Hertz 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

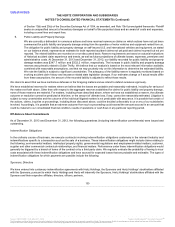

employees on our behalf. Consistent with the practices of other, similarly-situated companies that undergo relocations, the purchase price of

each of the residences was determined by obtaining multiple appraisals, which were averaged for the third party's purchase price. The total

amount that we spent under the program during the year ended December 31, 2013 was $3.1 million for the executive officers. The

Compensation Committee approved the program.

As a result of the Sponsors' sale of shares in May 2013, none of our outstanding debt at December 31, 2013 was with related parties. As of

December 31, 2012 approximately $189.8 million of our outstanding debt was with related parties.

On June 29, 2007, we entered into a master loan agreement with Hertz Holdings. The maximum amount which may be borrowed by us

under this facility is $100.0 million. The facility expired on June 28, 2013 and was extended through November 13, 2014 and amended to

increase its facility size to $300.0 million. The interest rate is based on the U.S. Dollar LIBOR rate plus a margin. As of December 31, 2013

and 2012, there was a $92.6 million and $12.8 million receivable from Hertz Holdings, respectively.

For information on our total indebtedness, see Note 5—Debt.

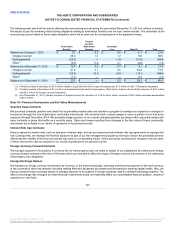

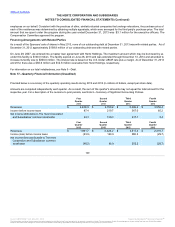

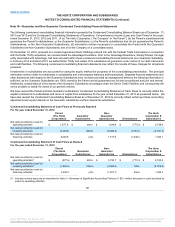

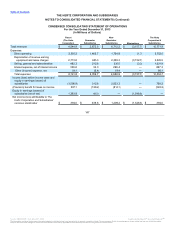

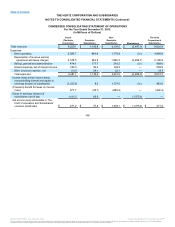

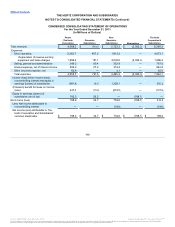

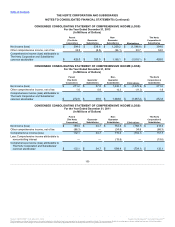

Provided below is a summary of the quarterly operating results during 2013 and 2012 (in millions of dollars, except per share data).

Amounts are computed independently each quarter. As a result, the sum of the quarter's amounts may not equal the total amount for the

respective year. For a description of the revisions to prior periods, see Note 2—Summary of Significant Accounting Policies.

Revenues $2,436.9

$2,709.2

$3,069.4

$2,556.4

Income before income taxes 87.4

219.7

367.0

65.2

Net income attributable to The Hertz Corporation

and Subsidiaries' common stockholder 24.3

129.3

237.1

3.4

Revenues $1,961.7

$2,226.2

$2,517.2

$2,319.7

Income (loss) before income taxes (23.9)

160.9

386.3

(29.7)

Net income (loss) attributable to The Hertz

Corporation and Subsidiaries' common

stockholder (48.2)

95.9

252.2

(28.7)

140

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.