Hertz 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

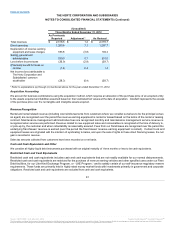

We account for our goodwill and indefinite-lived intangible assets under ASC 350. Under ASC 350, goodwill impairment is deemed to exist if

the carrying value of goodwill exceeds its fair value. In addition, ASC 350 requires that goodwill be tested at least annually using a two-step

process. The first step is to identify any potential impairment by comparing the carrying value of the reporting unit to its fair value. We

estimate the fair value of our reporting units using a discounted cash flow methodology. The cash flows represent management’s most

recent planning assumptions. These assumptions are based on a combination of industry outlooks, views on general economic conditions,

our expected pricing plans and expected future savings generated by our ongoing restructuring activities. If a potential impairment is

identified, the second step is to compare the implied fair value of goodwill with its carrying amount to measure the impairment loss. Those

intangible assets considered to have indefinite useful lives, including our trade name, are evaluated for impairment on an annual basis, by

comparing the fair value of the intangible assets to their carrying value. In addition, whenever events or changes in circumstances indicate

that the carrying value of intangible assets might not be recoverable, we will perform an impairment review. We estimate the fair value of our

indefinite lived intangible assets using the relief from royalty method. Intangible assets with finite useful lives are amortized over their

respective estimated useful lives and reviewed for impairment in accordance with ASC 360-10, "Impairment and Disposal of Long-Lived

Assets."

At October 1, 2013, 2012 and 2011, we performed our annual goodwill impairment test and determined that the respective book values of our

reporting units did not exceed their estimated fair values and therefore no impairment existed for the years ended December 31, 2013, 2012

and 2011.

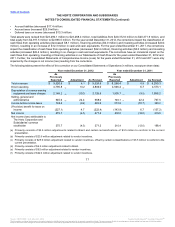

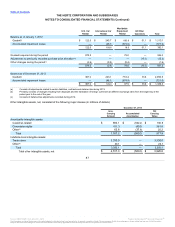

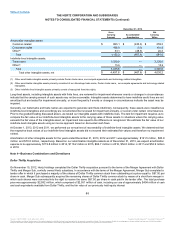

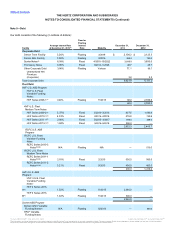

The following summarizes the changes in our goodwill, by segment (in millions of dollars):

Balance as of January 1, 2013

Goodwill $997.0

$ 245.1

$772.4

$35.8

$2,050.3

Accumulated impairment losses —

(46.1)

(674.9)

—

(721.0)

997.0

199.0

97.5

35.8

1,329.3

Goodwill acquired during the period 0.6

3.4

—

—

4.0

Adjustments to previously recorded purchase price allocation (a) 13.2

—

—

—

13.2

Other changes during the period(b) —

1.0

—

—

1.0

13.8

4.4

—

—

18.2

Balance as of December 31, 2013

Goodwill 1,010.8

249.5

772.4

35.8

2,068.5

Accumulated impairment losses —

(46.1)

(674.9)

—

(721.0)

$ 1,010.8

$ 203.4

$ 97.5

$35.8

$1,347.5

86

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.