IHOP 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

89

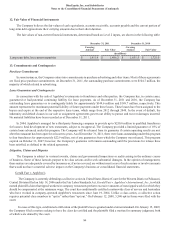

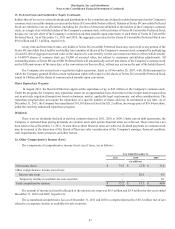

Tradename Impairment

In accordance with U.S. GAAP, indefinite-lived intangible assets must be evaluated for impairment, at a minimum, on an

annual basis, and more frequently if we believe indicators of impairment exist. Such indicators include, but are not limited to,

events or circumstances such as a significant adverse change in the business climate, unanticipated competition, a loss of key

personnel, adverse legal or regulatory developments, or a significant decline in the market price of our common stock. In performing

the impairment review of the tradename intangible asset, we primarily use the relief of royalty method under the income approach

method of valuation. Significant assumptions used to determine fair value under the relief of royalty method include future trends

in sales, a royalty rate and a discount rate to be applied to the forecast revenue stream. During the course of fiscal 2011, 2010 and

2009, the Company made periodic assessments as to whether there were indicators of impairment, particularly with respect to the

significant assumptions noted above. As a result of these assessments, we determined an interim test of indefinite-lived intangibles

was not necessary in either 2011, 2010 or 2009.

During the fourth quarter of 2011 and 2010, the Company performed the annual test of impairment for indefinite-lived

intangibles, primarily the Applebee's tradename assigned in the purchase price allocation. The Company determined the estimated

fair value of our indefinite-lived intangible assets exceeded the carrying values and in the absence of indicators of impairment we

concluded no impairment was necessary. During the fourth quarter of 2009, the Company performed the annual test of impairment

of indefinite-lived intangibles. The Company revised downwards the same-restaurant sales change assumption in its previous

five-year forecast. The Company also revised downward the assumed discount rate. As the result of the revised assumptions, the

estimated fair value of the tradename was less than the carrying value and an impairment of $93.5 million was recognized.

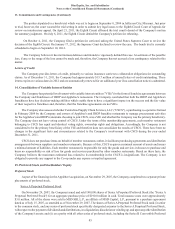

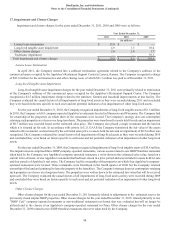

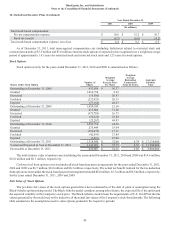

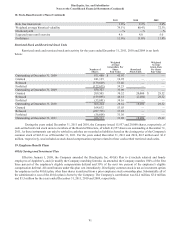

18. Stock-Based Incentive Plans

General Description

From time to time, the Company has granted nonqualified stock options, restricted stock awards, cash-settled and stock-

settled restricted stock units and performance units to officers, other employees and non-employee directors of the Company.

Currently, the Company is authorized to grant stock options, stock appreciation rights, restricted stock awards, cash-settled and

stock-settled restricted stock units and performance units to officers, other employees and non-employee directors under the

DineEquity, Inc. 2011 Stock Incentive Plan (the “2011 Plan”). The 2011 Plan was approved by stockholders on May 17, 2011 and

permits the issuance of up to 1,500,000 shares of the Company’ s common stock for incentive stock awards. The 2011 Plan will

expire in May 2021.

The IHOP Corp. 2001 Stock Incentive Plan (the "2001 Plan") was adopted in 2001 and amended and restated in 2005 and

2008 to authorize the issuance of up to 4,200,000 shares of common stock. The 2001 Plan has expired.

The Stock Option Plan for Non-Employee Directors (the "Directors Plan") was adopted in 1994 and amended and restated

in 1999 to authorize the issuance of up to 400,000 shares of common stock pursuant to options to non-employee directors. The

Directors Plan has expired but there are options issued under the Directors Plan outstanding as of December 31, 2011.

The 2005 Stock Incentive Plan for Non-Employee Directors (the "2005 Plan," the 2001 Plan and the Directors Plan, the

"Plans") was adopted in 2005 to authorize the issuance of up to 200,000 shares of common stock to non-employee members of

the Company's Board of Directors. Awards may be made in common stock, in options to purchase common stock, or in shares of

Restricted Stock, or any combination thereof.

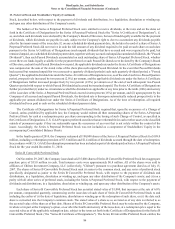

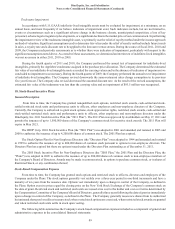

Stock-Based Compensation Expense

From time to time, the Company has granted stock options and restricted stock to officers, directors and employees of the

Company under the Plans. The stock options generally vest ratably over a three-year period in one-third increments and have a

maturity of ten years from the issuance date. Options vest immediately upon a change in control of the Company, as defined in

the Plans. Option exercise prices equal the closing price on the New York Stock Exchange of the Company's common stock on

the date of grant. Restricted stock and restricted stock units are issued at no cost to the holder and vest over terms determined by

the Compensation Committee of the Company's Board of Directors, generally three years following the date of grant or immediately

upon a change in control of the Company, as defined in the Plans. The Company generally issues new shares from its authorized

but unissued share pool or utilizes treasury stock when vested stock options are exercised, when restricted stock awards are granted

and when restricted stock units settle in stock upon vesting.

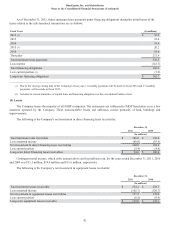

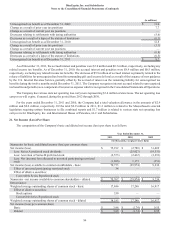

The following table summarizes the Company's stock-based compensation expense included as a component of general and

administrative expenses in the consolidated financial statements: