Hertz 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

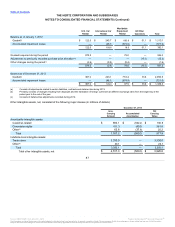

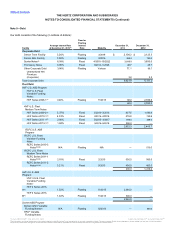

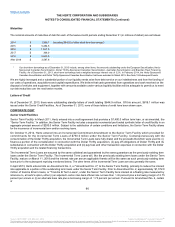

Maturities

The nominal amounts of maturities of debt for each of the twelve-month periods ending December 31 (in millions of dollars) are as follows:

2014 $ 1,968.7

(including $842.6 of other short-term borrowings*)

2015 $ 5,284.5

2016 $ 1,367.5

2017 $ 366.0

2018 $3,643.5

After 2018 $ 3,587.8

_______________________________________________________________________________

*Our short-term borrowings as of December 31, 2013 include, among other items, the amounts outstanding under the European Securitization, Hertz-

Sponsored Canadian Securitization, Dollar Thrifty-Sponsored Canadian Securitization, Australian Securitization and Brazilian Fleet Financing

Facility. As of December 31, 2013, short-term borrowings had a weighted average interest rate of 3.2%. In February 2014, the Hertz-Sponsored

Canadian Securitization and Dollar Thrifty-Sponsored Canadian Securitization had been extended to March 2015. See Note 19-Subsequent Events.

We are highly leveraged and a substantial portion of our liquidity needs arise from debt service on our indebtedness and from the funding of

our costs of operations, acquisitions and capital expenditures. We believe that cash generated from operations and cash received on the

disposal of vehicles and equipment, together with amounts available under various liquidity facilities will be adequate to permit us to meet

our debt maturities over the next twelve months.

Letters of Credit

As of December 31, 2013, there were outstanding standby letters of credit totaling $644.9 million. Of this amount, $619.1 million was

issued under the Senior Credit Facilities. As of December 31, 2013, none of these letters of credit have been drawn upon.

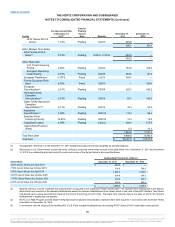

Senior Credit Facilities

Senior Term Facility: In March 2011, Hertz entered into a credit agreement that provides a $1,400.0 million term loan, or as amended, the

‘‘Senior Term Facility.’’ In addition, the Senior Term Facility includes a separate incremental pre-funded synthetic letter of credit facility in an

aggregate principal amount of $200.0 million. Subject to the satisfaction of certain conditions and limitations, the Senior Term Facility allows

for the incurrence of incremental term and/or revolving loans.

On October 9, 2012, Hertz entered into an Incremental Commitment Amendment to the Senior Term Facility which provided for

commitments for the Incremental Term Loans of $750.0 million under the Senior Term Facility. Contemporaneously with the

consummation of the Dollar Thrifty acquisition, the Incremental Term Loans were fully drawn and the proceeds therefrom were used to: (i)

finance a portion of the consideration in connection with the Dollar Thrifty acquisition, (ii) pay off obligations of Dollar Thrifty and its

subsidiaries in connection with the Dollar Thrifty acquisition and (iii) pay fees and other transaction expenses in connection with the Dollar

Thrifty acquisition and the related financing transactions.

The Incremental Term Loans are secured by the same collateral and guaranteed by the same guarantors as the previously existing term

loans under the Senior Term Facility. The Incremental Term Loans will, like the previously existing term loans under the Senior Term

Facility, mature on March 11, 2018 and the interest rate per annum applicable thereto will be the same as such previously existing term

loans prior to the subsequent repricing mentioned below. The other terms of the Incremental Term Loans are also generally the same.

In April 2013, Hertz entered into an Amendment No. 2, or "Amendment No. 2," to the Senior Term Facility, primarily to reduce the interest

rate applicable to a portion of the outstanding term loans under the Senior Term Facility. Prior to Amendment No. 2, approximately $1,372.0

million of tranche B term loans, or “Tranche B Term Loans”, under the Senior Term Facility bore interest at a floating rate measured by

reference to, at Hertz's option, either (i) an adjusted London inter-bank offered rate not less than 1.00 percent plus a borrowing margin of 2.75

percent per annum or (ii) an alternate base rate plus a borrowing margin of 1.75 percent per annum. Pursuant to Amendment No. 2, certain

of

96

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.