Hertz 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

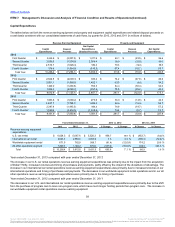

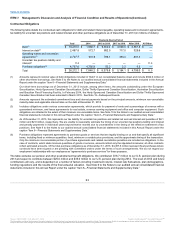

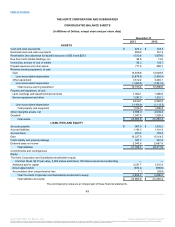

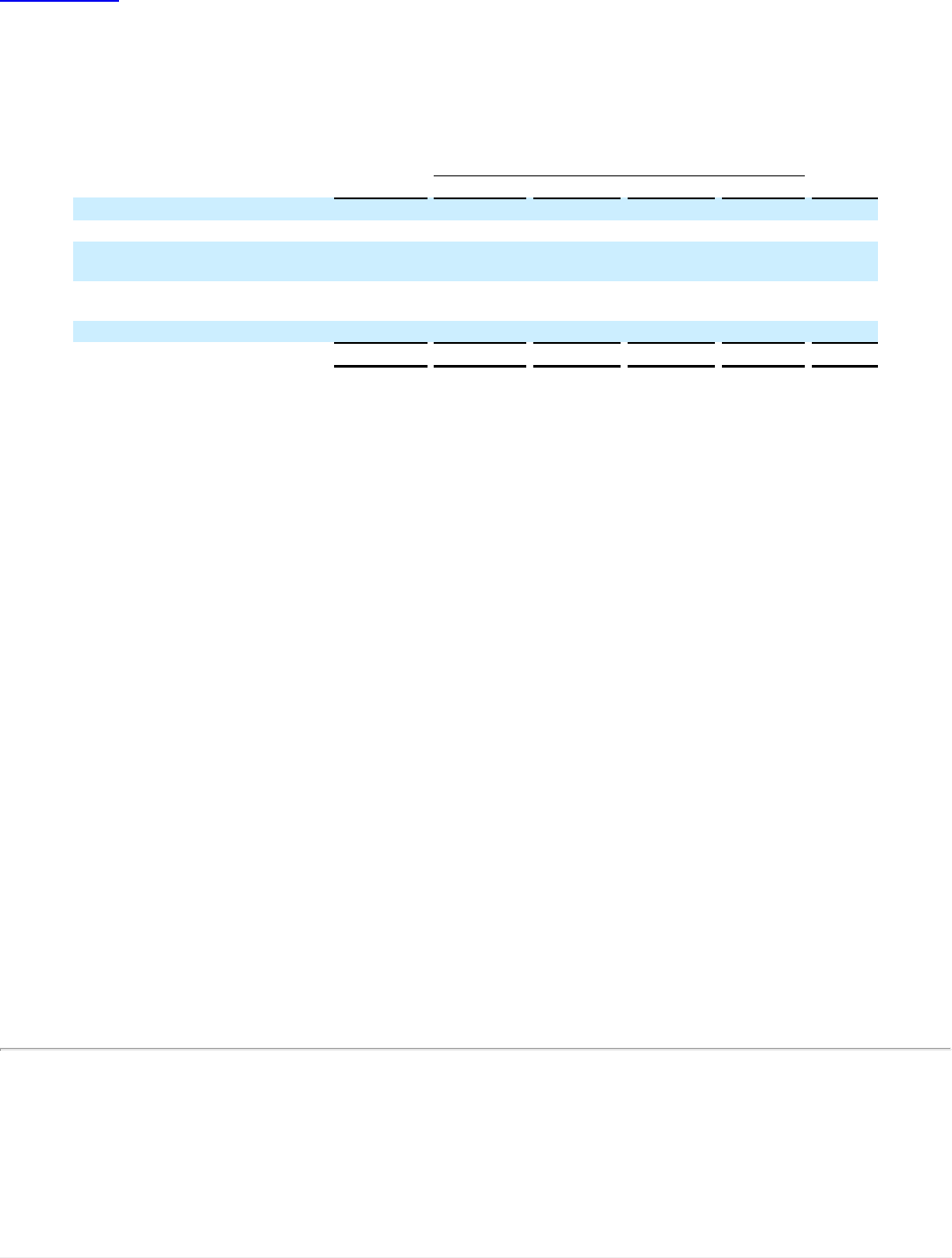

The following table details the contractual cash obligations for debt and related interest payable, operating leases and concession agreements,

tax liability for uncertain tax positions and related interest and other purchase obligations as of December 31, 2013 (in millions of dollars):

