IHOP 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

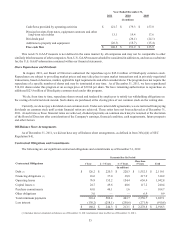

55

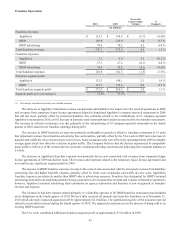

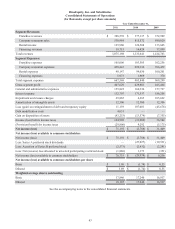

Cash flows provided by operating activities

Principal receipts from notes, equipment contracts and other

long-term receivables

Dividends paid

Additions to property and equipment

Free cash flow

Year Ended December 31,

2011

(In millions)

$ 121.7

13.1

—

(26.3)

$ 108.5

2010

$ 179.3

19.4

(26.1)

(18.7)

$ 153.9

2009

$ 157.8

17.6

(24.1)

(15.4)

$ 135.9

This non-U.S. GAAP measure is not defined in the same manner by all companies and may not be comparable to other

similarly titled measures of other companies. Non-U.S. GAAP measures should be considered in addition to, and not as a substitute

for, the U.S. GAAP information contained within our financial statements.

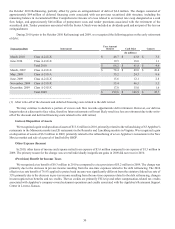

Share Repurchases and Dividends

In August, 2011, our Board of Directors authorized the repurchase up to $45.0 million of DineEquity common stock.

Repurchases are subject to prevailing market prices and may take place in open market transactions and in privately negotiated

transactions, based on business, market, applicable legal requirements and other considerations. The program does not require the

repurchase of a specific number of shares and may be terminated at any time. As of December 31, 2011, we have repurchased

534,101 shares under this program at an average price of $39.64 per share. We have remaining authorization to repurchase an

additional $23.8 million of DineEquity common stock under this program.

We do, from time to time, repurchase shares owned and tendered by employees to satisfy tax withholding obligations on

the vesting of restricted stock awards. Such shares are purchased at the closing price of our common stock on the vesting date.

Currently, we do not pay a dividend on our common stock. Under our current debt agreements, we are restricted from paying

dividends on common stock until certain financial ratios are achieved. Those ratios have not been achieved as of December 31,

2011. At such time as those financial ratios are achieved, dividend payments on common stock may be resumed at the discretion

of the Board of Directors after consideration of the Company's earnings, financial condition, cash requirements, future prospects

and other factors.

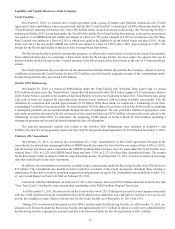

Off-Balance Sheet Arrangements

As of December 31, 2011, we did not have any off-balance sheet arrangements, as defined in Item 303(a)(4) of SEC

Regulation S-K.

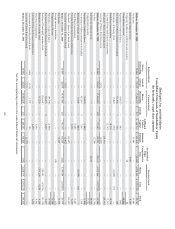

Contractual Obligations and Commitments

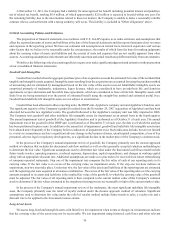

The following are our significant contractual obligations and commitments as of December 31, 2011:

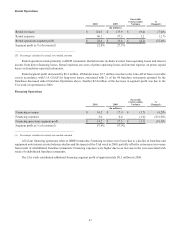

Contractual Obligations

Debt (1)

Financing obligations (1)

Operating leases

Capital leases (1)

Purchase commitments

Other obligations

Total minimum payments

Less interest

Payments Due By Period

1 Year

(in millions)

$ 126.2

16.6

76.9

24.7

63.0

3.0

310.4

(130.2)

$ 180.2

2 - 3 Years

$ 220.3

37.0

155.2

49.8

40.1

—

502.4

(258.1)

$ 244.3

4 - 5 Years

$ 220.3

38.8

154.4

48.6

1.6

—

463.7

(250.6)

$ 213.1

More than

5 Years

$ 1,552.3

217.9

656.4

117.2

—

6.9

2,550.7

(271.9)

$ 2,278.8

Total

$ 2,119.1

310.2

1,042.8

240.4

104.7

9.9

3,827.1

(910.8)

$ 2,916.3

(1) Includes interest calculated on balances as of December 31, 2011 and interest rates in effect as of December 31, 2011.