Hertz 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

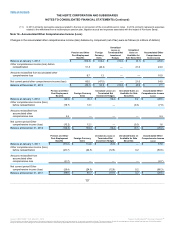

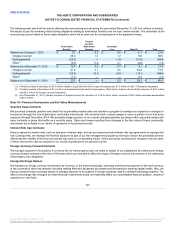

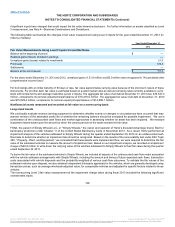

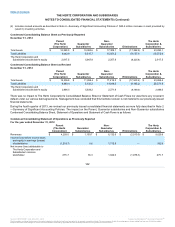

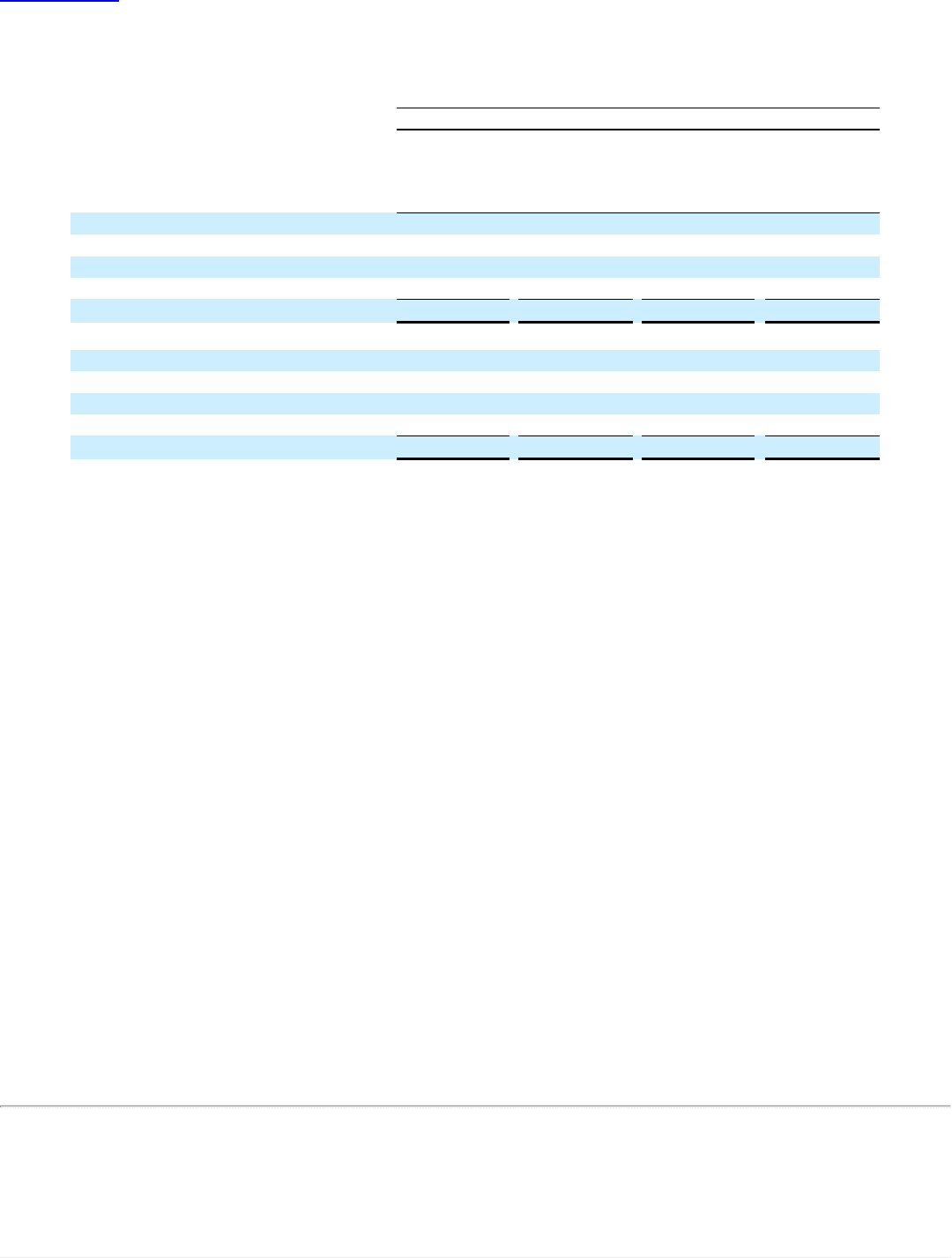

Interest rate caps $0.9

$ —

$0.9

$ —

Foreign currency forward contracts 3.4

—

3.4

—

Foreign exchange options 0.2

—

0.2

—

Total $4.5

$ —

$4.5

$ —

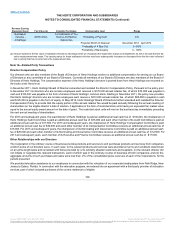

Gasoline swaps $0.1

$ —

$0.1

$ —

Interest rate caps 0.9

—

0.9

—

Foreign currency forward contracts 4.5

—

4.5

—

Total $5.5

$ —

$5.5

$ —

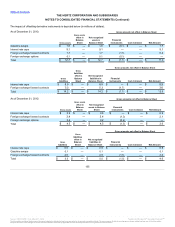

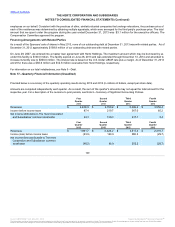

Gasoline swaps

Gasoline swaps classified as Level 2 assets and liabilities are priced using quoted market prices for similar assets or liabilities in active

markets.

Interest rate caps

Interest rate caps classified as Level 2 assets and liabilities are priced using quoted market prices for similar assets or liabilities in active

markets.

Foreign currency forward contracts

Foreign currency forward contracts classified as Level 2 assets and liabilities are priced using quoted market prices for similar assets or

liabilities in active markets.

Foreign exchange options

Foreign currency forward contracts classified as Level 2 assets and liabilities are priced using quoted market prices for similar assets or

liabilities in active markets.

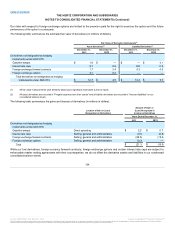

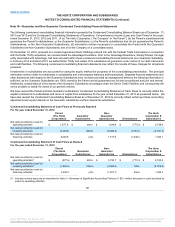

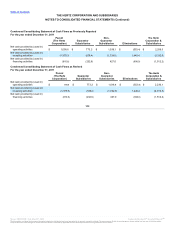

Fair Value of Financial Instruments

The fair values of cash and cash equivalents, accounts receivable, accounts payable and accrued expenses, to the extent the underlying

