maintains an allowance for credit losses based upon our historical experience taking into account current

economic conditions.

Cash and Cash Equivalents

The Company considers all highly liquid investment securities with remaining maturities at the date of purchase of three

months or less to be cash equivalents. These cash equivalents are stated at cost which approximates market value.

Restricted Assets

Restricted Cash

The Company receives funds from Applebee's franchisees pursuant to franchise agreements, usage of which is restricted to

advertising activities. Restricted cash balances as of December 31, 2011 and 2010 totaled $1.2 million and $1.6 million, respectively.

All of the 2011 balance was included as other current assets in the consolidated balance sheet; the 2010 balance included $0.8

million as other current assets and $0.8 million as other assets, net in the consolidated balance sheets.

Other Restricted Assets

At December 31, 2011 and 2010, restricted assets related to a captive insurance subsidiary totaled $3.6 million and were

included in other assets in the consolidated balance sheets. The captive insurance subsidiary, which has not underwritten coverage

since January 2006, was formed to provide insurance coverage to Applebee's and its franchisees. These restricted assets were

primarily investments, use of which is restricted to the payment of insurance claims that are in run-off.

Investments

The Company's investments comprise certificates of deposit, money market funds and auction rate securities that are the

restricted assets related to the captive insurance subsidiary. The Company has classified all investments as available-for-sale with

any unrealized gain or loss included in Accumulated Other Comprehensive Loss. The contractual maturity of the auction rate

security is 2030.

Inventories

Inventories consisting of food, beverages, merchandise and supplies are stated at the lower of cost (on a first-in, first-out

basis) or market. When necessary, the Company reserves for obsolescence and shrinkage based upon inventory turnover trends,

historical experience and the specific identification method.

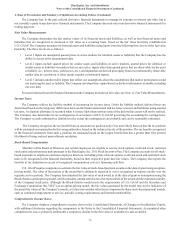

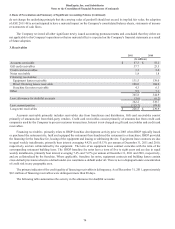

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Equipment under capital leases is stated at the

present value of the minimum lease payments. Depreciation is computed using the straight-line method over the estimated useful

lives of the assets or remaining useful lives. Leasehold improvements and equipment under capital leases are amortized on a

straight-line basis over their estimated useful lives or the lease term, if less. The Company has capitalized certain costs incurred

in connection with the development of internal-use software which are included in equipment and fixtures and amortized over the

expected useful life of the asset. The general ranges of depreciable and amortizable lives are as follows:

Category

Buildings and improvements

Leaseholds and improvements

Equipment and fixtures

Properties under capital leases

Depreciable Life

25 - 40 years

Shorter of primary lease term or between three to 40 years

Two to 10 years

Primary lease term or remaining primary lease term

Property and equipment are reported as assets held for sale when they meet the criteria of U.S. GAAP. The Company ceases

recording depreciation on assets classified as held for sale.

The Company capitalizes interest on borrowings during the active construction period of major capital projects. Capitalized

interest is added to the cost of qualified assets and is amortized over the estimated useful lives of the assets.