Hertz 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

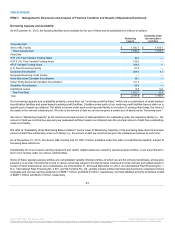

As of December 31, 2013 and 2012, the following guarantees (including indemnification commitments) were issued and outstanding:

Indemnification Obligations

In the ordinary course of business, we execute contracts involving indemnification obligations customary in the relevant industry and

indemnifications specific to a transaction such as the sale of a business. These indemnification obligations might include claims relating to

the following: environmental matters; intellectual property rights; governmental regulations and employment-related matters; customer,

supplier and other commercial contractual relationships; and financial matters. Performance under these indemnification obligations would

generally be triggered by a breach of terms of the contract or by a third party claim. We regularly evaluate the probability of having to incur

costs associated with these indemnification obligations and have accrued for expected losses that are probable and estimable. The types of

indemnification obligations for which payments are possible include the following:

Sponsors; Directors

We have entered into customary indemnification agreements with Hertz Holdings, the Sponsors and Hertz Holdings' stockholders affiliated

with the Sponsors, pursuant to which Hertz Holdings and Hertz will indemnify the Sponsors, Hertz Holdings' stockholders affiliated with the

Sponsors and their respective affiliates, directors, officers, partners, members, employees, agents, representatives and controlling persons,

against certain liabilities arising out of performance of a consulting agreement with Hertz Holdings and each of the Sponsors and certain other

claims and liabilities, including liabilities arising out of financing arrangements or securities offerings. Hertz Holdings also entered into

indemnification agreements with each of its directors. We do not believe that these indemnifications are reasonably likely to have a material

impact on us.

Environmental

We have indemnified various parties for the costs associated with remediating numerous hazardous substance storage, recycling or disposal

sites in many states and, in some instances, for natural resource damages. The amount of any such expenses or related natural resource

damages for which we may be held responsible could be substantial. The probable expenses that we expect to incur for such matters have

been accrued, and those expenses are reflected in our consolidated financial statements. As of December 31, 2013 and 2012, the aggregate

amounts accrued for environmental liabilities including liability for environmental indemnities, reflected in our consolidated balance sheets in

"Accrued liabilities" were $2.5 million and $2.6 million, respectively. The accrual generally represents the estimated cost to study potential

environmental issues at sites deemed to require investigation or clean-up activities, and the estimated cost to implement remediation

actions, including on-going maintenance, as required. Cost estimates are developed by site. Initial cost estimates are based on historical

experience at similar sites and are refined over time on the basis of in-depth studies of the sites. For many sites, the remediation costs and

other damages for which we ultimately may be responsible cannot be reasonably estimated because of uncertainties with respect to factors

such as our connection to the site, the materials there, the involvement of other potentially responsible parties, the application of laws and

other standards or regulations, site conditions, and the nature and scope of investigations, studies, and remediation to be undertaken

(including the technologies to be required and the extent, duration, and success of remediation).

For a discussion of additional risks arising from our operations, including vehicle liability, general liability and property damage insurable

risks, see “Item 1—Business—Risk Management” in this Annual Report.

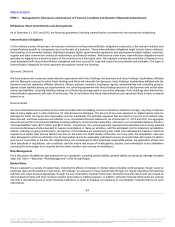

We are exposed to a variety of market risks, including the effects of changes in interest rates (including credit spreads), foreign currency

exchange rates and fluctuations in fuel prices. We manage our exposure to these market risks through our regular operating and financing

activities and, when deemed appropriate, through the use of derivative financial instruments. Derivative financial instruments are viewed as

risk management tools and have not been used for speculative or trading purposes. In addition, derivative financial instruments are entered

into with a diversified group of major financial institutions in order to manage our exposure to counterparty nonperformance on such

instruments.

64

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.