Hertz 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

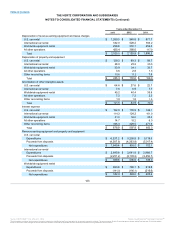

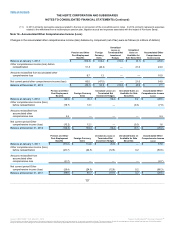

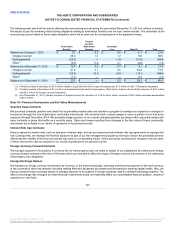

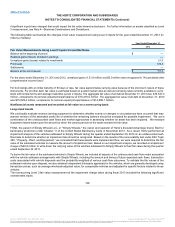

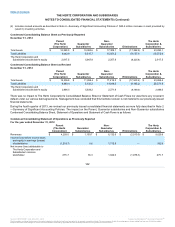

The following table sets forth the activity affecting the restructuring accrual during the year ended December 31, 2013 (in millions of dollars).

We expect to pay the remaining restructuring obligations relating to termination benefits over the next twelve months. The remainder of the

restructuring accrual relates to future lease obligations which will be paid over the remaining term of the applicable leases.

Balance as of January 1, 2012 $9.1

$0.2

$0.6

$11.7

$21.6

Charges incurred 26.2

1.0

1.2

9.6

38.0

Cash payments (22.6)

—

(1.6)

(12.6)

(36.8)

Other(1) (0.3)

(1.0)

0.1

(0.6)

(1.8)

Balance as of December 31, 2012 $12.4

$0.2

$0.3

$8.1

$21.0

Charges incurred 41.6

0.1

0.5

34.8

77.0

Cash payments (32.6)

(0.3)

(0.6)

(15.1)

(48.6)

Other(2) (1.3)

—

—

0.3

(1.0)

Balance as of December 31, 2013 $20.1

$ —

$0.2

$28.1

$48.4

_______________________________________________________________________________

(1) Primarily consists of decreases of $0.5 million related to a goodwill write-off on a sale of business and $1.0 million in ASC 715 pension adjustment.

(2) Primarily consists of decreases of $1.6 million of accelerated equity award compensation, offset by the inclusion of prior facility reserves of $0.3 million

and $0.2 million for foreign currency translation.

(3) As of December 31, 2013, primarily consists of charges incurred for relocation of $19.0 million, facility closures of $8.5 million and lease accelerations

of $7.0 million.

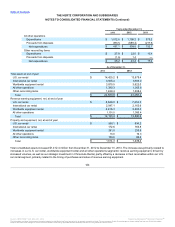

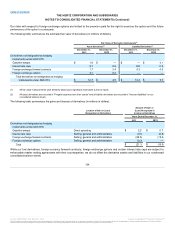

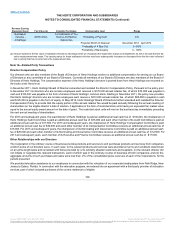

Gasoline Swap Contracts

We purchase unleaded gasoline and diesel fuel at prevailing market rates and maintain a program to manage our exposure to changes in

fuel prices through the use of derivative commodity instruments. We currently have in place swaps to cover a portion of our fuel price

exposure through December 2014. We presently hedge a portion of our overall unleaded gasoline purchases with commodity swaps and

have contracts in place that settle on a monthly basis. Gains and losses resulting from changes in the fair value of these commodity

instruments are included in our results of operations in the periods incurred.

Interest Rate Cap Contracts

Hertz is exposed to market risks, such as changes in interest rates, and has purchased and sold interest rate cap agreements to manage that

risk. Consequently, we manage the financial exposure as part of our risk management program by striving to reduce the potentially adverse

effects that the volatility of the financial markets may have on our operating results. Gains and losses resulting from changes in the fair value

of these interest rate caps are included in our results of operations in the periods incurred.

Foreign Currency Forward Contracts

We manage exposure to fluctuations in currency risk on intercompany loans we make to certain of our subsidiaries by entering into foreign

currency forward contracts at the time of the loans which are intended to offset the impact of foreign currency movements on the underlying

intercompany loan obligations.

Foreign Exchange Options

We manage our foreign currency risk primarily by incurring, to the extent practicable, operating and financing expenses in the local currency

in the countries in which we operate, including making fleet and equipment purchases and borrowing for working capital needs. Also, we

have purchased foreign exchange options to manage exposure to fluctuations in foreign exchange rates for selected marketing programs. The

effect of exchange rate changes on these financial instruments would not materially affect our consolidated financial position, results of

operations or cash flows.

133

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.