Hertz 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We account for business combinations using the acquisition method, which requires an allocation of the purchase price of an acquired entity

to the assets acquired and liabilities assumed based on their estimated fair values at the date of acquisition. Goodwill represents the excess

of the purchase price over the net tangible and intangible assets acquired.

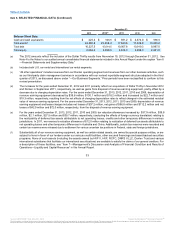

Revenue Earning Equipment

Our principal assets are revenue earning equipment, which represented approximately 58% of our total assets as of December 31, 2013.

Revenue earning equipment consists of vehicles utilized in our car rental operations and equipment utilized in our equipment rental

operations. For the year ended December 31, 2013, 30% of the vehicles purchased for our combined U.S. and international car rental fleets

were subject to repurchase by automobile manufacturers under contractual repurchase and guaranteed depreciation programs, subject to

certain manufacturers' car condition and mileage requirements, at a specific price during a specified time period. These programs limit our

residual risk with respect to vehicles purchased under these programs. For all other vehicles, as well as equipment acquired by our

equipment rental business, we use historical experience, as well as industry residual value guidebooks, and the monitoring of market

conditions, to set depreciation rates. Generally, when revenue earning equipment is acquired, we estimate the period that we will hold the

asset, primarily based on historical measures of the amount of rental activity (e.g., automobile mileage and equipment usage) and the

targeted age of equipment at the time of disposal. We also estimate the residual value of the applicable revenue earning equipment at the

expected time of disposal. The residual values for rental vehicles are affected by many factors, including make, model and options, age,

physical condition, mileage, sale location, time of the year and channel of disposition (e.g., auction, retail, dealer direct). The residual value

for rental equipment is affected by factors which include equipment age and amount of usage. Depreciation is recorded on a straight-line basis

over the estimated holding period. Depreciation rates are reviewed on a quarterly basis based on management's ongoing assessment of

present and estimated future market conditions, their effect on residual values at the time of disposal and the estimated holding periods.

Market conditions for used vehicle and equipment sales can also be affected by external factors such as the economy, natural disasters, fuel

prices and incentives offered by manufacturers of new cars. These key factors are considered when estimating future residual values.

Depreciation rates are adjusted prospectively through the remaining expected life. As a result of this ongoing assessment, we make periodic

adjustments to depreciation rates of revenue earning equipment in response to changing market conditions. Upon disposal of revenue

earning equipment, depreciation expense is adjusted for any difference between the net proceeds received and the remaining net book value

and a corresponding gain or loss is recorded.

Within our Donlen subsidiary, revenue earning equipment is under longer term lease agreements with our customers. These leases contain

provisions whereby we have a contracted residual value guaranteed to us by the lessee, such that we do not experience any gains or losses

on the disposal of these vehicles. Therefore depreciation rates on these vehicles are not adjusted at any point in time per the associated lease

contract.

See Note 8 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption “Item 8

—Financial Statements and Supplementary Data.”

Public Liability and Property Damage

The obligation for public liability and property damage on self-insured U.S. and international vehicles and equipment represents an estimate

for both reported accident claims not yet paid, and claims incurred but not yet reported. The related liabilities are recorded on a non-discounted

basis. Reserve requirements are based on rental volume and actuarial evaluations of historical accident claim experience and trends, as well

as future projections of ultimate losses, expenses, premiums and administrative costs. The adequacy of the liability is regularly monitored

based on evolving accident claim history and insurance related state legislation changes. If our estimates change or if actual results differ

from these assumptions, the amount of the recorded liability is adjusted to reflect these results. Our actual results as compared to our

estimates have historically resulted in relatively minor adjustments to our recorded liability.

Pension Benefit Obligations

Our employee pension costs and obligations are dependent on our assumptions used by actuaries in calculating such amounts. These

assumptions include discount rates, salary growth, long-term return on plan assets, retirement rates, mortality rates and other factors. Actual

results that differ from our assumptions are accumulated and amortized over future periods and, therefore, generally affect our recognized

expense in such future periods. While we believe that

38

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.