Hertz 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

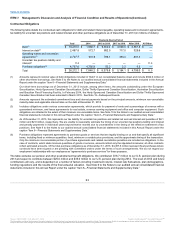

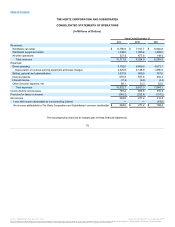

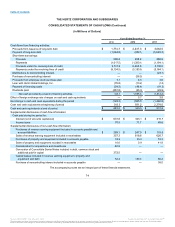

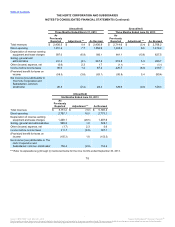

Cash flows from operating activities:

Net income $394.0

$271.2

$218.0

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation of revenue earning equipment 2,445.0

2,049.0

1,800.0

Depreciation of property and equipment 205.3

172.6

158.0

Amortization of other intangible assets 121.5

83.9

70.0

Amortization and write-off of deferred financing costs 54.3

51.8

89.9

Amortization and write-off of debt discount (5.6)

4.0

15.9

Stock-based compensation charges 34.8

30.3

31.1

(Gain) loss on derivatives 1.6

4.3

(8.0)

Loss on disposal of business, net 4.1

46.3

—

(Gain) loss on revaluation of foreign denominated debt —

2.5

(26.6)

Impairment charges and other 40.0

—

—

Income from equity investments (1.7)

—

—

Loss on extinguishment of debt 7.2

—

—

Provision for losses on doubtful accounts 45.9

38.3

28.2

Asset writedowns —

—

23.2

Deferred taxes on income 269.7

132.7

68.9

Gain on sale of property and equipment (3.9)

(8.3)

(43.5)

(Gain) loss on revaluation of investment —

(8.5)

—

Changes in assets and liabilities, net of effects of acquisition:

Receivables (34.7)

(149.2)

(73.6)

Inventories, prepaid expenses and other assets (33.6)

(21.2)

1.3

Accounts payable 23.2

34.0

(1.2)

Accrued liabilities 23.6

(29.6)

(145.1)

Accrued taxes 24.5

40.4

23.0

Public liability and property damage (3.7)

(4.3)

6.6

Net cash provided by operating activities 3,611.5

2,740.2

2,236.1

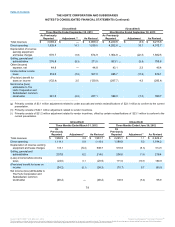

Cash flows from investing activities:

Net change in restricted cash and cash equivalents (308.3)

(241.6)

(101.7)

Revenue earning equipment expenditures (10,298.4)

(9,612.8)

(9,431.9)

Proceeds from disposal of revenue earning equipment 7,264.1

7,125.1

7,850.4

Property and equipment expenditures (313.8)

(297.1)

(281.7)

Proceeds from disposal of property and equipment 73.0

122.0

53.8

Acquisitions, net of cash acquired (254.0)

(1,905.2)

(227.1)

Purchase of short-term investments, net —

—

(32.9)

Proceeds from disposal of business —

84.5

—

Other investing activities (1.5)

(1.8)

0.6

Net cash used in investing activities $(3,838.9)

$(4,726.9)

$(2,170.5)

73

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.