Hertz 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Promissory Notes

References to our “Promissory Notes” relate to our promissory notes issued under three separate indentures prior to the acquisition on

December 21, 2005, by the Sponsors.

The governing documents of certain of the fleet debt financing arrangements specified below contain covenants that, among other things,

significantly limit or restrict (or upon certain circumstances may significantly restrict or prohibit) the ability of the borrowers, and the

guarantors if applicable, to make certain restricted payments (including paying dividends, redeeming stock, making other distributions, loans

or advances) to Hertz Holdings and Hertz, whether directly or indirectly.

On November 25, 2013, Hertz established a new securitization platform, the HVF II U.S. ABS Program, designed to facilitate its financing

activities relating to the vehicle fleet used by Hertz in the U.S. daily car rental operations of its Hertz, Dollar, Thrifty and Firefly brands. Hertz

Vehicle Financing II LP, a bankruptcy remote, indirect, wholly-owned, special purpose subsidiary of Hertz, or “HVF II,” is the issuer under the

HVF II U.S. ABS Program. HVF II has entered into a base indenture that permits it to issue term and revolving rental car asset -backed

securities, secured by one or more shared or segregated collateral pools consisting primarily of portions of the rental car fleet used in Hertz's,

Dollar Thrifty’s and Firefly's domestic car rental operations and contractual rights related to such vehicles that have been allocated as the

ultimate indirect collateral for HVF II's financings. HVF II uses proceeds from its note issuances to make loans to Hertz Vehicle Financing

LLC, or "HVF," pursuant to the HVF Series 2013-G1 Supplement (the “HVF Series 2013-G1 Notes”) and Rental Car Finance Corp., or

"RCFC," pursuant to the RCFC Series 2010-3 Notes, in each case on a continuing basis.

References to the “HVF II U.S. ABS Program” include HVF II’s U.S. Fleet Variable Funding Notes.

HVF II U.S. Fleet Variable Funding Notes

References to the “HVF II U.S. Fleet Variable Funding Notes” include HVF II's Series 2013-A Variable Funding Rental Car Asset Backed

Notes, or the “HVF II Series 2013-A Notes” and HVF II’s Series 2013-B Variable Funding Rental Car Asset Backed Notes, or the “HVF II

Series 2013-B Notes.”

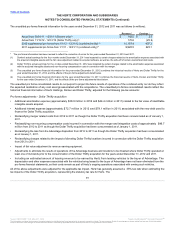

In connection with the establishment of the HVF II U.S. ABS Program, on November 25, 2013, HVF II executed a $3,175.0 million

committed financing arrangement, allocated between the HVF II Series 2013-A Notes and the HVF II Series 2013-B Notes, each of which

ultimately are backed by segregated collateral pools.

The initial aggregate maximum principal amount of the HVF II Series 2013-A Notes is $2,575.0 million, approximately $2,380.0 million of

which was funded as of December 31, 2013. The initial aggregate maximum principal amount of the HVF II Series 2013-B Notes is $600

million, approximately $585.0 million of which was funded as of December 31, 2013. The HVF II Series 2013-A Notes allow for

approximately $900 million of aggregate maximum principal amount of such notes to be transitioned to the aggregate maximum principal

amount of HVF II Series 2013-B Notes and the HVF II Series 2013-B Notes allow for all of the aggregate maximum principal amount of such

notes to be transitioned to the HVF II Series 2013-A Notes. The HVF II Series 2013-A Notes and HVF II Series 2013-B Notes each have an

expected maturity date of November 25, 2015.

The net proceeds from the sale of the HVF II Series 2013-A Notes were used to refinance almost all of the outstanding Series 2009-1 Variable

Funding Rental Car Asset Backed Notes previously issued by HVF, the collateral for which consisted primarily of a substantial portion of the

rental car fleet used in Hertz’s and certain of its subsidiaries’ domestic car rental operations. $60.0 million of the aggregate maximum

principal amount of the HVF Series 2009-1 Notes remained outstanding as of December 31, 2013. The net proceeds from the sale of the

HVF II Series 2013-B Notes were used to refinance the Series 2010-3 Variable Funding Rental Car Asset Backed Notes previously issued by

RCFC, the collateral for which consisted primarily of a substantial portion of the rental car fleet used in Dollar Thrifty ’s and certain of its

affiliates’ domestic car rental operations. The new HVF II financing platform also provides for the issuance from time to time of medium term

asset backed notes and is expected to serve as Hertz’s primary rental car securitization platform in the U.S. going forward.

As of December 31, 2013, a requirement under the HVF II Series 2013-B Notes was unknowingly not met, resulting in the occurrence of an

amortization event under the HVF II Series 2013-B Notes that also triggered amortization events under certain other series of our outstanding

U.S. rental car variable funding notes. As a result of the amortization

99

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.