Hertz 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

in Dollar Thrifty of $41 million. As a result of re-measuring to fair value our equity interest previously held in Dollar Thrifty immediately

before the acquisition date, we recognized a gain of approximately $8.4 million in our consolidated statements of operations within "Other

(income) expense, net." As a condition of the Merger Agreement, and pursuant to a divestiture agreement reached with the Federal Trade

Commission, Hertz divested its Simply Wheelz subsidiary, which owned and operated the Advantage brand, and secured for the buyer of

Advantage certain Dollar Thrifty on-airport car rental concessions. Dollar Thrifty is now a wholly-owned subsidiary of Hertz.

The purchase price of Dollar Thrifty was funded with (i) cash proceeds of $1,950 million received by Hertz from its issuance of $1,950 million

in aggregate principal amount of Senior Notes and Term Loans, (ii) approximately $404 million of acquired cash and cash equivalents from

Dollar Thrifty, and (iii) the balance funded by Hertz's existing cash.

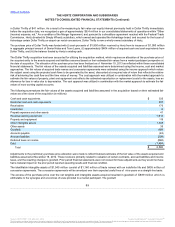

The Dollar Thrifty acquisition has been accounted for utilizing the acquisition method, which requires an allocation of the purchase price of

the acquired entity to the assets acquired and liabilities assumed based on their estimated fair values from a market-participant perspective at

the date of acquisition. The allocation of the purchase price has been finalized as of November 19, 2013 as reflected within these consolidated

financial statements. The fair values of the assets acquired and liabilities assumed were determined using the income, cost and market

approaches. The fair values of acquired trade names and concession agreements were estimated using the income approach which values

the subject asset using the projected cash flows to be generated by the asset, discounted at a required rate of return that reflects the relative

risk of achieving the cash flow and the time value of money. The cost approach was utilized in combination with the market approach to

estimate the fair values of property, plant and equipment and reflects the estimated reproduction or replacement costs for the assets, less an

allowance for loss in value due to depreciation. The cost approach was utilized in combination with the market approach to estimate the fair

values of most working capital accounts.

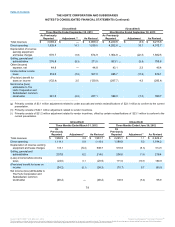

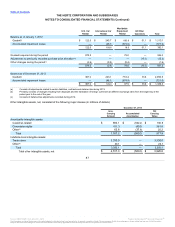

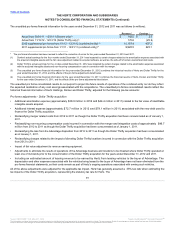

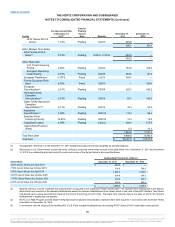

The following summarizes the fair values of the assets acquired and liabilities assumed in the acquisition based on their estimated fair

values as of the close of the acquisition (in millions):

Cash and cash equivalents $535

Restricted cash and cash equivalents 307

Receivables 170

Inventories 8

Prepaid expenses and other assets 41

Revenue earning equipment 1,614

Property and equipment 119

Other intangible assets 1,545

Other assets 35

Goodwill 889

Accounts payable (43)

Accrued liabilities (298)

Deferred taxes on income (846)

Debt (1,484)

Total $2,592

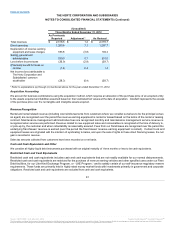

Adjustments to the preliminary purchase price allocation were made to reflect finalized estimates of the fair value of the assets acquired and

liabilities assumed at November 19, 2012. These revisions primarily related to valuation of certain contracts, accrued liabilities and income

taxes, and the resulting changes to goodwill. Prior period financial statements were not revised for these adjustments as they would not have

had a material impact on the prior period reported operating results and financial condition.

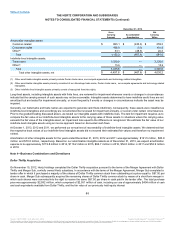

The identifiable intangible assets of $1,545 million consist of $1,140 million of trade names with an indefinite life and $405 million of

concession agreements. The concession agreements will be amortized over their expected useful lives of nine years on a straight-line basis.

The excess of the purchase price over the net tangible and intangible assets acquired resulted in goodwill of $889 million which is

attributable to the synergies and economies of scale provided to a market participant. The goodwill

89

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.