Hertz 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America, or

“GAAP,” requires management to make estimates and assumptions that affect the amounts reported in the financial statements and

footnotes. Actual results could differ materially from those estimates.

Significant estimates inherent in the preparation of the consolidated financial statements include depreciation of revenue earning equipment,

reserves for litigation and other contingencies, accounting for income taxes and related uncertain tax positions, pension and postretirement

benefit costs, the fair value of assets and liabilities acquired in business combinations, the recoverability of long-lived assets, useful lives and

impairment of long-lived tangible and intangible assets including goodwill, valuation of stock based compensation, public liability and

property damage reserves, reserves for restructuring, allowance for doubtful accounts, and fair value of derivatives, among others .

Reclassifications

Certain prior period amounts have been reclassified to conform with current year presentation.

In the third quarter of 2013 we changed the composition of our reportable segments upon further consideration of the guidance provided in the

Financial Accounting Standards Board, or “FASB,” Accounting Standards Codification, or “ASC,” Topic 280, Segment Reporting. We

historically aggregated our U.S., Europe, Other International and Donlen car rental operating segments together to produce a worldwide car

rental reportable segment. We now present our operations as four reportable segments (U.S. car rental, international car rental, worldwide

equipment rental and all other operations). We have revised our segment results presented herein to reflect this new segment structure,

including for prior periods. Such revisions have no impact on our consolidated financial condition, results of operations or cash flows for the

periods presented. See Note 11—Segment Information.

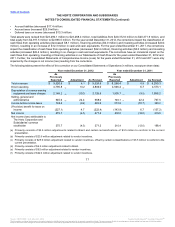

Correction of Errors

We have revised our consolidated statement of cash flows for the years ended December 31, 2012 and 2011 to correctly present borrowings

and repayments related to its revolving lines of credits on a gross basis. These amounts had previously been presented on a net basis within

the financing section. This revision had no impact on the Company's total operating, investing or financing cash flows.

During the fourth quarter of 2013, we identified certain out of period errors totaling $46.3 million, of which $34.7 million ($21.0 million, net

of tax) related to our previously issued consolidated financial statements for the years ended December 31, 2012, 2011 and prior. While these

errors did not, individually or in the aggregate, result in a material misstatement of our previously issued consolidated financial statements,

correcting these errors in the fourth quarter would have been material to the fourth quarter ended December 31, 2013. Accordingly,

management has revised in this filing and will revise in subsequent quarterly filings on Form 10-Q its previously reported consolidated

balance sheets and statements of operations as noted below. These recorded pre-tax adjustments relate to vendor incentives (reduced pre-tax

income by $12.9 million in 2011 and $2.4 million in 2012) which had been accounted for as a reduction of marketing expenses instead of

reducing the cost of revenue earning equipment, charges related to certain assets and allowances for doubtful accounts in Brazil (reduced pre-

tax income by $4.4 million in 2010, $6.2 million in 2011 and $3.6 million in 2012), as well as other immaterial errors (decreased pre-tax

income by $2.4 million in 2010 and $3.2 million in 2012, and increased pre-tax income by $0.4 million in 2011).

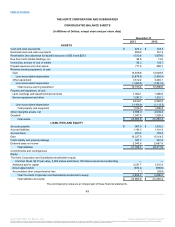

We are recording the cumulative effect of these adjustments of $4.5 million for periods prior to 2011 as an increase of the previously reported

December 31, 2010 accumulated deficit of $1,123.2 million resulting in a revised December 31, 2010 accumulated deficit of $1,127.7

million. These adjustments also cumulatively impacted the following consolidated balance sheet line items as of December 31, 2012:

•Cash and cash equivalents (increased $12.3 million)

•Restricted cash and cash equivalents (decreased $20.0 million)

•Receivables (decreased $7.0 million)

•Prepaid expenses and other assets (increased $19.2 million)

•Revenue earning equipment, at cost (decreased $42.3 million)

•Accumulated depreciation (decreased $30.5 million)

•Other intangible assets (decreased $1.9 million)

•Goodwill (decreased $12.5 million)

•Accounts payable (increased $4.1 million)

76

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.