Hertz 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

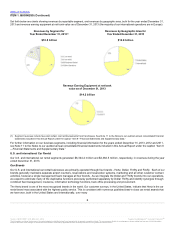

Table of Contents

Unless the context otherwise requires, in this Annual Report on Form 10-K, or “Annual Report,” (i) “we,” “us,” “our,” “Hertz,” or the

“Company,” mean The Hertz Corporation, Hertz Holdings' primary operating company and a direct wholly-owned subsidiary of Hertz

Investors, Inc., which is wholly-owned by Hertz Holdings, and its consolidated subsidiaries, including Hertz and Dollar Thrifty

Automotive Group, Inc. or "Dollar Thrifty," (ii) “Hertz Holdings” means Hertz Global Holdings, Inc., our top-level holding company,

(iii) “HERC” means Hertz Equipment Rental Corporation, our wholly-owned equipment rental subsidiary, together with our various

other wholly-owned international subsidiaries that conduct our industrial, construction and material handling and entertainment

equipment rental business, (iv) “cars” means cars, crossovers and light trucks (including sport utility vehicles and, outside North

America, light commercial vehicles), (v) “program cars” means cars purchased by car rental companies under repurchase or

guaranteed depreciation programs with car manufacturers, (vi) “non-program cars” means cars not purchased under repurchase or

guaranteed depreciation programs for we are exposed to residual risk and (vii) “equipment” means industrial, construction and

material handling equipment.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained or incorporated by reference in this Annual Report and in reports we subsequently file with the United

States Securities and Exchange Commission, or the “SEC,” on Forms 10-K, 10-Q and file or furnish on Form 8-K, and in related

comments by our management, include “forward-looking statements.” Forward-looking statements include information concerning

our liquidity and our possible or assumed future results of operations, including descriptions of our business strategies. These

statements often include words such as “believe,” “expect,” “project,” "potential," “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,”

“may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are based on certain assumptions that we

have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future

developments and other factors we believe are appropriate in these circumstances. We believe these judgments are reasonable, but

you should understand that these statements are not guarantees of performance or results, and our actual results could differ

materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative,

that may be revised or supplemented in subsequent reports on SEC Forms 10-K, 10-Q and 8-K. Some important factors that could

affect our actual results include, among others, those that may be disclosed from time to time in subsequent reports filed with the

SEC, those described under “Risk Factors” set forth in Item 1A of this Annual Report, and the following, which were derived in part

from the risks set forth in Item 1A of this Annual Report:

•our ability to integrate the car rental operations of Dollar Thrifty and realize operational efficiencies from the

acquisition;

•the operational and profitability impact of the divestitures that we agreed to undertake in order to secure regulatory

approval for the acquisition of Dollar Thrifty;

•the effect of our proposed separation of HERC and ability to obtain the expected benefits of any related transaction;

•levels of travel demand, particularly with respect to airline passenger traffic in the United States and in global

markets;

•significant changes in the competitive environment, including as a result of industry consolidation, and the effect of

competition in our markets, including on our pricing policies or use of incentives;

•an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at

which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed

depreciation programs;

•occurrences that disrupt rental activity during our peak periods;

•our ability to achieve cost savings and efficiencies and realize opportunities to increase productivity and profitability;

•our ability to accurately estimate future levels of rental activity and adjust the size and mix of our fleet accordingly;

•our ability to maintain sufficient liquidity and the availability to us of additional or continued sources of financing for

our revenue earning equipment and to refinance our existing indebtedness;

1

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.