Hertz 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

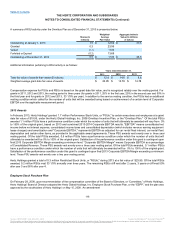

change in control, as defined in the Omnibus Plan) specified by the compensation committee of our Board of Directors. No stock options or

stock appreciation rights will be exercisable after ten years from the grant date.

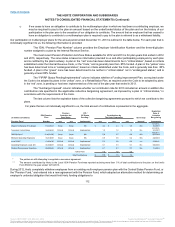

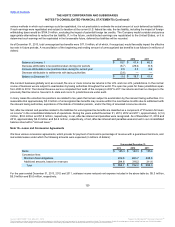

We have accounted for our employee stock-based compensation awards in accordance with ASC 718, “Compensation-Stock Compensation.”

The non-cash stock based compensation expense associated with the Stock Incentive Plan is pushed down from Hertz Holdings and

recorded on the books at the Hertz level. The options are being accounted for as equity-classified awards. We will recognize compensation cost

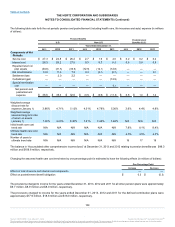

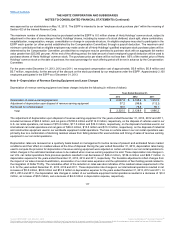

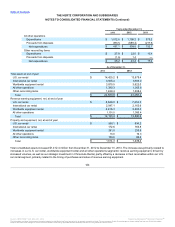

on a straight-line basis over the vesting period. The value of each option award is estimated on the grant date using a Black-Scholes option

valuation model that incorporates the assumptions noted in the following table. Because the stock of Hertz Holdings became publicly traded

in November 2006 and had a short trading history, it was not practicable for us to estimate the expected volatility of Hertz Holdings' share

price, or a peer company share price, because there was insufficient historical information about past volatility prior to 2013. Therefore, prior

to 2013 we used the calculated value method, substituting the historical volatility of an appropriate industry sector index for the expected

volatility of Hertz Holdings' common stock price as an assumption in the valuation model. We selected the Dow Jones Specialized

Consumer Services sub-sector within the consumer services industry, and we used the U.S. large capitalization component, which includes

the top 70% of the index universe (by market value).

The calculation of the historical volatility of the index was made using the daily historical closing values of the index for the preceding

6.25 years, because that is the expected term of the options using the simplified approach.

Hertz did not award any stock option equity grants in 2013.

Expected volatility N/A

81.5%

36.7%

Expected dividend yield N/A

—%

—%

Expected term (years) N/A

3

6.25

Risk-free interest rate N/A

0.40%

2.56%

Weighted-average grant date fair value N/A

$14.62

$5.93

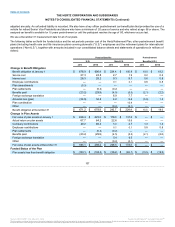

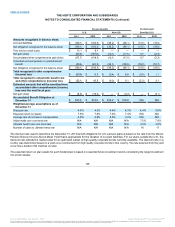

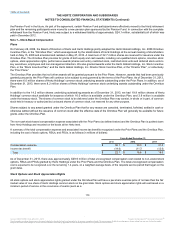

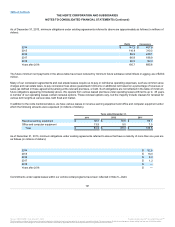

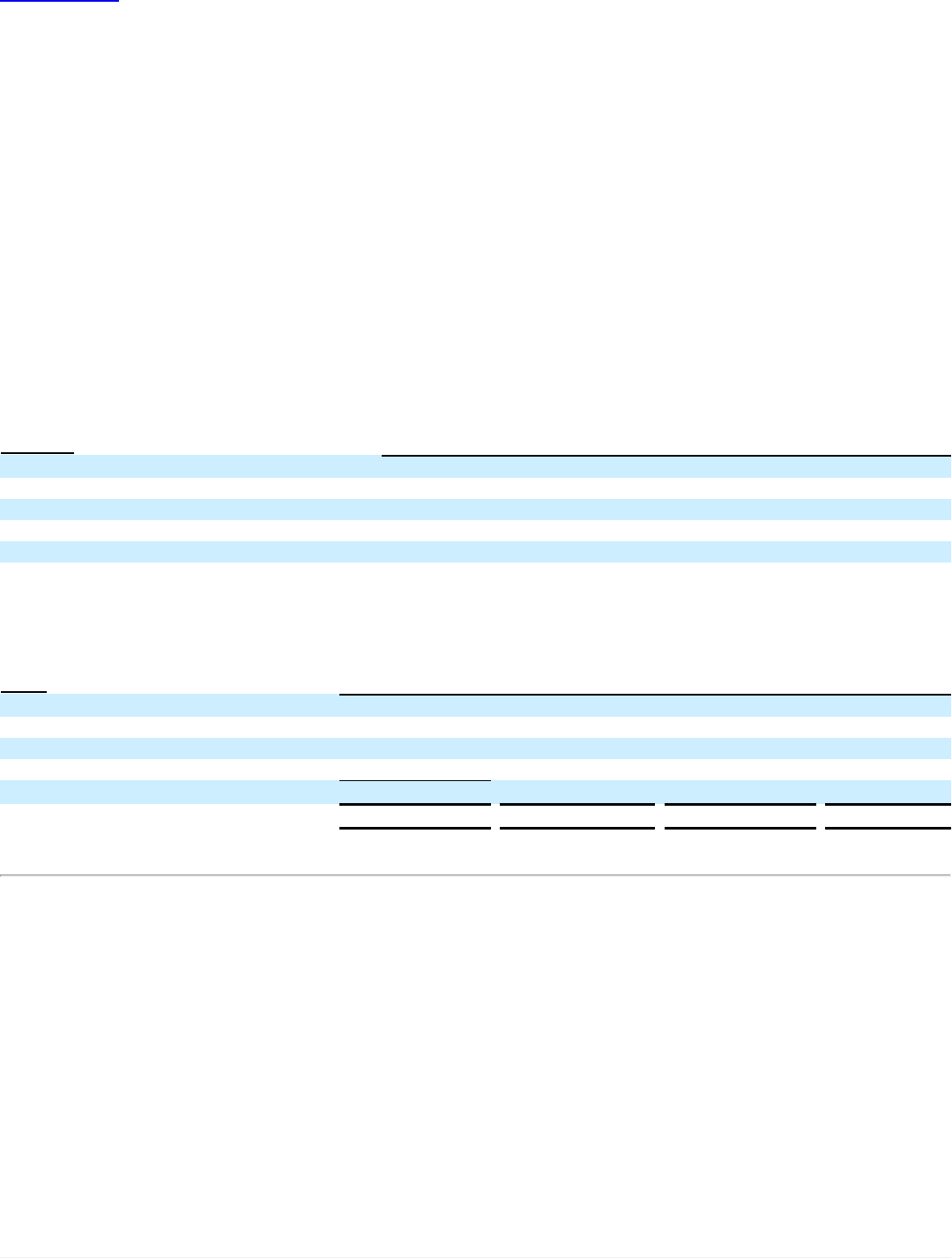

A summary of option activity under the Stock Incentive Plan and the Omnibus Plan as of December 31, 2013 is presented below.

Outstanding at January 1, 2013 13.2

$11.13

5.4

$74.7

Granted —

—

Exercised (3.0)

9.64

Forfeited or Expired (0.2)

12.1

Outstanding at December 31, 2013 10.0

$11.55

4.5

$170.1

Exercisable at December 31, 2013 8.5

$11.37

4.1

$146.6

114

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.