Hertz 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

if significant inputs have changed that would impact the fair value hierarchy disclosure. For further information on assets classified as Level

3 measurement, see Note 4—Business Combinations and Divestitures.

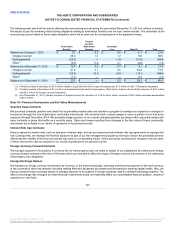

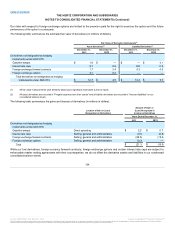

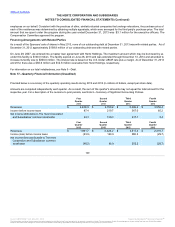

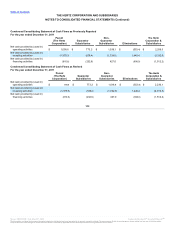

The following table summarizes the changes in fair value measurement using Level 3 inputs for the year ended December 31, 2013 (in

millions of dollars):

Balance at the beginning of period

$ —

Realized gains (losses) included in earnings

—

Unrealized gains (losses) related to investments

21.0

Purchases

130.0

Settlements

—

Balance at the end of period

$151.0

For the years ended December 31, 2013 and 2012, unrealized gains of 21.0 million and $0.0 million were recognized in "Accumulated other

comprehensive income (loss)."

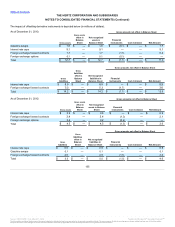

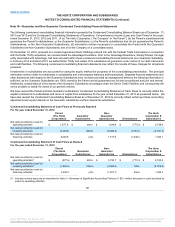

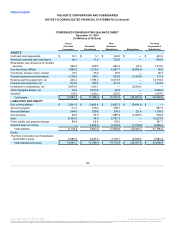

For borrowings with an initial maturity of 90 days or less, fair value approximates carrying value because of the short-term nature of these

instruments. For all other debt, fair value is estimated based on quoted market rates as well as borrowing rates currently available to us for

loans with similar terms and average maturities (Level 2 inputs). The aggregate fair value of all debt at December 31, 2013 was $16,547.3

million, compared to its nominal unpaid principal balance of $16,218.0 million. The aggregate fair value of all debt at December 31, 2012

was $15,529.4 million, compared to its nominal unpaid principal balance of $14,999.1 million.

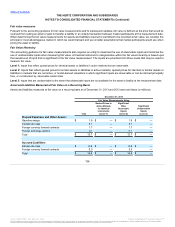

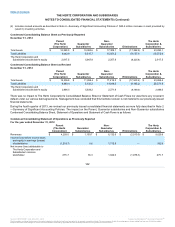

Nonfinancial assets measured and recorded at fair value on a nonrecurring basis

Long-Lived Assets

We continually evaluate revenue earning equipment to determine whether events or changes in circumstances have occurred that may

warrant revision of the estimated useful life or whether the remaining balance should be evaluated for possible impairment. We use a

combination of the undiscounted cash flows and market approaches in assessing whether an asset has been impaired. We measure

impairment losses based upon the amount by which the carrying amount of the asset exceeds the fair value.

FSNA, the parent of Simply Wheelz LLC, or "Simply Wheelz," the owner and operator of Hertz’s divested Advantage brand, filed for

bankruptcy protection under Chapter 11 of the United States Bankruptcy Code in November 2013. As a result, Hertz performed an

impairment analysis of the vehicles subleased to Simply Wheelz during the quarter ended September 30, 2013 on an undiscounted cash

flow basis to determine whether an impairment loss should be recognized. Based on the results of the recoverability test under ASC Topic

360, “Property, Plant, and Equipment,” we concluded that these assets were impaired and thus, we were required to determine the fair

value of the subleased vehicles to measure the amount of impairment loss. Based on our impairment analysis, we recorded an impairment

charge of $40.0 million to write down the carrying value of the vehicles subleased to Simply Wheelz to their fair value during the quarter

ended September 30, 2013.

To derive the fair value of the subleased vehicles to Simply Wheelz, we included all aspects of the undiscounted cash flow model associated

with the vehicle sublease arrangements with Simply Wheelz, including the amount and timing of future expected cash flows, transaction

costs associated with vehicle disposals and the probability weighted of various cash flow outcomes. To validate the fair values of the

subleased vehicles upon disposal, we also obtained independent third-party appraisals for the vehicles, which are generally developed using

transaction prices, such as average wholesale adjusted value, for comparable vehicles and adjusted for specific factors related to those

vehicles.

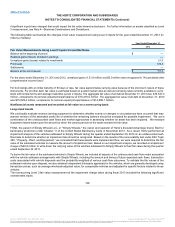

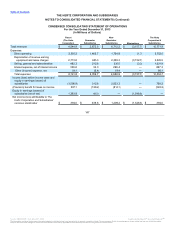

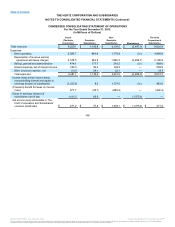

The nonrecurring Level 3 fair value measurement of the impairment charge taken during fiscal 2013 included the following significant

unobservable inputs:

138

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.