Hertz 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

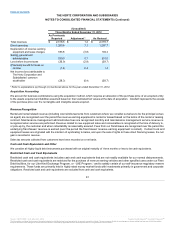

Stock-Based Compensation

We measure the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of the

award. That cost is to be recognized over the period during which the employee is required to provide service in exchange for the award. We

have estimated the fair value of options issued at the date of grant using a Black-Scholes option-pricing model, which includes assumptions

related to volatility, expected life, dividend yield and risk-free interest rate. See Note 7—Stock-Based Compensation.

We are using equity accounting for restricted stock unit and performance stock unit awards. For restricted stock units the expense is based on

the grant-date fair value of the stock and the number of shares that vest, recognized over the service period. For performance stock units the

expense is based on the grant-date fair value of the stock, recognized over a two to four year service period depending upon a performance

condition. For performance stock units, we re-assess the probability of achieving the applicable performance condition each reporting period

and adjust the recognition of expense accordingly. The performance condition is not considered in determining the grant date fair value.

Franchise Revenues and Transactions

“Franchise revenues” includes franchise fees for use of our brands and services. Generally franchise fees from franchised locations are

based on a percentage of net sales of the franchised business and are recognized as earned and when collectability is reasonably assured.

Initial franchise fees are recorded as deferred income when received and are recognized as revenue when all material services and conditions

related to the franchise fee have been substantially performed.

Renewal franchise fees are recognized as revenue when the license agreements are effective and collectability is reasonably assured.

Other (income) expense, net includes the gains or losses from the sales of our operations or assets to new and existing franchisees. Such

gains or losses are included in operating income because they are expected to be a recurring part of our business.

Recently Issued Accounting Pronouncements

In March 2013, the FASB issued Accounting Standards Update, or "ASU," No. 2013-05, “Foreign Currency Matters (Topic 830): Parent's

Accounting for the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign

Entity or of an Investment in a Foreign Entity,” or “ASU 2013-05”, which permits an entity to release cumulative translation adjustments into

net income when a reporting entity (parent) ceases to have a controlling financial interest in a subsidiary or group of assets that is a business

within a foreign entity. Accordingly, the cumulative translation adjustment should be released into net income only if the sale or transfer

results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided, or, if a

controlling financial interest is no longer held. The revised standard is effective for reporting periods beginning after December 15, 2013. The

amendments should be applied prospectively to derecognition events occurring after the effective date. Prior periods should not be adjusted.

Early adoption is permitted. This accounting guidance is not expected to have a material impact on our consolidated financial statements or

financial statement disclosures.

In July 2013, the FASB issued ASU No. 2013-11, "Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a

Similar Tax Loss, or a Tax Credit Carryforward Exists," an amendment to FASB ASC Topic 740, Income Taxes, or "FASB ASC Topic 740."

This update clarifies that an unrecognized tax benefit, or a portion of an unrecognized tax benefit, should be presented in the financial

statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward if such

settlement is required or expected in the event the uncertain tax position is disallowed. In situations where a net operating loss carryforward,

a similar tax loss, or a tax credit carryforward is not available at the reporting date under the tax law of the applicable jurisdiction or the tax law

of the jurisdiction does not require, and the entity does not intend to use, the deferred tax asset for such purpose, the unrecognized tax benefit

should be presented in the financial statements as a liability and should not be combined with deferred tax assets. This ASU is effective

prospectively for fiscal years, and interim periods within those years, beginning after December 15, 2013. Early adoption and retrospective

application are permitted. This accounting guidance is not expected to have a material impact on our consolidated financial statements or

financial statement disclosures.

85

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.