liability will be settled in cash, approximate carrying values because of the short-term nature of these instruments.

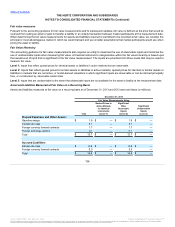

Marketable securities held by us consist of debt securities classified as available-for-sale, which are carried at fair value and are included

within "Prepaid expenses and other assets." Unrealized gains and losses, net of related income taxes, are included in "Accumulated other

comprehensive loss." As of December 31, 2013 and December 31, 2012, the fair value of debt securities was $151.0 million and $0.0

million, respectively. Unrealized gain of $21.0 million was recognized for the year ended December 31, 2013. Hertz classifies its investment

in the China Auto Rental convertible notes within Level 3 because it is valued using significant unobservable inputs. To estimate the fair

value, Hertz utilized a binomial valuation model. The most significant unobservable inputs we use are our estimates of the underlying equity

value of the investee. The discount rate and volatility used in the measurements of fair value were 6.5% and 40%, respectively, and are

based on the underlying risk associated with our estimate of the underlying equity value of the investee, as well as the terms of the

respective contracts. The credit rating of the investee, general business conditions, liquidity, and underlying equity value could materially

affect the fair value of the convertible notes. Hertz periodically conducts reviews and engages valuation specialists to verify pricing and

assesses liquidity to determine

137

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.