IHOP 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

93

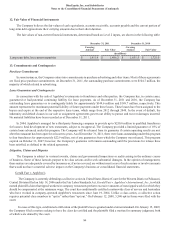

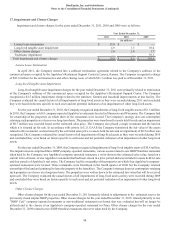

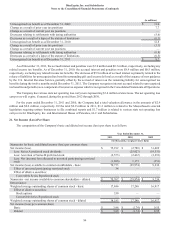

Net deferred tax assets (liabilities) consisted of the following components:

Differences in capitalization and depreciation and amortization of reacquired franchises and

equipment

Differences in acquisition financing costs

Employee compensation

Deferred gain on sale of assets

Book/tax difference in revenue recognition

Michigan business tax

Kansas High Performance Incentive Program credits

Other

Deferred tax assets

Valuation allowance

Total deferred tax assets after valuation allowance

Differences between financial and tax accounting in the recognition of franchise and

equipment sales

Differences in capitalization and depreciation (1)

Differences in acquisition financing costs

Book/tax difference in revenue recognition

Differences between book and tax basis of property and equipment

Other

Deferred tax liabilities

Net deferred tax (liabilities)

Net deferred tax asset (liability)—current

Valuation allowance—current

Net deferred tax asset (liability)—current

Net deferred tax asset (liability)—non current

Valuation allowance—non current

Net deferred tax asset (liability)—non current

Net deferred tax (liabilities)

2011

(In millions)

$ 4.9

1.9

14.2

2.0

18.1

—

—

35.9

77.0

(2.9)

74.1

(59.4)

(322.2)

(9.3)

(19.8)

(9.8)

(16.8)

(437.3)

$ (363.2)

$ 21.0

(0.4)

20.6

(381.3)

(2.5)

(383.8)

$ (363.2)

2010

$ 4.9

1.9

17.1

2.0

16.6

9.5

3.2

37.6

92.8

(9.6)

83.2

(63.4)

(325.6)

(0.5)

(22.6)

(8.9)

(13.6)

(434.6)

$ (351.4)

$ 27.0

(2.7)

24.3

(368.8)

(6.9)

(375.7)

$ (351.4)

_____________________________________

(1) Primarily related to the Applebee's acquisition.

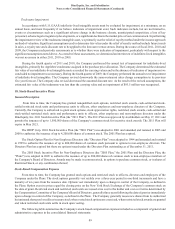

The Company and its subsidiaries file federal income tax returns and income tax returns in various state and foreign

jurisdictions. With few exceptions, the Company is no longer subject to federal, state or non-United States tax examinations by

tax authorities for years before 2007. Applebee's is currently under audit by the United States Internal Revenue Service for the

period ended November 29, 2007. The Internal Revenue Service commenced examination of the Company's U.S. federal income

tax return for the tax years 2008 to 2010 in the first quarter of 2012. The examination is anticipated to be completed by the first

quarter of 2013.

At December 31, 2011, the Company had a liability for unrecognized tax benefit including potential interest and penalties,

net of related tax benefit, totaling $8.9 million, of which approximately $2.0 million is expected to be paid within one year. For

the remaining liability, due to the uncertainties related to these tax matters, the Company is unable to make a reasonably reliable

estimate when a cash settlement with a taxing authority will occur.

The total unrecognized tax benefit as of December 31, 2011 and 2010 was $8.2 million and $12.8 million, respectively,

excluding interest, penalties and related income tax benefits. The decrease of $4.6 million is primarily related to settlements with

taxing authorities resulting in a decrease in unrecognized tax benefits related to prior year positions. The entire $8.2 million will

be included in the Company's effective income tax rate if recognized.

The Company estimates the unrecognized tax benefits may decrease over the upcoming 12 months by an amount up to $2.8

million related to settlements with taxing authorities and the lapse of the statute of limitations. A reconciliation of the beginning

and ending amount of unrecognized tax benefits is as follows: