Hertz 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

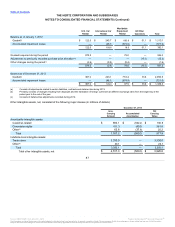

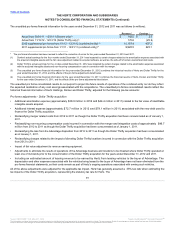

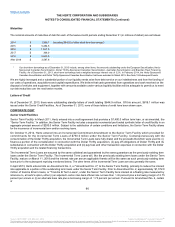

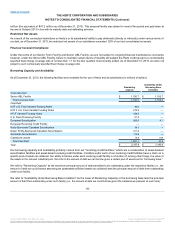

HFLF Series 2013-2

Notes(3) 1.16%

Floating

9/2015

206.0

—

486.1

899.3

HFLF Medium Term Notes

HFLF Series 2013-A

Notes(3) 0.79%

Floating

9/2016–11/2016

500.0

—

500.0

—

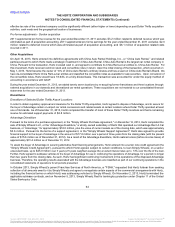

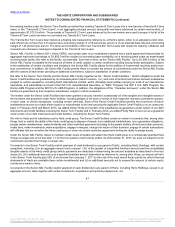

Other Fleet Debt

U.S. Fleet Financing

Facility 2.92%

Floating

9/2015

153.0

166.0

European Revolving

Credit Facility 2.97%

Floating

6/2015

302.5

185.3

European Fleet Notes 4.375%

Fixed

1/2019

584.3

—

Former European Fleet

Notes 8.50%

Fixed

3/2015

—

529.4

European

Securitization(3) 2.61%

Floating

7/2014

280.5

242.2

Hertz-Sponsored

Canadian

Securitization(3) 2.15%

Floating

3/2014

88.7

100.5

Dollar Thrifty-Sponsored

Canadian

Securitization(3)(5) 2.14%

Floating

8/2014

38.3

55.3

Australian

Securitization(3) 3.94%

Floating

12/2014

110.9

148.9

Brazilian Fleet

Financing Facility 14.05%

Floating

10/2014

12.3

14.0

Capitalized Leases 4.09%

Floating

Various

385.4

337.6

Unamortized Premium

(Fleet)

6.3

12.1

1,962.2

1,791.3

Total Fleet Debt

9,805.6

8,903.3

Total Debt

$16,227.5

$15,014.5

_______________________________________________________________________________

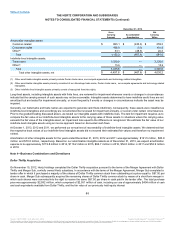

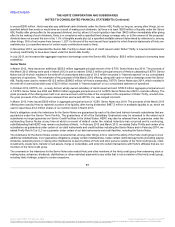

(1) As applicable, reference is to the December 31, 2013 weighted average interest rate (weighted by principal balance).

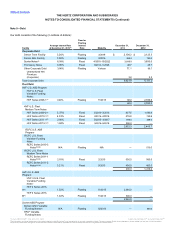

(2) References to our "Senior Notes" include the series of Hertz's unsecured senior notes set forth in the table below. As of December 31, 2013 and December

31, 2012, the outstanding principal amount for each such series of the Senior Notes is also specified below.

4.25% Senior Notes due April 2018 $250.0

$—

7.50% Senior Notes due October 2018 700.0

700.0

6.75% Senior Notes due April 2019 1,250.0

1,250.0

5.875% Senior Notes due October 2020 699.8

700.0

7.375% Senior Notes due January 2021 500.0

500.0

6.25% Senior Notes due October 2022 500.0

500.0

$3,899.8

$3,650.0

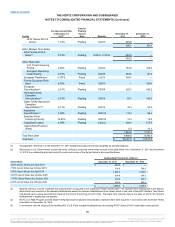

(3) Maturity reference is to the "expected final maturity date" as opposed to the subsequent "legal maturity date." The expected final maturity date is the date by

which Hertz and investors in the relevant indebtedness expect the relevant indebtedness to be repaid, which in the case of the HFLF Medium Term Notes

was based upon various assumptions made at the time of the pricing of such notes. The legal final maturity date is the date on which the relevant

indebtedness is legally due and payable.

(4) RCFC U.S. ABS Program and the Dollar Thrifty-Sponsored Canadian Securitization represent fleet debt acquired in connection with the Dollar Thrifty

acquisition on November 19, 2012.

(5) In connection with the closing of the existing HVF II U.S. Fleet Variable Funding Notes, the existing RCFC Series 2010-3 noteholders were paid off.

95

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.