Hertz 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

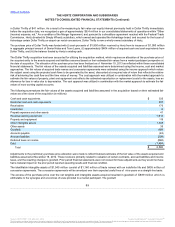

the existing lenders under the Senior Term Facility converted their existing Tranche B Term Loans into a new tranche of tranche B-2 term

loans, or the “Tranche B-2 Term Loans”, in an aggregate principal amount, along with new loans advanced by certain new lenders, of

approximately $1,372.0 million. The proceeds of Tranche B-2 Term Loans advanced by the new lenders were used to prepay in full all of the

Tranche B Term Loans that were not converted into Tranche B-2 Term Loans.

The Tranche B-2 Term Loans bear interest at a floating rate measured by reference to, at Hertz's option, either (i) an adjusted London inter-

bank offered rate not less than 0.75 percent plus a borrowing margin of 2.25 percent per annum or (ii) an alternate base rate plus a borrowing

margin of 1.25 percent per annum. The terms and conditions of the new Tranche B-2 Term Loans with respect to maturity, collateral, and

covenants are otherwise unchanged compared to the Tranche B Term Loans.

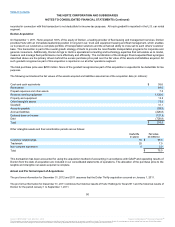

Senior ABL Facility: In March 2011, Hertz, HERC, and certain other of our subsidiaries entered into a credit agreement that provides for

aggregate maximum borrowings of $1,800.0 million (subject to borrowing base availability) on a revolving basis under an asset-based

revolving credit facility. We refer to this facility, as amended, from time to time, as the “Senior ABL Facility.” Up to $1,500.0 million of the

Senior ABL Facility is available for the issuance of letters of credit, subject to certain conditions including issuing lender participation. Subject

to the satisfaction of certain conditions and limitations, the Senior ABL Facility allows for the addition of incremental revolving and/or term

loan commitments. In addition, the Senior ABL Facility permits Hertz to increase the amount of commitments under the Senior ABL Facility

with the consent of each lender providing an additional commitment, subject to satisfaction of certain conditions.

We refer to the Senior Term Facility and the Senior ABL Facility together as the “Senior Credit Facilities.” Hertz's obligations under the

Senior Credit Facilities are guaranteed by its immediate parent (Hertz Investors, Inc.) and most of its direct and indirect domestic subsidiaries

(subject to certain exceptions, including Hertz International Limited, which ultimately owns entities carrying on most of our international

operations, and subsidiaries involved in the HVF U.S. Asset-Backed Securities, or "ABS," Program, the HVF II U.S. ABS Program, the

Donlen ABS Program and the RCFC U.S. ABS Program). In addition, the obligations of the “Canadian borrowers” under the Senior ABL

Facility are guaranteed by their respective subsidiaries, subject to certain exceptions.

The lenders under the Senior Credit Facilities have been granted a security interest in substantially all of the tangible and intangible assets of

the borrowers and guarantors under those facilities, including pledges of the stock of certain of their respective domestic subsidiaries (subject,

in each case, to certain exceptions, including certain vehicles). Each of the Senior Credit Facilities permits the incurrence of future

indebtedness secured on a basis either equal to or subordinated to the liens securing the applicable Senior Credit Facility or on an unsecured

basis. In February 2013 and March 2013, we added Dollar Thrifty and certain of its subsidiaries as guarantors under certain of our debt

instruments and credit facilities including the Senior Term Facility and in February 2014, we added Firefly Rent A Car LLC as a guarantor

under certain of our debt instruments and credit facilities, including the Senior Term Facility.

We refer to Hertz and its subsidiaries as the Hertz credit group. The Senior Credit Facilities contain a number of covenants that, among other

things, limit or restrict the ability of the Hertz credit group to dispose of assets, incur additional indebtedness, incur guarantee obligations,

prepay certain indebtedness, make dividends and other restricted payments (including to the parent entities of Hertz and other persons),

create liens, make investments, make acquisitions, engage in mergers, change the nature of their business, engage in certain transactions

with affiliates that are not within the Hertz credit group or enter into certain restrictive agreements limiting the ability to pledge assets.

Under the Senior ABL Facility, failure to maintain certain levels of liquidity will subject the Hertz credit group to a contractually specified fixed

charge coverage ratio of not less than 1:1 for the four quarters most recently ended. As of December 31, 2013, we were not subject to such

contractually specified fixed charge coverage ratio.

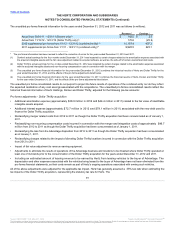

Covenants in the Senior Term Facility restrict payment of cash dividends to any parent of Hertz, including Hertz Holdings, with certain

exceptions, including: (i) in an aggregate amount not to exceed 1.0% of the greater of a specified minimum amount and the consolidated

tangible assets of the Hertz credit group (which payments are deducted in determining the amount available as described in the next

clause (ii)), (ii) in additional amounts up to a specified available amount determined by reference to, among other things, an amount set forth

in the Senior Term Facility plus 50% of net income from January 1, 2011 to the end of the most recent fiscal quarter for which financial

statements of Hertz are available (less certain investments) and (iii) in additional amounts not to exceed the amount of certain equity

contributions made to Hertz.

Covenants in the Senior ABL Facility restrict payment of cash dividends to any parent of Hertz, including Hertz Holdings, except in an

aggregate amount, taken together with certain investments, acquisitions and optional prepayments, not

97

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.