IHOP 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

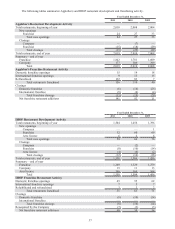

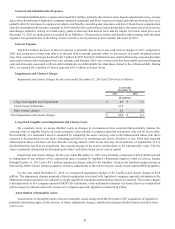

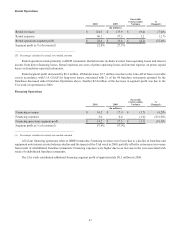

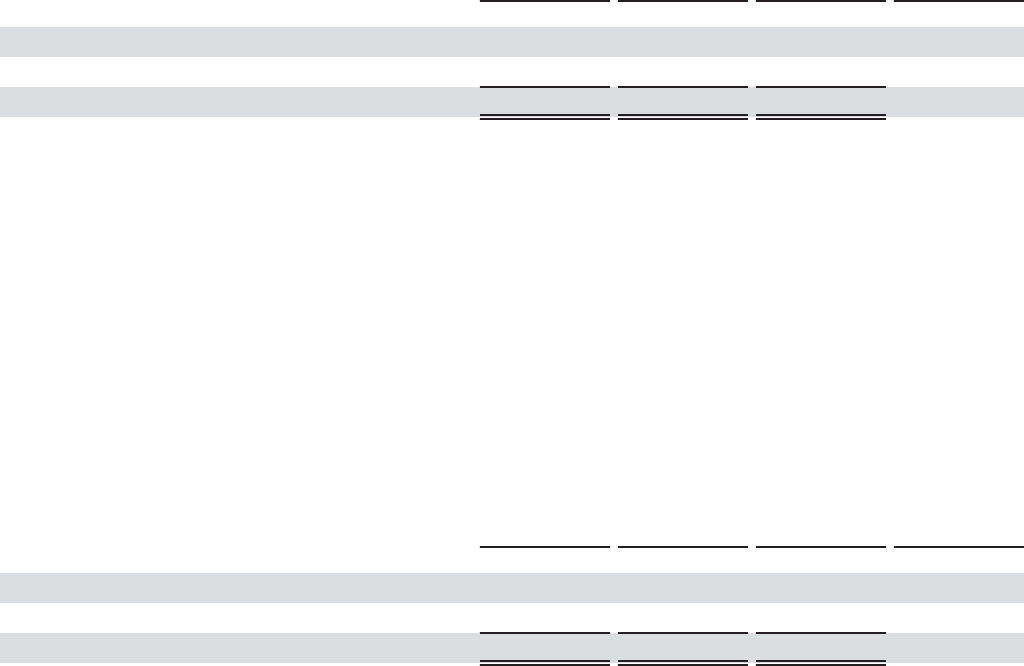

Rental Operations

Rental revenues

Rental expenses

Rental operations segment profit

Segment profit as % of revenue(1)

2010

(In millions)

$ 124.5

96.1

$ 28.4

22.8%

2009

$ 133.9

97.3

$ 36.6

27.3%

Favorable

(Unfavorable)

Variance

$(9.4)

1.2

$(8.2)

%

Change(1)

(7.0)%

1.2 %

(22.4)%

_________________________________________

(1) Percentages calculated on actual, not rounded, amounts

Rental operations relate primarily to IHOP restaurants. Rental income includes revenue from operating leases and interest

income from direct financing leases. Rental expenses are costs of prime operating leases and interest expense on prime capital

leases on franchisee-operated restaurants.

Rental segment profit decreased by $8.2 million. Of that decrease, $5.7 million was due to the write-off of lease receivable

cost in accordance with U.S. GAAP for long-term leases, associated with 21 of the 40 franchise restaurants operated by the

franchisee discussed under Franchise Operations above. Another $2.4 million of the decrease in segment profit was due to the

53rd week of operations in 2009.

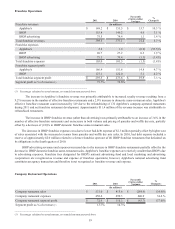

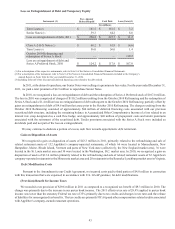

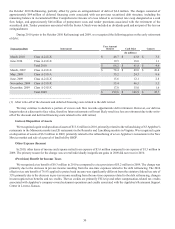

Financing Operations

Financing revenues

Financing expenses

Financing operations segment profit

Segment profit as % of revenue(1)

2010

(In millions)

$ 16.2

2.0

$ 14.2

87.9%

2009

$ 17.9

0.4

$ 17.5

97.9%

Favorable

(Unfavorable)

Variance

$(1.7)

(1.6)

$(3.3)

%

Change(1)

(9.2)%

(431.9)%

(18.5)%

________________________________________

(1) Percentages calculated on actual, not rounded, amounts

All of our financing operations relate to IHOP restaurants. Financing revenues were lower due to a decline in franchise and

equipment note interest as note balances decline and the impact of the 53rd week in 2009, partially offset by an increase in revenue

from resale of rehabilitated franchise restaurants. Financing expenses were higher due to an increase in the cost associated with

resale of rehabilitated franchise restaurants.

The 53rd week contributed additional financing segment profit of approximately $0.3 million in 2009.