Hertz 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

designated as fair value or cash flow hedges. The effective portion of changes in fair value of derivatives designated as cash flow hedging

instruments is recorded as a component of other comprehensive income (loss). Amounts included in accumulated other comprehensive

income (loss) for cash flow hedges are reclassified into earnings in the same period that the hedged item is recognized in earnings. The

ineffective portion of changes in the fair value of derivatives designated as cash flow hedges is recognized currently in earnings within the

same line item as the hedged item, based upon the nature of the hedged item. For derivative instruments that are not part of a qualified

hedging relationship, the changes in their fair value are recognized currently in earnings. See Note 15—Financial Instruments and Fair Value

Measurements.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The effect of a change in tax rates is recognized in the statement of operations in the period that includes the enactment date. Valuation

allowances are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit will not be realized. Subsequent

changes to enacted tax rates and changes to the global mix of earnings will result in changes to the tax rates used to calculate deferred taxes

and any related valuation allowances. Provisions are not made for income taxes on undistributed earnings of international subsidiaries that

are intended to be indefinitely reinvested outside of the United States or are expected to be remitted free of taxes. Future distributions, if any,

from these international subsidiaries to the United States or changes in U.S. tax rules may require a change to reflect tax on these amounts.

See Note 9—Taxes on Income.

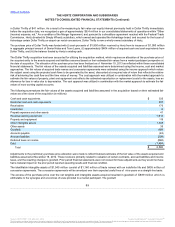

Advertising

Advertising and sales promotion costs are expensed the first time the advertising or sales promotion takes place. Advertising costs are

reflected as a component of “Selling, general and administrative” in our consolidated statements of operations and for the years ended

December 31, 2013, 2012 and 2011 were $213.1 million, $183.9 million and $168.2 million, respectively.

Goodwill

Goodwill is not amortized but is subject to periodic testing for impairment in accordance with FASB ASC Topic 350, “Intangibles—Goodwill

and Other,” or “ASC 350,” at the reporting unit level which is one level below our operating segments. The assessment of goodwill

impairment is conducted by estimating and comparing the fair value of our reporting units, as defined in ASC 350, to their carrying value as

of that date. The fair value is estimated using an income approach whereby the fair value of the reporting unit is based on the future cash

flows that each reporting unit's assets can be expected to generate. Future cash flows are based on forward-looking information regarding

market share and costs for each reporting unit and are discounted using an appropriate discount rate. Future discounted cash flows can be

affected by changes in industry or market conditions or the rate and extent to which anticipated synergies or cost savings are realized with

newly acquired entities. The test for impairment is conducted annually each October 1st, and more frequently if events occur or

circumstances change that indicate that the fair value of a reporting unit may be below its carrying amount.

Intangible and Long-lived Assets

Intangible assets include concession agreements, technology, customer relationships, trademarks and trade-names and other intangibles.

Intangible assets with finite lives are amortized using the straight-line method over the estimated economic lives of the assets, which range

from two to fifteen years. Long-lived assets, including intangible assets with finite lives, are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount of such assets may not be recoverable in accordance with FASB ASC Topic 360,

“Property, Plant, and Equipment,” or “ASC 360.” Determination of recoverability is based on an estimate of undiscounted future cash flows

resulting from the use of the asset and its eventual disposition. Measurement of an impairment loss for long-lived assets that management

expects to hold and use is based on the estimated fair value of the asset. Long-lived assets to be disposed of are reported at the lower of

carrying amount or estimated fair value less costs to sell. Intangible assets determined to have indefinite useful lives are not amortized but

are tested for impairment annually each October 1st and more frequently if events occur or circumstances change that indicate an asset may

be impaired.

84

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.