Hertz 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

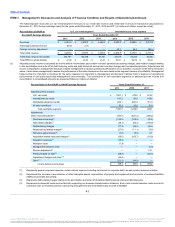

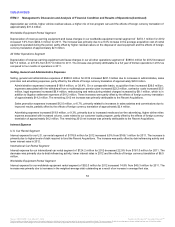

2012 totaled $22.6 million (which consists of purchase accounting charges of $18.7 million, debt-related charges of $3.8 million,

restructuring related charges of $0.3 million and gain on derivatives of $0.2 million). See footnote (c) to the table under “Results of

Operations” for a summary and description of these adjustments.

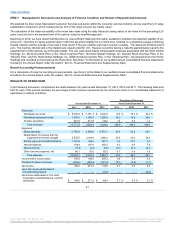

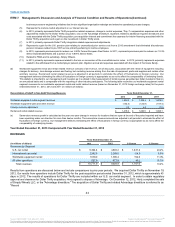

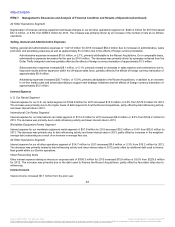

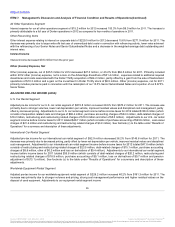

PROVISION FOR TAXES ON INCOME AND NET INCOME ATTRIBUTABLE TO THE HERTZ CORPORATION AND SUBSIDIARIES'

COMMON STOCKHOLDER

Income before income taxes $ 739.2

$493.6

$ 245.6

49.8%

Provision for taxes on income (345.2)

(222.4)

(122.8)

55.2%

Net income attributable to The Hertz Corporation

and Subsidiaries' common stockholder $394.0

$271.2

$122.8

45.3%

Provision for Taxes on Income

The effective tax rate for the year ended December 31, 2013 was 46.7% as compared to 45.1% for the year ended December 31, 2012. The

provision for taxes on income increased $122.8 million, primarily due to higher income before income taxes, changes in geographic

earnings mix, increased state and local tax expense, increase in deductible interest limitations in various countries and other permanent

differences; offset by a decrease in valuation allowance relating to losses in certain non-U.S. jurisdictions for which tax benefits are not

realized. See Note 9 to the Notes to our consolidated financial statements included in this Annual Report under the caption "Item 8

—Financial Statements and Supplementary Data."

Net Income Attributable to The Hertz Corporation and Subsidiaries' Common Stockholder

Net income attributable to The Hertz Corporation and Subsidiaries' common stockholder increased 45.3% primarily due to higher rental

volumes and pricing in our U.S. car rental, international car rental and worldwide equipment rental, disciplined cost management, lower net

depreciation per vehicle in our international car rental operations and higher volumes in our all other operations segment. Most revenue and

expense transactions from operations outside of the United States are recorded in local currencies, which reduces the effect of changes in

exchange rates on net income.

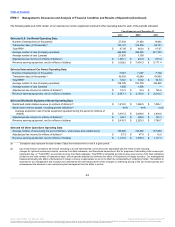

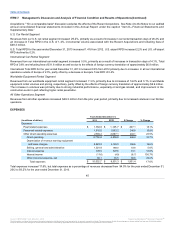

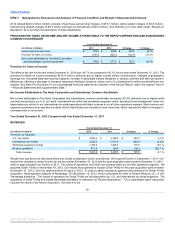

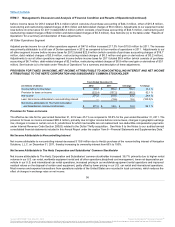

Revenues by Segment

U.S. car rentals $4,893.2

$4,468.9

$ 424.3

9.5 %

International car rentals 2,268.5

2,471.9

(203.4)

(8.2)%

Worldwide equipment rentals 1,385.4

1,209.5

175.9

14.5 %

All other operations 477.8

149.0

328.8

220.7 %

Total revenues $9,024.9

$8,299.3

$725.6

8.7 %

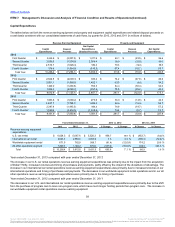

Results from operations are discussed below and include comparisons to prior year periods. We acquired Donlen on September 1, 2011. Our

results from operations include Donlen for the year ended December 31, 2012 and the post-acquisition period ended December 31, 2011,

which is approximately four months in 2011. The results of operations for Donlen are included within our all other operations segment. We

acquired Dollar Thrifty on November 19, 2012. Our results from operations include Dollar Thrifty for the post-acquisition period ended

December 31, 2012, which is approximately 43 days in 2012. In order to obtain regulatory approval and clearance for Dollar Thrifty

acquisition, Hertz agreed to dispose of Advantage. On December 12, 2012, Hertz completed the sale of Simply Wheelz LLC, or the

"Advantage divestiture." The results of operations for Dollar Thrifty are included within our U.S. and international car rental segments. The

acquisition of Dollar Thrifty and related Advantage divestiture is referred to as "Recent Acquisitions." "On a comparable basis" discussion

excludes the effects of the Recent Acquistions. See Note 4 to the

50

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.