Hertz 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

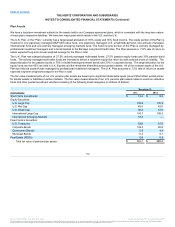

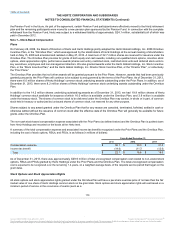

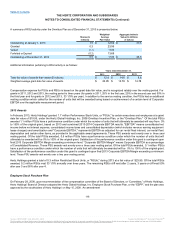

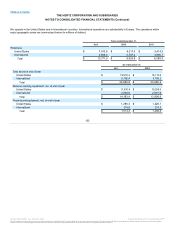

was approved by our stockholders on May 15, 2013. The ESPP is intended to be an “employee stock purchase plan” within the meaning of

Section 423 of the Internal Revenue Code.

The maximum number of shares that may be purchased under the ESPP is 8.0 million shares of Hertz Holdings' common stock, subject to

adjustment in the case of any change in Hertz Holdings' shares, including by reason of a stock dividend, stock split, share combination,

recapitalization, reorganization, merger, consolidation or change in corporate structure. An eligible employee may elect to participate in the

ESPP each quarter (or other period established by the Compensation Committee) through a payroll deduction. The maximum and

minimum contributions that an eligible employee may make under all of Hertz Holdings' qualified employee stock purchase plans will be

determined by the Compensation Committee, provided that no employee may be permitted to purchase stock with an aggregate fair market

value greater than $25,000 per year. At the end of the offering period, the total amount of each employee's payroll deduction will be used to

purchase shares of Hertz Holdings' common stock. The purchase price per share will be not less than 85% of the market price of Hertz

Holdings' common stock on the date of purchase; the exact percentage for each offering period will be set in advance by the Compensation

Committee.

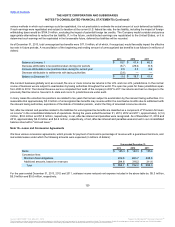

For the years ended December 31, 2013, 2012 and 2011, we recognized compensation cost of approximately $0.9 million, $0.8 million and

$0.7 million, respectively, for the amount of the discount on the stock purchased by our employees under the ESPP. Approximately 2,100

employees participated in the ESPP as of December 31, 2013.

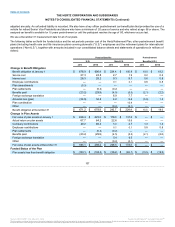

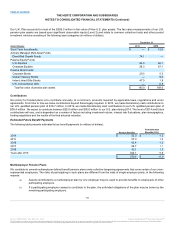

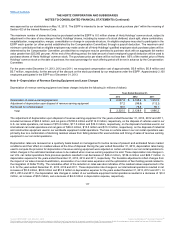

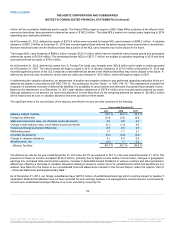

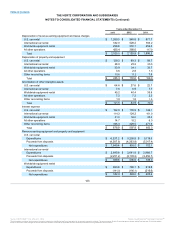

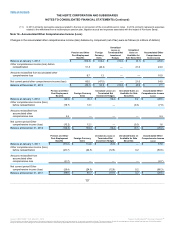

Depreciation of revenue earning equipment and lease charges includes the following (in millions of dollars):

Depreciation of revenue earning equipment $2,407.8

$2,145.9

$1,912.3

Adjustment of depreciation upon disposal of revenue earning equipment 37.2

(96.8)

(112.2)

Rents paid for vehicles leased 80.5

79.8

96.1

Total $2,525.5

$2,128.9

$1,896.2

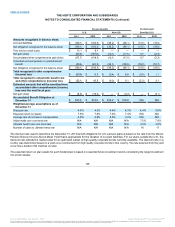

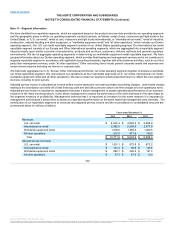

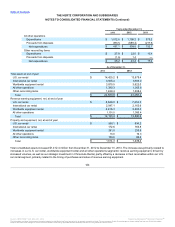

The adjustment of depreciation upon disposal of revenue earning equipment for the years ended December 31, 2013, 2012 and 2011,

included net losses of $48.2 million, and net gains of $100.6 million and $114.9 million, respectively, on the disposal of vehicles used in our

U.S. car rental operations, net losses of $15.2 million, $17.3 million and $16.0 million, respectively, on the disposal of vehicles used in our

international car rental operations and net gains of $26.2 million, $13.5 million and $13.3 million, respectively, on the disposal of industrial

and construction equipment used in our worldwide equipment rental operations. The loss on vehicle sales in our car rental operations was

primarily due to a combination of declining residual values from falling demand for used vehicles and timing of sales of revenue earning

equipment in our car rental operations.

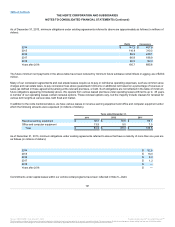

Depreciation rates are reviewed on a quarterly basis based on management's routine review of present and estimated future market

conditions and their effect on residual values at the time of disposal. During the year ended December 31, 2013, depreciation rates being

used to compute the provision for depreciation of revenue earning equipment were adjusted on certain vehicles in our car rental operations to

reflect changes in the estimated residual values to be realized when revenue earning equipment is sold. These depreciation rate changes in

our U.S. car rental operations from previous quarters resulted in net decreases of $44.2 million, $139.4 million and $26.7 million in

depreciation expense for the years ended December 31, 2013, 2012 and 2011, respectively. The favorable adjustments reflect changes from

the impact of car sales channel diversification, acceleration of our retail sales expansion and the optimization of fleet holding periods related to

the integration of Dollar Thrifty. The cumulative effect of the reduction in rates was also indicative of the residual values experienced in the

U.S. for the years ended December 31, 2013, 2012 and 2011. These depreciation rate changes in our international operations resulted in net

increases of $5.0 million, $8.8 million and $12.9 million in depreciation expense for the years ended December 31, 2013, 2012 and 2011. In

2013, 2012 and 2011, the depreciation rate changes in certain of our worldwide equipment rental operations resulted in a decrease of $0.4

million, an increase of $0.5 million, and a decrease of $4.4 million in depreciation expense, respectively.

117

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.