Debt(1) $16,218.0

$1,968.7

$6,652.0

$4,009.5

$3,587.8

$ —

Interest on debt(2) 2,497.8

572.7

882.5

717.0

325.6

—

Operating leases and concession

agreements(3) 2,727.7

601.9

789.1

455.4

881.3

—

Uncertain tax positions liability and

interest(4) 11.0

—

—

—

—

11.0

Purchase obligations(5) 4,757.6

4,702.9

52.2

2.2

0.3

—

Total $26,212.1

$7,846.2

$8,375.8

$5,184.1

$4,795.0

$11.0

(1) Amounts represent nominal value of debt obligations included in “Debt” in our consolidated balance sheet and include $842.6 million of

other short-term borrowings. See Note 5 to the Notes to our audited annual consolidated financial statements included in this Annual

Report under the caption “Item 8—Financial Statements and Supplementary Data.”

Our short-term borrowings as of December 31, 2013 include, among other items, the amounts outstanding under the European

Securitization, Hertz-Sponsored Canadian Securitization, Dollar Thrifty-Sponsored Canadian Securitization, Australian Securitization

and Brazilian Fleet Financing Facility. In February 2014, the Hertz-Sponsored Canadian Securitization and Dollar Thrifty-Sponsored

Canadian Securitization had been extended to March 2015. See Note 19—Subsequent Events.

(2) Amounts represent the estimated commitment fees and interest payments based on the principal amounts, minimum non-cancelable

maturity dates and applicable interest rates on the debt at December 31, 2013.

(3) Includes obligations under various concession agreements, which provide for payment of rents and a percentage of revenue with a

guaranteed minimum, and lease agreements for real estate, revenue earning equipment and office and computer equipment. Such

obligations are reflected to the extent of their minimum non-cancelable terms. See Note 10 to the Notes to our audited annual consolidated

financial statements included in this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.”

(4) As of December 31, 2013, this represents our tax liability for uncertain tax positions and related net accrued interest and penalties of $8.1

million and $2.9 million, respectively. We are unable to reasonably estimate the timing of our uncertain tax positions liability and interest

and penalty payments in individual years beyond twelve months due to uncertainties in the timing of the effective settlement of tax

positions. See Note 9 to the Notes to our audited annual consolidated financial statements included in this Annual Report under the

caption “Item 8—Financial Statements and Supplementary Data.”

(5) Purchase obligations represent agreements to purchase goods or services that are legally binding on us and that specify all significant

terms, including fixed or minimum quantities; fixed, minimum or variable price provisions; and the approximate timing of the transaction.

Only the minimum non-cancelable portion of purchase agreements and related cancellation penalties are included as obligations. In the

case of contracts, which state minimum quantities of goods or services, amounts reflect only the stipulated minimums; all other contracts

reflect estimated amounts. Of the total purchase obligations as of December 31, 2013, $4,457.5 million represent fleet purchases where

contracts have been signed or are pending with committed orders under the terms of such arrangements. We do not regard our

employment relationships with our employees as “agreements to purchase services” for these purposes.

The table excludes our pension and other postretirement benefit obligations. We contributed $18.7 million to our U.S. pension plan during

2013 and expect to contribute between $25.0 million and $35.0 million to our U.S. pension plan during 2014. The level of 2014 and future

contributions will vary, and is dependent on a number of factors including investment returns, interest rate fluctuations, plan demographics,

funding regulations and the results of the final actuarial valuation. See Note 6 to the Notes to our audited annual consolidated financial

statements included in this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.”

63

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.