IHOP 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

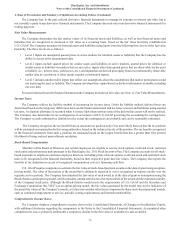

8. Debt (Continued)

79

by a majority vote, will have the ability to direct the Administrative Agent to terminate the loan commitments, accelerate all loans

and exercise any of the lenders' other rights under the Credit Agreement and the related loan documents on behalf of the lenders.

Amendment to Credit Agreement

On February 25, 2011, the Company entered into Amendment No. 1 (the ''Amendment'') to the Credit Agreement. Pursuant

to the Amendment, the interest rate margin applicable to LIBOR-based term loans made under the Credit Facility (“Term Loans”)

was reduced from 4.50% to 3.00%, and the interest rate floors used to determine the LIBOR and Base Rate reference rates for

Term Loans was reduced from 1.50% to 1.25% for LIBOR-based Term Loans and from 2.50% to 2.25% for Base Rate-denominated

Term Loans. In addition, the Amendment increased the lender commitments under the Revolving Facility from $50 million to $75

million. The Amendment also modified certain restrictive covenants of the Credit Agreement, including those relating to repurchases

of other debt securities, permitted acquisitions and payments on equity.

The Company paid $12.3 million in fees and costs related to the Amendment, of which $7.4 million in fees paid to lenders

was recorded as additional discount on debt and $0.8 million of costs related to the increase in the Revolving Facility was recorded

as deferred financing costs. Fees paid to third parties of $4.0 million were recorded as “Debt modification costs” in the Consolidated

Statement of Operations for the year ended December 31, 2011.

Effective Interest Rate

Taking into account fees and expenses associated with the Credit Agreement and the Amendment that will be amortized as

additional non-cash interest expense over a seven-year period, the weighted average effective interest rate for the Credit Facility

as of December 31, 2011 was 5.6%.

Borrowings Under Senior Secured Credit Facility

Concurrent with the Amendment, on February 25, 2011, the Company borrowed $742.0 million under the Term Facility

( the "New Term Loan"), retiring the amount then outstanding of the original $900.0 million borrowed under the Credit Agreement.

The mandatory repayment of 1% per fiscal year is based upon the $742.0 million New Term Loan. There was $682.5 million of

the New Term Loan outstanding at December 31, 2011.

During 2011, the Company borrowed a total of $40.0 million under the Revolving Facility, all of which was repaid. As of

December 31, 2011, there were no amounts outstanding under the Revolving Facility; however, available borrowing capacity

under the Revolving Facility is reduced by $15.7 million of letters of credit outstanding as of December 31, 2011 pursuant to sub-

limits of the Credit Agreement.

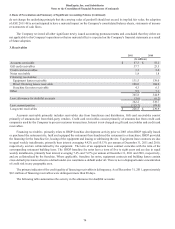

9.5% Senior Notes due 2018

On October 19, 2010, the Company, issued $825.0 million aggregate principal amount of its 9.5% Senior Notes due

October 30, 2018 (the "Notes") pursuant to an Indenture (the "Indenture"), by and among the Company, the Guarantors and Wells

Fargo Bank, National Association, as trustee (the "Trustee"). The Notes are unsecured senior obligations of the Company and are

jointly and severally guaranteed on a senior unsecured basis by the Guarantors under the Credit Agreement.

Interest/Effective Interest

The Notes bear interest at the rate of 9.5% per annum. Interest on the Notes is payable on April 30 and October 30 of each

year, beginning on April 30, 2011. Taking into account fees and expenses associated with the Notes that will be amortized as

additional non-cash interest expense over an eight-year period, the weighted average effective interest rate for the Notes as of

December 31, 2011 was 10.8%.

Prepayment

The Company may redeem the Notes for cash in whole or in part, at any time or from time to time, on and after October 30,

2014, at specified redemption premiums, plus accrued and unpaid interest, as specified in the Indenture. In addition, prior to

October 30, 2014, the Company may redeem the Notes for cash in whole or in part, at any time and from time to time, at a

redemption price equal to 100% of the principal amount plus accrued and unpaid interest and a "make-whole" premium, as specified

in the Indenture. In addition, prior to October 30, 2013, the Company may redeem up to 35% of the aggregate principal amount

of Notes issued with the net proceeds raised in one or more equity offerings. If the Company undergoes a change of control under

certain circumstances, the Company may be required to offer to purchase the Notes at a purchase price equal to 101% of the

principal amount plus accrued and unpaid interest. If the Company sells assets under certain circumstances, the Company may be