Hertz 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

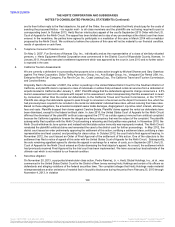

various methods in which such earnings could be repatriated, it is not practicable to estimate the actual amount of such deferred tax liabilities.

If such earnings were repatriated and subject to taxation at the current U.S. federal tax rate, the tax liability, including the impact of foreign

withholding taxes would be $184.0 million, excluding the impact of potential foreign tax credits. The Company would consider and pursue

appropriate alternatives to reduce the tax liability. If, in the future, undistributed earnings are repatriated to the United States, or it is

determined such earnings will be repatriated in the foreseeable future, deferred tax liabilities will be recorded.

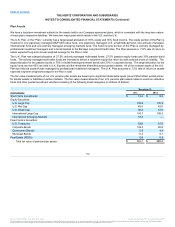

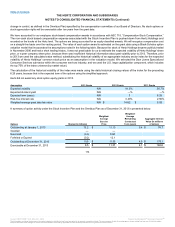

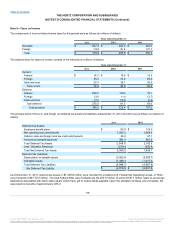

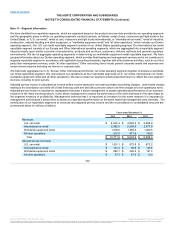

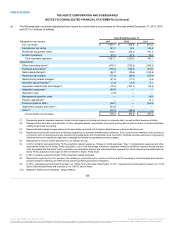

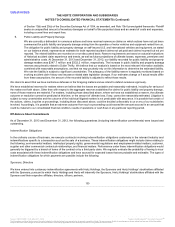

As of December 31, 2013, total unrecognized tax benefits were $11.0 million, all of which, if recognized, would favorably impact the effective

tax rate in future periods. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in millions of

dollars):

Balance at January 1

$18.7

$41.4

$46.3

Decrease attributable to tax positions taken during prior periods

(6.7)

(26.0)

(9.5)

Increase attributable to tax positions taken during the current year

2.6

3.3

4.6

Decrease attributable to settlements with taxing authorities

(3.6)

—

—

Balance at December 31

$11.0

$18.7

$41.4

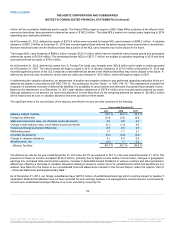

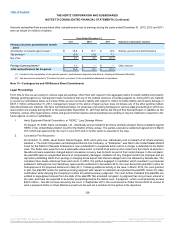

We conduct business globally and, as a result, file one or more income tax returns in the U.S. and non-U.S. jurisdictions. In the normal

course of business we are subject to examination by taxing authorities throughout the world. The open tax years for these jurisdictions span

from 2003 to 2012. The Internal Revenue service completed their audit of the company's 2007 to 2011 tax returns and had no changes to the

previously filed tax returns. Several U.S. state and non-U.S. jurisdictions are under audit.

In many cases the uncertain tax positions are related to tax years that remain subject to examination by the relevant taxing authorities. It is

reasonable that approximately $3.0 million of unrecognized tax benefits may reverse within the next twelve months due to settlement with

the relevant taxing authorities, expirations of the statute of limitation periods, and/or the filing of amended income tax returns.

Net, after-tax interest and penalties related to the liabilities for unrecognized tax benefits are classified as a component of “Provision for taxes

on income” in the consolidated statement of operations. During the years ended December 31, 2013, 2012 and 2011, approximately $(1.0)

million, $0.6 million and $1.9 million, respectively, in net, after-tax interest and penalties were recognized. As of December 31, 2013 and

2012, approximately $2.9 million and $4.2 million, respectively, of net, after-tax interest and penalties was accrued in our consolidated

balance sheet within "Accrued taxes."

