Hertz 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In March 2013, the Sponsors sold 60,050,777 shares of their Hertz Holdings common stock to Citigroup Global Markets Inc. and Barclays

Capital Inc. as the underwriters in the registered public offering of those shares. In connection with the offering, Hertz Holdings repurchased

from the underwriters 23,200,000 of the 60,050,777 shares of common stock sold by the Sponsors.

In May 2013, the Sponsors sold 49,800,405 shares of their remaining Hertz Holdings common stock to Goldman Sachs & Co. and J.P.

Morgan Securities LLC as the underwriters in the registered public offering of those shares.

After giving effect to our initial public offering in November 2006, subsequent offerings and a March 2013 share repurchase, the Sponsors do

not own any of the outstanding shares of common stock of Hertz Holdings, other than de minimus amounts held from time to time by the

Sponsors and their affiliates in the ordinary course of business.

In May 2013, we announced plans to relocate our worldwide headquarters to Estero, Florida from Park Ridge, New Jersey over a two-year

period.

Our Markets

We are engaged principally in the global car rental industry and equipment rental industry.

U.S. Car Rental

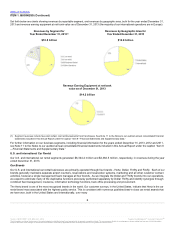

We believe that the global car rental industry exceeds $49.4 billion in annual revenues. According to Auto Rental News, car rental industry

revenues in the United States were estimated to be approximately $24.5 billion for 2013 and grew in 2013 by 4.0%.

Rentals by airline travelers at or near airports, or ‘‘airport rentals,’’ are influenced by developments in the travel industry and particularly in

airline passenger traffic, or ‘‘enplanements,’’ as well as the Gross Domestic Product, or ‘‘GDP.’’

The off-airport portion of the industry has rental volume primarily driven by local business use, leisure travel and the replacement of cars

being repaired. However, we believe that in recent years, industry revenues from off-airport car rentals in the United States have grown faster

than revenues from airport rentals.

International Car Rental

We believe car rental industry revenues in Europe account for over $13.4 billion in annual revenues, with the airport portion of the industry

comprising approximately 38% of the total. Because Europe has generally demonstrated a lower historical reliance on air travel, the

European off-airport car rental market is significantly more developed than it is in the United States. Within Europe, the largest markets are

Germany, France, Spain, Italy and the United Kingdom. We believe total rental revenues for the car rental industry in Europe in 2013 were

approximately $11.1 billion in 10 countries—Germany, the United Kingdom, France, Italy, Spain, the Netherlands, Belgium, the Czech

Republic, Luxembourg and Slovakia—where we have company-operated rental locations and approximately $2.3 billion in 11 other countries

—Ireland, Sweden, Portugal, Greece, Denmark, Austria, Poland, Finland, Malta, Hungary and Romania—where our Hertz brand is present

through our franchisees.

We believe car rental industry revenues in Asia Pacific account for over $11.5 billion in annual revenues, with the airport portion of the

industry comprising approximately 20% of the total. Within Asia Pacific, the largest markets are China, Australia, Japan and South Korea

—where we have company-operated rental locations or where our Hertz brand is present through our franchisees.

Worldwide Equipment Rental

We estimate the size of the North American equipment rental industry, which is highly fragmented with few national competitors and many

regional and local operators, increased to approximately $38.0 billion in annual revenues for 2013 from $35.7 billion in annual revenues for

2012, but the portion of the rental industry dealing with equipment of the type HERC rents is somewhat smaller than that. Other market data

indicates that the equipment rental industries in China, France, Spain and Saudi Arabia generate approximately $5.1 billion, $4.4 billion,

$1.7 billion and $0.5 billion in annual revenues, respectively, although the portions of those markets in which HERC competes are smaller.

The equipment rental industry serves a broad range of customers from small local contractors to large industrial national accounts and

encompasses a wide range of rental equipment from small tools to heavy earthmoving equipment.

All Other Operations

In addition to car rental and equipment rental, we also operate our third party claim management services as well as Donlen, of which we

acquired a 100% equity interest on September 1, 2011, a leading provider of fleet leasing and management services for corporate fleets.

4

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.