Hertz 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

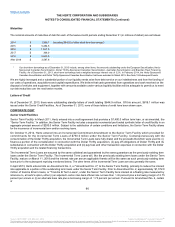

to exceed $200 million. Hertz may also pay additional cash dividends under the Senior ABL Facility so long as, among other things, (a) no

specified default then exists or would arise as a result of making such dividends, (b) there is at least $200 million of liquidity under the Senior

ABL Facility after giving effect to the proposed dividend, and (c) either (i) if such liquidity is less than $400 million immediately after giving

effect to the making of such dividends, Hertz is in compliance with a specified fixed charge coverage ratio, or (ii) the amount of the proposed

dividend does not exceed the sum of (x) 1.0% of tangible assets plus (y) a specified available amount determined by reference to, among

other things, 50% of net income from January 1, 2011 to the end of the most recent fiscal quarter for which financial statements of Hertz are

available plus (z) a specified amount of certain equity contributions made to Hertz.

In November 2012, we amended the Senior ABL Facility to deem letters of credit issued under Dollar Thrifty 's now-terminated senior

revolving credit facility to have been issued under the Senior ABL Facility.

In July 2013, we increased the aggregate maximum borrowings under the Senior ABL Facility by $65.0 million (subject to borrowing base

availability).

Senior Notes

In March 2012, Hertz issued an additional $250.0 million aggregate principal amount of the 6.75% Senior Notes due 2019. The proceeds of

this March 2012 offering were used in March 2012 in part to redeem $162.3 million principal amount of Hertz's outstanding 8.875% Senior

Notes due 2014 which resulted in the write-off of unamortized debt costs of $1.2 million recorded in "Interest expense" on our consolidated

statement of operations. The remainder of the proceeds of this March 2012 offering, along with cash on hand or drawings under the Senior

ABL Facility were used to redeem €213.5 million ($286.0 million) of Hertz's outstanding 7.875% Senior Notes due 2014, which resulted in

the write-off of unamortized debt costs of $2.0 million recorded in "Interest expense" on our consolidated statement of operations.

In October 2012, HDTFS, Inc., a newly-formed, wholly-owned subsidiary of Hertz issued and sold $700.0 million aggregate principal amount

of 5.875% Senior Notes due 2020 and $500.0 million aggregate principal amount of 6.250% Senior Notes due 2022 in a private offering. The

gross proceeds of the offering were held in an escrow account until the date of the completion of the acquisition of Dollar Thrifty, at which time

the gross proceeds of the offering were released from escrow and HDTFS, Inc. was merged into Hertz.

In March 2013, Hertz issued $250 million in aggregate principal amount of 4.25% Senior Notes due 2018. The proceeds of this March 2013

offering were used by Hertz to replenish a portion of its liquidity, after having dividended $467.2 million in available liquidity to us, which we

used to repurchase 23.2 million shares of our common stock in March 2013.

Hertz's obligations under the indentures for the Senior Notes are guaranteed by each of its direct and indirect domestic subsidiaries that are

guarantors under the Senior Term Facility. The guarantees of all of the Subsidiary Guarantors may be released to the extent such

subsidiaries no longer guarantee our Senior Credit Facilities in the United States. HERC may also be released from its guarantee under the

outstanding Senior Notes at any time at which no event of default under the related indenture has occurred and is continuing,

notwithstanding that HERC may remain a subsidiary of Hertz. In February 2013 and March 2013, we added Dollar Thrifty and certain of its

subsidiaries as guarantors under certain of our debt instruments and credit facilities including the Senior Notes and in February 2014, we

added Firefly Rent A Car LLC as a guarantor under certain of our debt instruments and credit facilities, including the Senior Notes.

The indentures for the Senior Notes contain covenants that, among other things, limit or restrict the ability of the Hertz credit group to incur

additional indebtedness, incur guarantee obligations, prepay certain indebtedness, make certain restricted payments (including paying

dividends, redeeming stock or making other distributions to parent entities of Hertz and other persons outside of the Hertz credit group), make

investments, create liens, transfer or sell assets, merge or consolidate, and enter into certain transactions with Hertz's affiliates that are not

members of the Hertz credit group.

The covenants in the indentures for the Senior Notes also restrict Hertz and other members of the Hertz credit group from redeeming stock or

making loans, advances, dividends, distributions or other restricted payments to any entity that is not a member of the Hertz credit group,

including Hertz Holdings, subject to certain exceptions.

98

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.