Hertz 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The valuation of our indefinite lived assets utilized the relief from royalty method, which incorporates cash flows and discount rates

comparable to those discussed above. We also considered the excess earnings as a percentage of revenues to ensure their reasonableness.

Our analysis supported our conclusion that an impairment did not exist.

Derivatives

We periodically enter into cash flow and other hedging transactions to specifically hedge exposure to various risks related to interest rates,

fuel prices and foreign currency rates. Derivative financial instruments are viewed as risk management tools and have not been used for

speculative or trading purposes. All derivatives are recorded on the balance sheet as either assets or liabilities measured at their fair value.

The effective portion of changes in fair value of derivatives designated as cash flow hedging instruments is recorded as a component of other

comprehensive income. The ineffective portion is recognized currently in earnings within the same line item as the hedged item, based upon

the nature of the hedged item. For derivative instruments that are not part of a qualified hedging relationship, the changes in their fair value

are recognized currently in earnings. The valuation methods used to mark these to market are either market quotes (for fuel swaps, interest

rate caps and foreign exchange instruments) or a discounted cash flow method (for interest rate swaps). The key inputs for the discounted

cash flow method are the current yield curve and the credit default swap spread. These valuations are subject to change based on

movements in items such as the London inter-bank offered rate, or “LIBOR,” our credit worthiness and unleaded gasoline and diesel fuel

prices.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The effect of a change in tax rates is recognized in the statement of operations in the period that includes the enactment date. Valuation

allowances are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit will not be realized. Subsequent

changes to enacted tax rates and changes to the global mix of earnings will result in changes to the tax rates used to calculate deferred taxes

and any related valuation allowances. Provisions are not made for income taxes on undistributed earnings of international subsidiaries that

are intended to be indefinitely reinvested outside the United States or are expected to be remitted free of taxes. Future distributions, if any,

from these international subsidiaries to the United States or changes in U.S. tax rules may require recording a tax on these amounts. We

have recorded a deferred tax asset for unutilized net operating loss carryforwards in various tax jurisdictions. Upon utilization, the taxing

authorities may examine the positions that led to the generation of those net operating losses. If the utilization of any of those losses are

disallowed a deferred tax liability may have to be recorded.

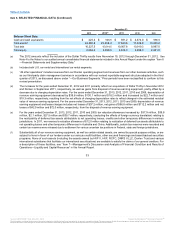

See Note 9 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the caption “Item 8

—Financial Statements and Supplementary Data.”

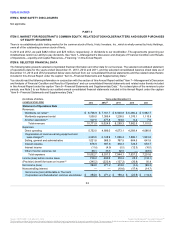

Stock Based Compensation

The cost of employee services received in exchange for an award of equity instruments is based on the grant date fair value of the award. The

compensation expense for RSUs and PSUs is recognized ratably over the vesting period. For grants in 2011, 2012 and 2013, the vesting

period is two or three years (for grants in 2011, 25% in the first year, 25% in the second year and 50% in the third year and for grants in 2012

and 2013, 33 1/3% per year). In addition to the service vesting condition, the PSUs had an additional vesting condition which called for the

number of units that will be awarded based on achievement of a certain level of Corporate EBITDA over the applicable measurement period.

The cost of employee services received in exchange for an award of equity instruments is based on the grant date fair value of the award.

That cost is recognized over the period during which the employee is required to provide service in exchange for the award. We estimated the

fair value of options issued at the date of grant using a Black-Scholes option-pricing model, which includes assumptions related to volatility,

expected term, dividend yield, and risk-free interest rate. These factors combined with the stock price on the date of grant result in a fixed

expense which is recorded on a straight-line basis over the vesting period. The key factors used in the valuation process, other than the

volatility, remained unchanged from the date of grant. Because the stock of Hertz Holdings became publicly traded in November 2006 and

had a short trading history, it was not practicable for us to estimate the expected volatility of our share price, or a peer company share price,

because there was not sufficient historical information about past volatility prior to 2012. Therefore, prior to 2012 we used the calculated value

method, substituting the historical volatility of an appropriate industry sector index for the expected volatility of our common stock price as an

assumption in the valuation model.

40

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.