Hertz 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of Section 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, and Rule 10b-5 promulgated thereunder. Plaintiff

seeks an unspecified amount of monetary damages on behalf of the purported class and an award of costs and expenses,

including counsel fees and expert fees.

6. Public Liability and Property Damage

We are currently a defendant in numerous actions and have received numerous claims on which actions have not yet been

commenced for public liability and property damage arising from the operation of motor vehicles and equipment rented from us.

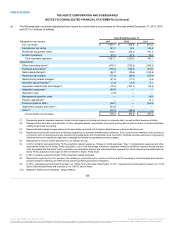

The obligation for public liability and property damage on self-insured U.S. and international vehicles and equipment, as stated

on our balance sheet, represents an estimate for both reported accident claims not yet paid and claims incurred but not yet

reported. The related liabilities are recorded on a non-discounted basis. Reserve requirements are based on actuarial evaluations

of historical accident claim experience and trends, as well as future projections of ultimate losses, expenses, premiums and

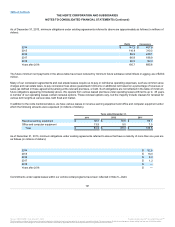

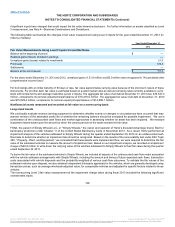

administrative costs. At December 31, 2013 and December 31, 2012, our liability recorded for public liability and property

damage matters was $347.7 million and $332.2 million, respectively. The increase in public liability and property damage

reserves was primarily related to Dollar Thrifty. We believe that our analysis is based on the most relevant information available,

combined with reasonable assumptions, and that we may prudently rely on this information to determine the estimated liability.

We note the liability is subject to significant uncertainties. The adequacy of the liability reserve is regularly monitored based on

evolving accident claim history and insurance related state legislation changes. If our estimates change or if actual results differ

from these assumptions, the amount of the recorded liability is adjusted to reflect these results.

We intend to assert that we have meritorious defenses in the foregoing matters and we intend to defend ourselves vigorously.

We have established reserves for matters where we believe that the losses are probable and reasonably estimated, including for various of

the matters set forth above. Other than with respect to the aggregate reserves established for claims for public liability and property damage,

none of those reserves are material. For matters, including those described above, where we have not established a reserve, the ultimate

outcome or resolution cannot be predicted at this time, or the amount of ultimate loss, if any, cannot be reasonably estimated. Litigation is

subject to many uncertainties and the outcome of the individual litigated matters is not predictable with assurance. It is possible that certain of

the actions, claims, inquiries or proceedings, including those discussed above, could be decided unfavorably to us or any of our subsidiaries

involved. Accordingly, it is possible that an adverse outcome from such a proceeding could exceed the amount accrued in an amount that

could be material to our consolidated financial condition, results of operations or cash flows in any particular reporting period.

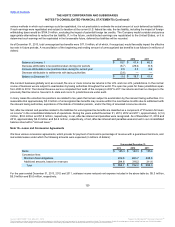

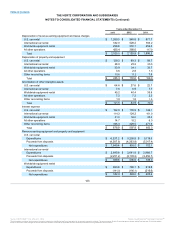

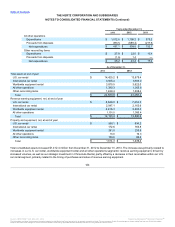

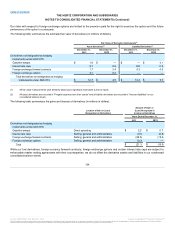

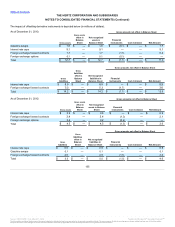

As of December 31, 2013 and December 31, 2012, the following guarantees (including indemnification commitments) were issued and

outstanding.

Indemnification Obligations

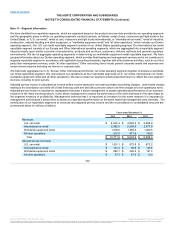

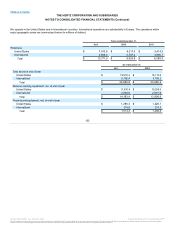

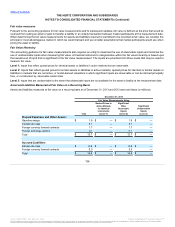

In the ordinary course of business, we execute contracts involving indemnification obligations customary in the relevant industry and

indemnifications specific to a transaction such as the sale of a business. These indemnification obligations might include claims relating to

the following: environmental matters; intellectual property rights; governmental regulations and employment-related matters; customer,

supplier and other commercial contractual relationships; and financial matters. Performance under these indemnification obligations would

generally be triggered by a breach of terms of the contract or by a third party claim. We regularly evaluate the probability of having to incur

costs associated with these indemnification obligations and have accrued for expected losses that are probable and estimable. The types of

indemnification obligations for which payments are possible include the following:

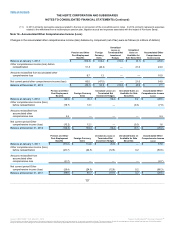

Sponsors; Directors

We have entered into customary indemnification agreements with Hertz Holdings, the Sponsors and Hertz Holdings' stockholders affiliated

with the Sponsors, pursuant to which Hertz Holdings and Hertz will indemnify the Sponsors, Hertz Holdings' stockholders affiliated with the

Sponsors and their respective affiliates, directors, officers, partners,

130

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.