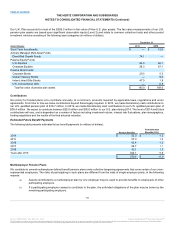

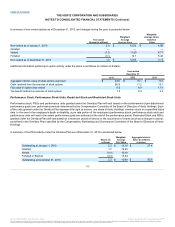

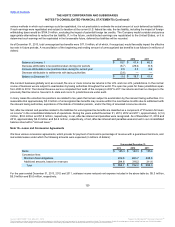

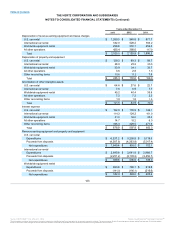

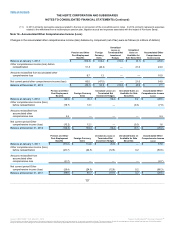

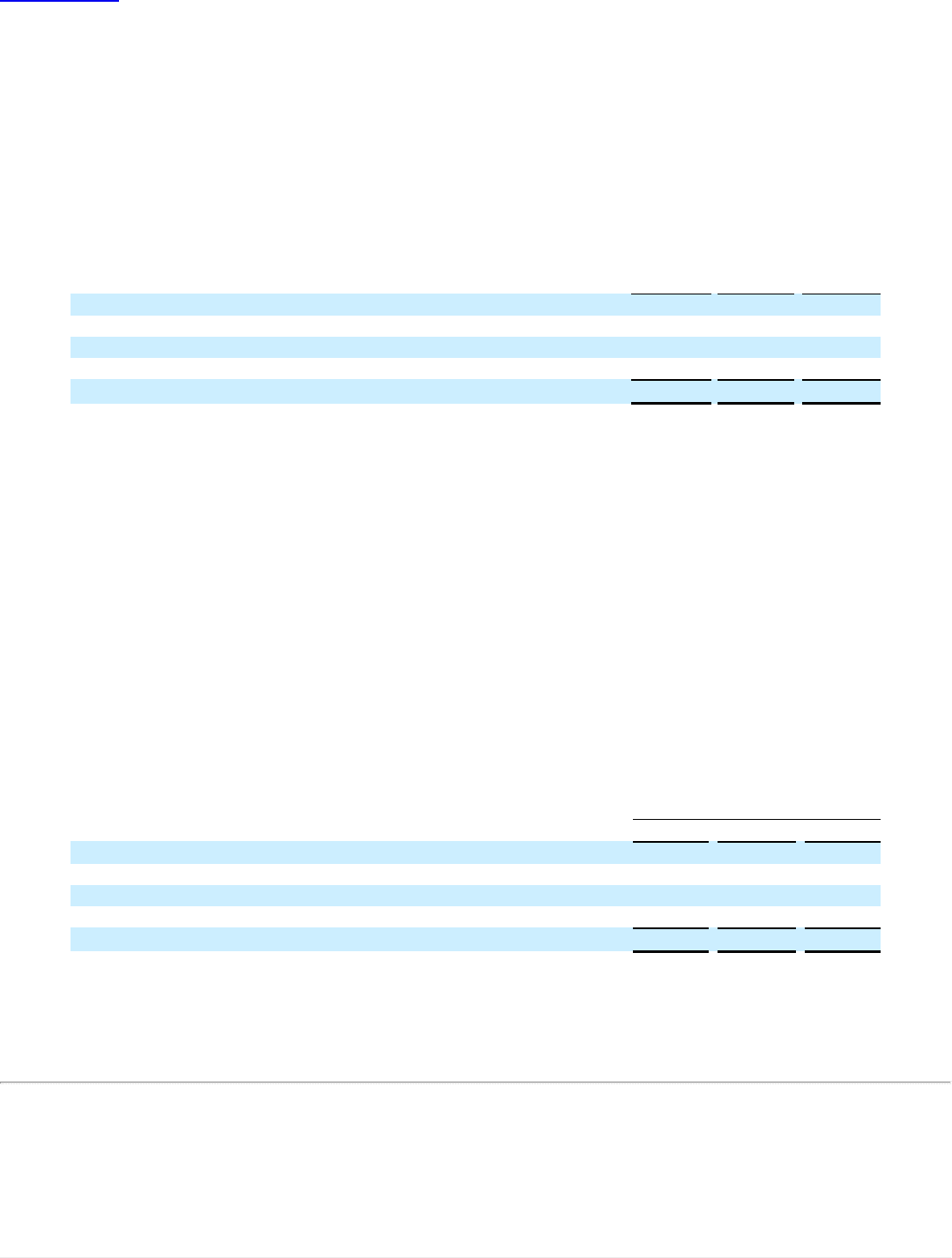

We have various concession agreements, which provide for payment of rents and a percentage of revenue with a guaranteed minimum, and

real estate leases under which the following amounts were expensed (in millions of dollars):

Rents

$185.3

$142.3

$135.9

Concession fees:

Minimum fixed obligations

404.8

263.7

248.8

Additional amounts, based on revenues

294.6

316.2

311.6

Total

$884.7

$722.2

$696.3

For the years ended December 31, 2013, 2012 and 2011, sublease income reduced rent expense included in the above table by $5.3 million,

$5.0 million and $5.0 million, respectively.

120

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.