Hertz 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

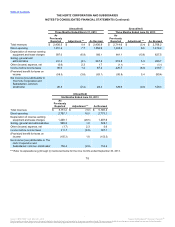

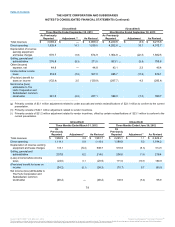

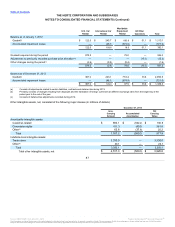

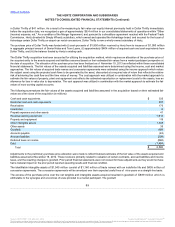

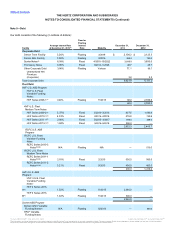

Amortizable intangible assets:

Customer-related $693.1

$(433.8)

$259.3

Concession rights 406.0

(5.0)

401.0

Other(2) 53.1

(28.8)

24.3

Total 1,152.2

(467.6)

684.6

Indefinite-lived intangible assets:

Trade name 3,330.0

—

3,330.0

Other(3) 15.6

—

15.6

Total 3,345.6

—

3,345.6

Total other intangible assets, net $4,497.8

$(467.6)

$4,030.2

_______________________________________________________________________________

(1) Other amortizable intangible assets primarily include Donlen trade name, non-compete agreements and technology-related intangibles.

(2) Other amortizable intangible assets primarily consisted of our Advantage trade name, Donlen trade name, non-compete agreements and technology-related

intangibles.

(3) Other indefinite-lived intangible assets primarily consist of reacquired franchise rights.

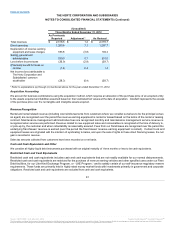

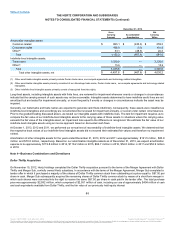

Long-lived assets, including intangible assets with finite lives, are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of such assets may not be recoverable. Intangible assets determined to have indefinite useful lives are not

amortized but are tested for impairment annually, or more frequently if events or changes in circumstances indicate the asset may be

impaired.

Generally, our trademarks and trade names are expected to generate cash flows indefinitely. Consequently, these assets were classified as

indefinite-lived intangibles and accordingly are not amortized but reviewed for impairment annually, or sooner under certain circumstances.

Prior to the goodwill testing discussed above, we tested our intangible assets with indefinite lives. The test for impairment requires us to

compare the fair value of our indefinite-lived intangible assets to the carrying value of those assets. In situations where the carrying value

exceeds the fair value of the intangible asset, an impairment loss equal to the difference is recognized. We estimate the fair value of our

indefinite-lived intangible assets using an income approach based on discounted cash flows.

At October 1, 2013, 2012 and 2011, we performed our annual test of recoverability of indefinite-lived intangible assets. We determined that

the respective book values of our indefinite-lived intangible assets did not exceed their estimated fair values and therefore no impairment

existed.

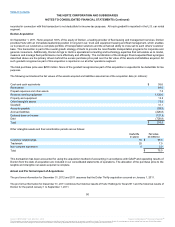

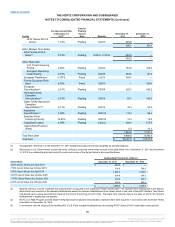

Amortization of other intangible assets for the years ended December 31, 2013, 2012 and 2011 was approximately $121.5 million, $83.9

million and $70.0 million, respectively. Based on our amortizable intangible assets as of December 31, 2013, we expect amortization

expense to be approximately $119.8 million in 2014, $116.2 million in 2015, $66.7 million in 2016, $54.0 million in 2017 and $52.9 million

in 2018.

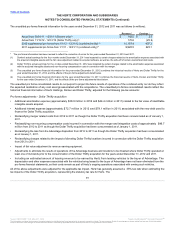

Dollar Thrifty Acquisition

On November 19, 2012, Hertz Holdings completed the Dollar Thrifty acquisition pursuant to the terms of the Merger Agreement with Dollar

Thrifty and Merger Sub, a wholly owned Hertz subsidiary. In accordance with the terms of the Merger Agreement, Merger Sub completed a

tender offer in which it purchased a majority of the shares of Dollar Thrifty common stock then outstanding at a price equal to $87.50 per

share in cash. Merger Sub subsequently acquired the remaining shares of Dollar Thrifty common stock by means of a short-form merger in

which such shares were converted into the right to receive the same $87.50 per share in cash paid in the tender offer. The total purchase

price was approximately $2,592 million, which comprised of $2,551 million of cash, including our use of approximately $404 million of cash

and cash equivalents available from Dollar Thrifty, and the fair value of our previously held equity interest

88

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.