Hertz 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

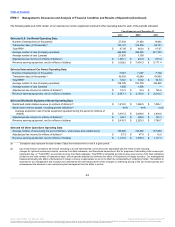

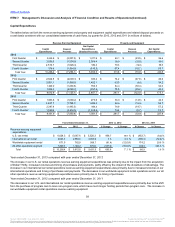

Direct Operating Expenses

U.S. Car Rental Segment

Direct operating expenses for our U.S. car rental segment of $2,677.9 million for 2012 increased $246.4 million, or 10.1%, from $2,431.5

million for 2011 as a result of increases in fleet related expenses, personnel related expenses and other direct operating expenses.

Fleet related expenses for our U.S. car rental segment of $539.1 million for 2012 increased $35.3 million, or 7.0%, from 2011. On a

comparable basis, the increase was primarily related to U.S. rental volume demand which resulted in increases in gasoline costs of

$19.6 million, self insurance expenses of $7.0 million and vehicle maintenance costs of $1.1 million. The increase in gasoline costs

reflect higher gasoline prices. These increases were partly offset by a decrease in vehicle damage costs of $12.1 million. The

remaining 2012 net increase was primarily attributable to the Recent Acquisitions.

Personnel related expenses for our U.S. car rental segment of $922.1 million for 2012 increased $66.0 million, or 7.7%, from 2011.

On a comparable basis, the increase was primarily related to increases in salaries and related expenses associated with improved

volume and compensation for employees at additional off-airport locations in 2012 as well as higher incentives. The remaining 2012

net increase was primarily attributable to the Recent Acquisitions.

Other direct operating expenses for our U.S. car rental segment of $1,216.7 million for 2012 increased $145.1 million, or 13.5%,

from 2011. On a comparable basis, the increase was primarily related to increases in facilities expenses of $51.1 million due to 2011

property sales, commissions of $9.7 million, concession fees of $14.0 million, restructuring charges of $6.5 million, field systems

of $5.6 million and customer service costs of $4.3 million. The increases were primarily a result of improved U.S. car rental volume

and off-airport expansions. The increases in other direct operating expenses were partly offset by a decrease in computer costs of

$6.0 million. The remaining 2012 net increase was primarily attributable to the Recent Acquisitions.

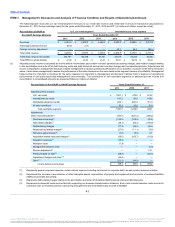

International Car Rental Segment

Direct operating expenses for our international car rental segment of $1,341.4 million for 2012 decreased $66.4 million, or 4.7%, from

$1,407.8 million for 2011 as a result of decreases in fleet related expenses, personnel related expenses and other direct operating expenses.

Fleet related expenses for our international car rental segment of $392.6 million for 2012 decreased $30.1 million, or 7.1%, from

2011. On a comparable basis, the decrease was primarily due to a decrease in vehicle damage costs of $15.9 million, self insurance

expense of $2.4 million and the effects of foreign currency translation of approximately $26.0 million. The decrease was offset by an

increase in international rental volume demand which resulted in increases in gasoline costs of $7.2 million and vehicle

maintenance costs of $7.1 million.

Personnel related expenses for our international car rental segment of $345.9 million for 2012 decreased $11.1 million, or 3.1%,

from 2011. The decrease was primarily due to the effects of foreign currency translation of approximately $18.4 million. On a

comparable basis, the decrease was partly offset by increases in salaries and related expenses associated with improved volume

and compensation for employees at additional off-airport locations in 2012 as well as higher incentives.

Other direct operating expenses for our international car rental segment of $602.9 million for 2012 decreased $25.2 million, or

4.0%, from 2011. On a comparable basis, the decrease in other direct operating expenses was primarily due to the effects of foreign

currency translation of approximately $35.0 million and decreases in concession fees of $4.5 million and charge card fees of

$2.8 million. The decreases in other direct operating expenses were partly offset by increases in commissions of $9.6 million and

customer service costs of $6.4 million. The increases were primarily a result of improved international rental volume demand and

off-airport expansions.

52

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.